Cabot Options Institute Earnings Trader – Alert (MA)

As discussed in our weekly issue and on our weekly call, I will be taking a position in Mastercard (MA) today.

Mastercard is due to announce before the opening bell Thursday.

Iron Condor Earnings Trade in Mastercard (MA)

MA is currently trading for 379.56. Let’s examine an iron condor trade with a high probability of success.

First, let’s take a look at the expected move in MA for the expiration cycle that I’m interested in. Since Mastercard is due to report late in the week, I want to go out at least one additional week, in this case to the February 3, 2023, expiration cycle.

The expected move or expected range over the next 9 days can be seen in the pale, orange-colored bar below. The expected move is from roughly 362.5 to 395, for a range of 32.5.

Knowing the expected range, I want to place the short call strike and short put strike of my iron condor outside of the expected range, in this case outside of 362.5 to 395.

This is my preference most of the time when using iron condors.

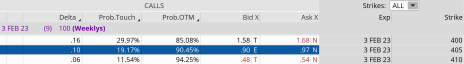

If we look at the call side of MA for the February 3, 2023, expiration, we can see that the 405 call strike offers a 90.45% probability of success. So, I’m going to sell the short call at the 405 call strike and define my risk with the 410 call strike. By choosing the 410 call strike to define my risk, I know that there is less than a 12% chance that I will take a max loss on the trade.

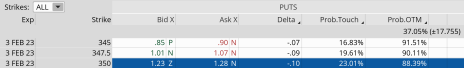

Now let us move to the put side. Same process as the call side. But now we want to find a suitable strike below the low side of our expected move, or 362.5. The 350 put strike, with an 88.39% probability of success, works. I’m going to define my risk by choosing the 345 put strike with a 91.51% probability of success. This means we have less than a 9% chance of taking a max loss on the downside.

We can create a trade with a nice probability of success if MA stays between our 55-point range, or between the 405 call strike and the 350 put strike. Our probability of success on the trade is 90.45% on the upside and 88.39% on the downside.

I like those odds. The question is, will the premium be enough to make the trade worth the risk? Let’s take a look.

Here is the trade:

Simultaneously:

Sell to open MA February 3, 2023, 405 calls

Buy to open MA February 3, 2023, 410 calls

Sell to open MA February 3, 2023, 350 puts

Buy to open MA February 3, 2023, 345 puts for roughly $0.75 or $75 per iron condor (prices will fluctuate, please adjust accordingly if you wish to enter trade)

Our potential return on the trade: 17.6%

Our margin requirement is $425 per iron condor.

Again, the goal of selling the MA iron condor is to have the underlying stock stay below the 405 call strike and above the 350 put strike immediately after Mastercard’s earnings are announced.

Here are the parameters for this trade:

- The Probability of Success – 90.45% (call side) and 88.39% (put side)

- The maximum return on the trade is the credit of $0.75, or $75 per iron condor

- Breakeven level: 405.75 – 349.25

- The maximum loss on the trade is $425 per iron condor. Remember, we always adjust if necessary, and always stick to our stop-loss guidelines.

The premium and probabilities look good to me and warrant a trade.

*Also, proper position size is the KEY to long-term success when trading earnings. Keep your size within reason and allow the law of large numbers to do the work. Losses will occur, so manage your position via position size accordingly.