We are only two weeks away from our first subscriber-exclusive event and subsequent earnings cycle. That first week of earnings should offer some nice trades in some of the major banks.

I will be going over potential trades, step-by-step, in our webinar. This will give you all the insights into how I approach earnings trades, our goals for the upcoming earnings season, the approach to order entry and more importantly order exits, managing trades, chasing trades, etc.

Cabot Options Institute – Earnings Trader Issue: June 24, 2022

We are only two weeks away from our first subscriber-exclusive event and subsequent earnings cycle. That first week of earnings should offer some nice trades in some of the major banks.

I will be going over potential trades, step-by-step, in our webinar. This will give you all the insights into how I approach earnings trades, our goals for the upcoming earnings season, the approach to order entry and more importantly order exits, managing trades, chasing trades, etc.

Of course, it will be recorded so don’t worry if you are unable to attend. You can watch at your own leisure. But give the presentation your undivided attention if you are serious about making earnings trades. You need to know the both mechanics and the nuance around placing a trade.

Again, another week in the doldrums between earnings season. But as I said before we are only a few weeks away from the next round of earnings and there is no doubt it will be an interesting one. This week, we actually have a few potential trades on our hands, with one being in Nike (NKE). I will discuss the trade in the “Trade Ideas” section below.

So far, our “Trade Ideas” have led to some decent profits. Last week we discussed FedEx (FDX) and presented a potential trade. FDX closed right in the middle of our range which would have resulted in another decent profit-taking opportunity.

Again, as stated last week, we recognize opportunities are scarce; they always are when we are in between earnings cycles. However, when earnings season is in full swing, we will often see 20 to 30 trade ideas per week, with the potential to send out alerts on two to five each week. Of course, if you wish to trade more (beyond our alerts), other ideas will be there for you to peruse and trade.

We try to place trades on at least 10-15 trades per earnings cycle, sometimes more, sometimes less.

As always, if you have any questions, please do not hesitate to email me at andy@cabotoptions.com.

The Week Ahead

Here are a few companies that I think could offer an interesting opportunity next week.

Below you will find the implied volatility (IV), IV rank, IV percentile, average past price movements around earnings, expected move (implied move) and a few other key items to help you with any potential trades.

The following list is a guide for potential earnings season trades next week.

We only have one idea for next week: Nike (NKE). Below are a few more ideas for those of you who tend to be a bit more aggressive.

Top Earnings Options Plays

Here are a few other top earnings options plays for next week (6/27 to 7/01):

Trade Ideas for Next Week

Next week we actually have a potential trade on our hands in Nike (NKE). Let’s take a look to see if NKE warrants a potential trade alert.

Nike (NKE)

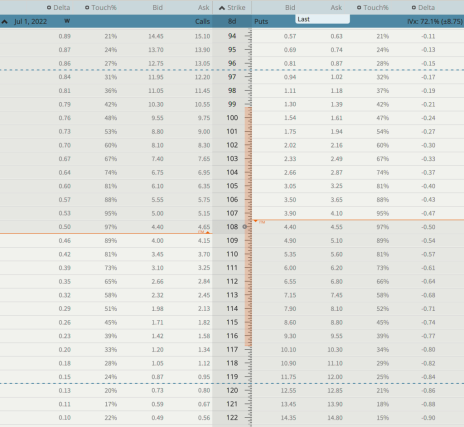

NKE is due to announce earnings Monday (6/27) after the closing bell. The stock is currently trading for 108.00.

IV Rank: 98.21

Expected Move for the July 1, 2022, Expiration Cycle: 99 to 117

Knowing the expected range, I want to, in most cases, place the short call strike and short put strike of my iron condor outside of the expected range, in this case outside of 99 to 117.

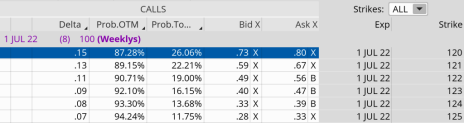

If we look at the call side of NKE for the July 1, 2022, expiration, we can see that selling the 120 call strike offers an 87.28% probability of success. The 120 call strike sits just above the expected move, or 117. We can define our risk through buying the 125 call, thereby creating a five-strike-wide bear call spread at the 120/125 call strikes.

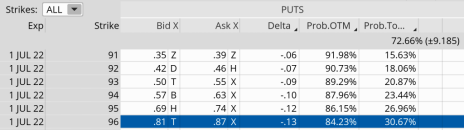

Now let us move to the put side. Same process as the call side. But now we want to find a suitable strike below the low side of our expected move, or 99. The 96 put, with an 84.23% probability of success, works. Staying with a five-strike-wide spread I can buy the 91 put to define our risk and create a bull put spread at the 96/91 strikes.

We can create a trade with a nice probability of success if NKE stays between the 24-point range, or between the 120 call strike and the 96 put strike. Our probability of success on the trade is 87.28% on the upside and 84.23% on the downside.

Here is the trade:

Simultaneously:

Sell to open NKE July 1, 2022, 120 calls

Buy to open NKE July 1, 2022, 125 calls

Sell to open NKE July 1, 2022, 96 puts

Buy to open NKE July 1, 2022, 91 for roughly $0.90 or $90 per iron condor

Our margin requirement would be $410 per iron condor. Again, the goal of selling the NKE iron condor is to have the underlying stock stay below the 120 call strike and above the 96 put strike immediately after NKE earnings are announced.

Here are the parameters for this trade:

- The Probability of Success – 87.28% (call side) and 84.23% (put side)

- The maximum return on the trade is the credit of $0.90, or $90 per iron condor

- Max Return: 22.0%

- Break-even level: 120.90 – 95.10

Summary

Nike offers a decent opportunity for a trade. I like the 24-point range that we can create while still having the ability to bring in $0.90 in premium for a potential 22.0% return. Because NKE reports early in the week (after the close Monday), I want to use the near-term expiration cycle, which is why I’ve chosen the July 1, 2022, as opposed to the July 8, 2022, expiration cycle.

As always, if I decide to place a trade, I will let everyone know well ahead of time. Stay tuned!

Next Live Analyst Briefing with Q&A

Our next live analyst briefing with Q&A is scheduled for July 8, 2022 at 12:00 p.m. ET and we are going to get right to it. Every Friday during earnings season I will hold a live webinar. In the webinar we will discuss the prior trades of the week, look at potential trades for the upcoming week (including any trades that you wish to discuss), and take any questions you might have. Earnings trades tend to bring lively discussions so I’m looking forward to our first of many. Register here.

Portfolio

No positions at this time.

The next Cabot Options Institute – Earnings Trader issue will be published on July 1, 2022.

About the Analyst

Andy Crowder

Andy Crowder is a professional options trader, researcher and Chief Analyst of Cabot Options Institute. Formerly with Oppenheimer & Co. in New York, Andy has leveraged his investment experience to develop his statistically based options trading strategy which applies probability theory to option valuations in order to execute risk-controlled trades. This proprietary strategy has been refined through two decades of research and real-world experience and has been featured in the Wall Street Journal, Seeking Alpha, and numerous other financial publications. Andy has helped thousands of option traders learn and implement his meticulous rules-driven options trading strategies through highly attended conferences, one-on-one coaching, webinars, and his work as a financial columnist. He currently resides in Bolton Valley, Vermont and when he’s not trading, teaching and writing about options, he enjoys spending time with his wife and two daughters, backcountry skiing, biking, running and enjoying all things outdoors.