We are firmly entrenched in the doldrums between earnings cycles, but it doesn’t mean that opportunities won’t arise.

Plus, as I wrote last week, the downtime between cycles gives us some time to reflect on the prior earnings season and, more importantly, prepare for what is ahead.

There is one potential opportunity next week, which we will discuss below. Again, there is no doubt that opportunities are scarce as we are firmly between earnings cycles.

Cabot Options Institute – Earnings Trader Issue: June 10, 2022

We are firmly entrenched in the doldrums between earnings cycles, but it doesn’t mean that opportunities won’t arise.

Plus, as I wrote last week, the downtime between cycles gives us some time to reflect on the prior earnings season and, more importantly, prepare for what is ahead.

There is one potential opportunity next week, which we will discuss below. Again, there is no doubt that opportunities are scarce as we are firmly between earnings cycles. When earnings season is in full swing we will often see 20 to 30 trade ideas per week, with the potential to send out alerts on 2 to 5 each week. Of course, if you wish to trade more (beyond our alerts), other ideas will be there for you to peruse and trade as you wish.

We try to place trades on at least 10-15 trades per earnings cycle, sometimes more, sometimes less.

As always, if you have any questions, please do not hesitate to email me at andy@cabotoptions.com.

The Week Ahead

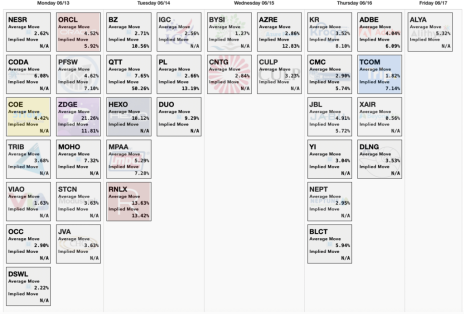

Here are a few companies that I think could offer some interesting opportunities next week.

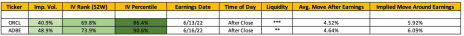

Below you will find the implied volatility (IV), IV rank, IV percentile, average past price movements around earnings, expected move (implied move) and a few other key items to help you with any potential trades.

The following list is a guide for potential earnings season trades next week.

The two ideas for next week are, naturally, in the two stocks we listed above: Adobe (ADBE) and Oracle (ORCL).

Both ADBE and ORCL are offering above average levels of premium going into earnings.

All four ideas are in highly volatile stocks as seen through the Implied Volatility column, ranging from 70.9% in ASO to 110.3% in DOCU. These are typically levels of volatility that I avoid when trading around earnings. My preference is to find stocks with implied volatility in the range of 25% to 45%. So, today’s examples, while interesting, are definitely ideas for the more aggressive bunch out there. I have no problem sitting on the sidelines.

Top Earnings Options Plays

Here are a few other top earnings options plays for next week (6/13 to 6/17):

A Few Trade Ideas for Next Week

Interestingly enough, our NIO trade idea from last week turned out to be quite successful. For those that placed the trade you can buy it back for roughly $0.18, for a gain of 11.5%.

As I said in last week’s issue, NIO’s implied volatility was way too high for my liking, hence no trade alert this past week. I decided it would be best to simply sit on the sidelines. But again, for those of you who are a bit more aggressive, good for you … you have a profitable trade on your hands. Now some of you may be tempted to hold on a bit longer to try and squeeze a few more dollars out of the trade. If so, please understand the risk at hand. You are essentially risking $2.69 to make an additional $0.18.

My preference is to always take my gains and move on to the next opportunity, but if you are tempted to hold on, just be careful … and don’t let your winner turn into a loser.

At the time of this writing our DOCU trade also looks good. The underlying stock is trading near the bottom part of our range after hours, but if it remains here or pushes higher on Friday, we should be able to take off the trade for a profit. Of course, things could change by the opening bell. Either way, I’m looking forward to seeing how it performs.

Next week we actually have a potential trade on our hands in Oracle (ORCL). Let’s take a look to see if ORCL warrants a potential trade alert.

Oracle (ORCL)

ORCL is due to announce Monday (6/13) after the closing bell. The stock is currently trading for 70.59.

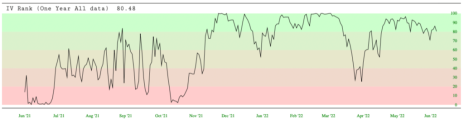

IV Rank: 80.43

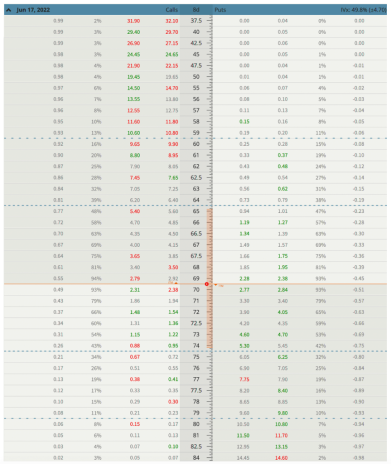

Expected Move for the June 17, 2022 Expiration Cycle: 65 to 74

Knowing the expected range, I want to, in most cases, place the short call strike and short put strike of my iron condor outside of the expected range, in this case outside of 65 to 74.

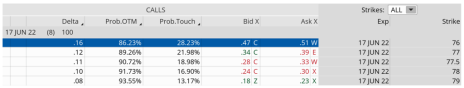

If we look at the call side of ORCL for the June 17, 2022 expiration, we can see that selling the 76 call strike offers an 86.23% probability of success. The 76 call strike sits just above the expected move, or 74. We can define our risk through buying the 79 call, thereby creating a three-strike-wide bear call spread at the 76/79 strikes.

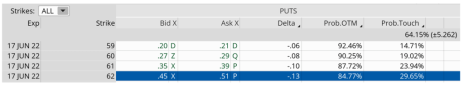

Now let us move to the put side. Same process as the call side. But now we want to find a suitable strike below the low side of our expected move, or 65. The 62 put, with an 84.77% probability of success, works. Staying with a three-strike-wide spread I can buy the 59 put to define our risk and create a bull put spread at the 62/59 strikes.

We can create a trade with a nice probability of success if ORCL stays between the 14-point range, or between the 76 call strike and the 62 put strike. Our probability of success on the trade is 86.23% on the upside and 84.77% on the downside.

Here is the trade:

Simultaneously:

Sell to open ORCL June 17, 2022 76 calls

Buy to open ORCL June 17, 2022 79 calls

Sell to open ORCL June 17, 2022 62 puts

Buy to open ORCL June 17, 2022 59 for roughly $0.55 or $55 per iron condor

Our margin requirement would be $251 per iron condor. Again, the goal of selling the NIO iron condor is to have the underlying stock stay below the 22 call strike and above the 15 put strike immediately after NIO earnings are announced.

Here are the parameters for this trade:

- The Probability of Success – 86.23% (call side) and 84.77% (put side)

- The maximum return on the trade is the credit of $0.55, or $55 per iron condor

- Break-even level: 76.50 – 61.50

Summary

Like NIO last week, ORCL’s implied volatility is a bit too high for my liking. That being said, I’ll be curious to see what Monday brings. If ORCL is offering decent premium I might take a position. If I do, it will certainly be on the smaller side of my position-size range (1% to 6% per trade).

Most likely I will be sitting this one out. But for those of you who wish to be a bit more aggressive, a trade in ORCL might be right up your alley. If so, remember to always use proper position size.

If I do decide to take on a trade in ORCL I will send out a trade alert shortly after the opening bell on Monday. If anything, follow this ORCL trade, or a variation of your choosing, so you start to get a feel for what we are trying to accomplish when earnings season is in full swing. Learn what a trade looks like when it’s a winner and a loser so you can plan accordingly when the real trading begins.

Next Live Analyst Briefing with Q&A

Our first live analyst briefing with Q&A is scheduled for July 8, 2022 at 1:00 p.m. ET and we are going to get right to it. Every Friday during earnings season I will hold a live webinar. In the webinar we will discuss the prior trades of the week, look at potential trades for the upcoming week (including any trades that you wish to discuss), and take any questions you might have. Earnings trades tend to bring lively discussions so I’m looking forward to our first of many. Register here.

Portfolio

No positions.

The next Cabot Options Institute – Earnings Trader issue will be published on June 17, 2022.

About the Analyst

Andy Crowder

Andy Crowder is a professional options trader, researcher and Chief Analyst of Cabot Options Institute. Formerly with Oppenheimer & Co. in New York, Andy has leveraged his investment experience to develop his statistically based options trading strategy which applies probability theory to option valuations in order to execute risk-controlled trades. This proprietary strategy has been refined through two decades of research and real-world experience and has been featured in the Wall Street Journal, Seeking Alpha, and numerous other financial publications. Andy has helped thousands of option traders learn and implement his meticulous rules-driven options trading strategies through highly attended conferences, one-on-one coaching, webinars, and his work as a financial columnist. He currently resides in Bolton Valley, Vermont and when he’s not trading, teaching and writing about options, he enjoys spending time with his wife and two daughters, backcountry skiing, biking, running and enjoying all things outdoors.