I’m going to keep it rather short this week as we are moving through the final week of the earnings doldrums. And I can’t be happier. Next week offers up little to nothing in the way of earnings trades as we enter one of the slowest weeks for announcements on the calendar. But the following week is a completely different story as the big banks kick off earnings season.

Cabot Options Institute – Earnings Trader Issue: July 1, 2022

I’m going to keep it rather short this week as we are moving through the final week of the earnings doldrums. And I can’t be happier. Next week offers up little to nothing in the way of earnings trades as we enter one of the slowest weeks for announcements on the calendar. But the following week is a completely different story as the big banks kick off earnings season.

As I stated last week, I will be going over potential trades, step-by-step, in our upcoming live analyst briefing with Q&A next Friday, which should prepare you for the upcoming earnings season. This will give you all the insights into how I approach earnings trades, our goals for the upcoming earnings season, the approach to order entry, order exits, managing trades, chasing trades, etc.

Of course, it will be recorded so don’t worry if you are unable to attend. You can watch at your own leisure. But give the presentation your undivided attention if you are serious about making earnings trades. It’s important to understand the mechanics and nuance around placing an earnings trade.

Like I said, not much on the earnings front next week. Yes, you could probably get into a few of the companies on the earnings calendar below, but liquidity could be questionable. For me, it just isn’t worth the risk, nor the effort. Plus, the following week could offer several good opportunities as JPM, MS, C, UNH, WFC, and USB are due to announce.

So, if you haven’t had a chance to read the strategy reports, user guide, etc., now is the time. If you can, try to come to the webinar next Friday with at least some familiarity regarding the approach we take around earnings announcements.

Lastly, as I’ve stated for several weeks now, we recognize opportunities are scarce; they always are when we are in between earnings cycles. However, when earnings season is in full swing, we will often see 20 to 30 trade ideas per week, with the potential to send out alerts on two to five each week. Of course, if you wish to trade more (beyond our alerts), other ideas will be there for you to peruse and trade.

We try to place trades on at least 10-15 trades per earnings cycle, sometimes more, sometimes less.

As always, if you have any questions, please do not hesitate to email me at andy@cabotoptions.com.

Top Earnings Options Plays

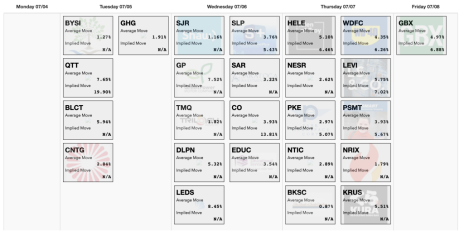

Here are a few other top earnings options plays for next week (7/5 to 7/8) if you are so inclined:

Next Live Analyst Briefing with Q&A

Our next live analyst briefing with Q&A is scheduled for July 8, 2022 at 12:00 p.m. ET and we are going to get right to it. Every Friday during earnings season I will hold a live webinar. In the webinar we will discuss the prior trades of the week, look at potential trades for the upcoming week (including any trades that you wish to discuss), and take any questions you might have. Earnings trades tend to bring lively discussions so I’m looking forward to our first of many. Register here.

Portfolio

No positions at this time.

The next Cabot Options Institute – Earnings Trader issue will be published on July 8, 2022.

About the Analyst

Andy Crowder

Andy Crowder is a professional options trader, researcher and Chief Analyst of Cabot Options Institute. Formerly with Oppenheimer & Co. in New York, Andy has leveraged his investment experience to develop his statistically based options trading strategy which applies probability theory to option valuations in order to execute risk-controlled trades. This proprietary strategy has been refined through two decades of research and real-world experience and has been featured in the Wall Street Journal, Seeking Alpha, and numerous other financial publications. Andy has helped thousands of option traders learn and implement his meticulous rules-driven options trading strategies through highly attended conferences, one-on-one coaching, webinars, and his work as a financial columnist. He currently resides in Bolton Valley, Vermont and when he’s not trading, teaching and writing about options, he enjoys spending time with his wife and two daughters, backcountry skiing, biking, running and enjoying all things outdoors.