Amgen (AMGN)

Amgen (AMGN)

Amgen (AMGN) is due to announce earnings today after the closing bell.

The stock is currently trading for 320.

- IV Rank: 73.5

- IV: 40.3%

Expected Move for the February 16, 2024, Expiration Cycle: 304 to 336

Knowing the expected range, I want to place the short call strike and short put strike of my iron condor outside of the expected range, in this case outside of 304 to 336.

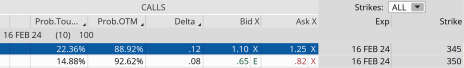

If we look at the call side of AMGN for the February 16, 2024, expiration, we can see that selling the 345 call strike offers an 88.92% probability of success. The 345 call strike sits just above the expected move, or 336.

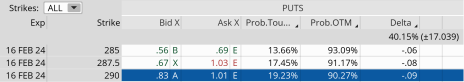

Now let us move to the put side. Same process as the call side. But now we want to find a suitable strike below the low side of our expected move, or 304. The 290 put, with a 90.27% probability of success, works.

We can create a trade with a nice probability of success if AMGN stays within the 55-point range, or between the 345 call strike and the 290 put strike. Our probability of success on the trade is 88.92% on the upside and 90.27% on the downside.

Moreover, we have a 7.8% cushion to the upside and a 7.8% margin of error to the downside.

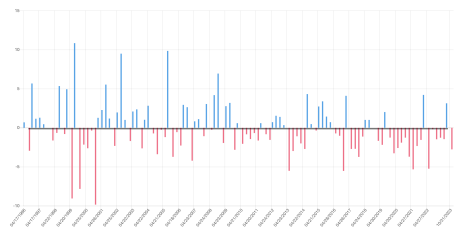

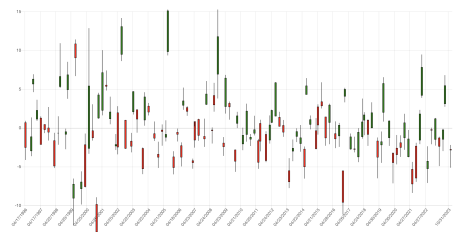

If we look at the earnings reactions since 4/17/1996, we can see that there have been only a few breaches of 5% to the upside or downside after an earnings announcement. That being said, we have seen some decent moves, so, as always, make sure your position size is at reasonable levels.

Net Change – At the Opening Bell

Full Bar – Price Movement Throughout the Day

If one wanted to make a trade, below are the potential strikes that make the most sense or are at least a starting point for a trade.

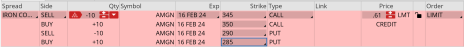

Here is my trade:

Simultaneously:

Sell to open AMGN February 16, 2024, 345 calls

Buy to open AMGN February 16, 2024, 350 calls

Sell to open AMGN February 16, 2024, 290 puts

Buy to open AMGN February 16, 2024, 285 puts for roughly $0.61 or $61 per iron condor (adjust accordingly, prices may vary from time of alert).

Our margin requirement would be roughly $439 per iron condor. Again, the goal of selling the AMGN iron condor is to have the underlying stock stay below the 345 call strike and above the 290 put strike immediately after AMGN earnings are announced.

Here are the parameters for this trade:

- The probability of success – 88.92% (call side) and 90.27% (put side)

- The maximum return on the trade is the credit of $0.61, or $61 per iron condor

- Max return: 13.9% (based on $439 margin per iron condor)

- Break-even level: 345.61 – 289.39.

As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

Copyright © 2024. All rights reserved. Copying or electronic transmission of this information without permission is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. Disclosures: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to our publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Employees of Cabot Wealth Network may own some of the stocks recommended by our advisory services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: are made in regular issues, updates, or alerts by email and on the private subscriber website. Subscribers agree to adhere to all terms and conditions which can be found on CabotWealth.com and are subject to change. Violations will result in termination of all subscriptions without refund in addition to any civil and criminal penalties available under the law.