Weekly Earnings Commentary

Quick reminder: If you wish to sign up for the upcoming subscriber-only call this Friday at 12 p.m. ET, please click here. If you are unable to make it live, no worries, sign up and we will send you the replay. But, if you are able to make it to the live event and have a few tickers you would like me to review, show up and we can go over all of your requests.

We decided to place our third trade of the season in Mastercard (MA) by using a 47.5-point range, with our short strikes at 360 (puts) and 407.5 (calls). We felt comfortable with the range as it was not only well outside of the expected range (370 – 400) for MA, but covered, on a percentage basis, almost every earnings move going back to November 2011. These are the type of setups we prefer to trade.

As you can see from the chart below, MA opened the day at roughly 370, testing the expected move immediately, but still 10 points from the short put strike (360) of our chosen, 47.5-point range iron condor. Thankfully, after the open, the stock began to surge higher and float around the high of the day (375) for the next 25 minutes.

We sold the spread for roughly $0.75 the day prior, and shortly after the opening bell, we sent the alert price out for $0.50. We traded there for a few minutes before slowly kicking up to the $0.60s. Thankfully, we were able to lock in our third winning trade this earnings season, this time for a profit of 5.2%, as the stock continued to trade lower before hitting what seems to be a level of strong support around the 363 area. For those that chose to hold on through expiration, the current price of the spread stands at $1.24.

*As I’ve said over and over in our weekly conversations, risk management is key. If one trade stresses you out, your position size is way too large. Pare it back. Position size is the only true way to manage risk using this approach. Yes, in almost every case, we will be able to get out for far less than a max loss, but stop-losses are only secondary to position size when managing risk. So please don’t overlook the importance of choosing an appropriate level of position size. Every investor will have a different level of risk tolerance, but without understanding your own risk-reward per trade, you are surely destined to create unnecessary challenges. Make it easy on yourself.

We’ve made 37 trades in total with a win ratio of 81.1% (30 out of 37 winning trades).

If you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

Weekly Watchlist

Pfizer (PFE)

Expected Move or Range: (24 - 36)

Caterpillar (CAT)

Expected Move or Range (217.5 – 257.5)

Amgen (AMGN)

Expected Move or Range (250 – 272.5)

Starbucks (SBUX)

Expected Move or Range (86 - 98)

Apple (AAPL)

Expected Move or Range (160 – 177.5)

Top Earnings Options Plays

Here are a few top earnings options plays for this week (10/30 to 11/3) if you are so inclined:

Images Courtesy of Slope of Hope

Trade Ideas for This Week

As a reminder, you will quickly begin to notice I tend to stick with stocks that have high liquidity as it’s far easier to get in and out of a trade. Medium liquidity offers tradable options, but sometimes the bid-ask spread is wider, which means a greater potential for more price adjustments, making entering and exiting a trade difficult from time to time. Remember, there are roughly 3,200 tradable stocks with options and 11% have medium liquidity while only 3% have what’s considered high liquidity.

Potential Trade Ideas for This Week (Not Official Trade Alerts)

Starbucks (SBUX)

Starbucks (SBUX) is due to announce earnings Thursday before the opening bell.

The stock is currently trading for 92.02.

- IV Rank: 53.3

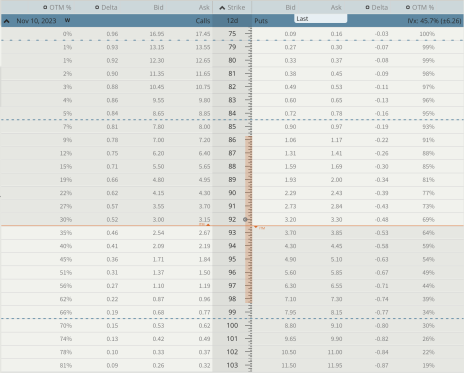

Expected Move for the November 10, 2023, Expiration Cycle: 86 to 98

Knowing the expected range, I want to place the short call strike and short put strike of my iron condor outside of the expected range, in this case outside of 86 to 98.

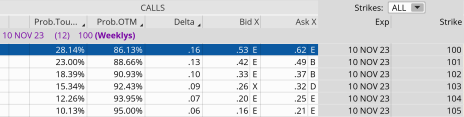

If we look at the call side of SBUX for the November 10, 2023, expiration, we can see that selling the 100 call strike offers an 86.13% probability of success. The call strike sits just above the expected move, or at 98.

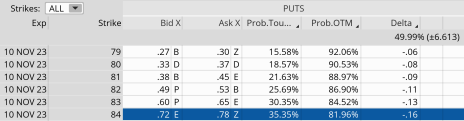

Now let us move to the put side. Same process as the call side. But now we want to find a suitable strike below the low side of our expected move, 86. The 84 put, with an 81.96% probability of success, works.

We can create a trade with a nice probability of success if SBUX stays within the 16-point range, or between the 100 call strike and the 84 put strike. Our probability of success on the trade is 86.13% on the upside and 81.96% on the downside.

Moreover, we have an 8.7% cushion to the upside and an 8.7% margin of error to the downside.

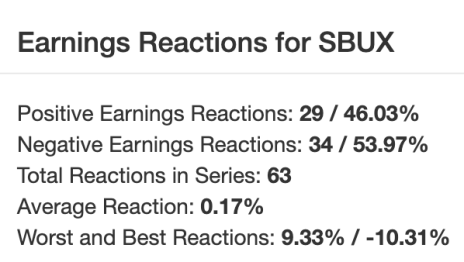

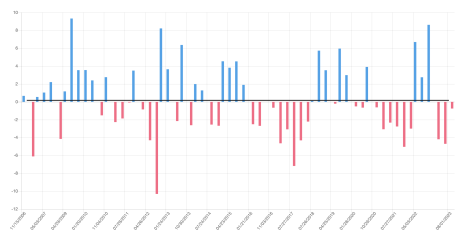

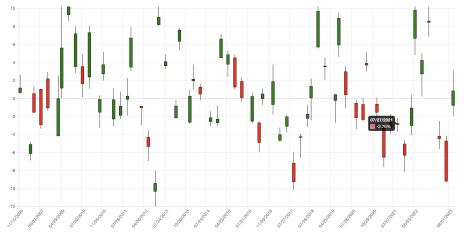

If we look at the earnings reactions since 11/15/2006, we can see that there have only been a few large moves of roughly 8% to the upside and 8% to the downside after an earnings announcement, so the wide margins of error of 8.7%, on both sides of the trade seem appealing … and more importantly, opportunistic.

Quick Stats

Net Change – At the Opening Bell

Full Bar – Closing Bell

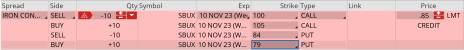

If one wanted to make a trade, below are the potential strikes that make the most sense or are at least a starting point for a trade.

Here is the potential trade (as always, if I decide to place a trade in SBUX, I will send a trade alert with updated data):

Simultaneously:

Sell to open SBUX November 3, 2023, 100 calls

Buy to open SBUX November 3, 2023, 105 calls

Sell to open SBUX November 3, 2023, 84 puts

Buy to open SBUX November 3, 2023, 79 puts for roughly $0.85 or $85 per iron condor.

Our margin requirement would be roughly $415 per iron condor. Again, the goal of selling the SBUX iron condor is to have the underlying stock stay below the 100 call strike and above the 84 put strike immediately after SBUX earnings are announced.

Here are the parameters for this trade:

- The probability of success – 86.13% (call side) and 81.96% (put side)

- The maximum return on the trade is the credit of $0.85, or $85 per iron condor

- Max return: 20.5% (based on $415 margin per iron condor)

- Break-even level: 100.85 – 83.15

As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

The next Cabot Options Institute – Earnings Trader issue will be

published on November 6, 2023.