Weekly Earnings Commentary

We are officially entering the earnings doldrums, but that certainly doesn’t mean that opportunities won’t present themselves. For instance, this week Marvell (MRVL) announces earnings and offers a decent opportunity for an iron condor and is potentially a candidate for a short strangle, a strategy we haven’t used in a while. I’ve gone over a detailed iron condor example in the “Weekly Trade Ideas” section below.

We’ve made 39 trades in total with a win ratio of 76.9% (30 out of 39 winning trades).

If you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

Weekly Watchlist

Marvell Technology (MRVL)

Expected Move or Range: (51 - 61)

Kroger (KR)

Expected Move or Range (41 - 47)

Top Earnings Options Plays

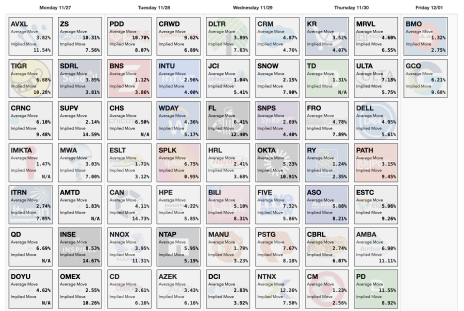

Here are a few top earnings options plays for this week (11/27 to 12/1) if you are so inclined:

Images Courtesy of Slope of Hope

As a reminder, you will quickly begin to notice I tend to stick with stocks that have high liquidity as it’s far easier to get in and out of a trade. Medium liquidity offers tradable options, but sometimes the bid-ask spread is wider, which means a greater potential for more price adjustments, making entering and exiting a trade difficult from time to time. Remember, there are roughly 3,200 tradable stocks with options and 11% have medium liquidity while only 3% have what’s considered high liquidity.

Potential Trade Ideas for This Week (Not Official Trade Alerts)

Marvell Technology (MRVL)

Marvell Technology (MRVL) is due to announce earnings Thursday after the closing bell.

The stock is currently trading for 56.03.

- IV Rank: 39.2

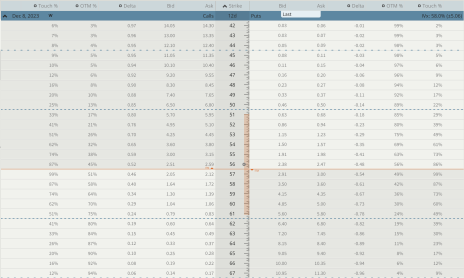

Expected Move for the December 8, 2023, Expiration Cycle: 51 to 61

Knowing the expected range, I want to place the short call strike and short put strike of my iron condor outside of the expected range, in this case outside of 51 to 61.

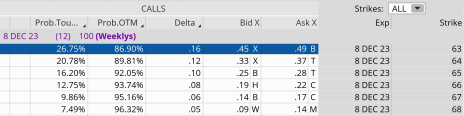

If we look at the call side of MRVL for the December 8, 2023, expiration, we can see that selling the 63 call strike offers an 86.90% probability of success. The call strike sits just above the expected move, or at 61.

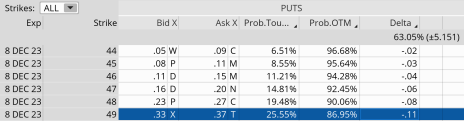

Now let us move to the put side. Same process as the call side. But now we want to find a suitable strike below the low side of our expected move, 51. The 49 put, with an 86.95% probability of success, works.

We can create a trade with a nice probability of success if MRVL stays within the 14-point range, or between the 63 call strike and the 49 put strike. Our probability of success on the trade is 86.90% on the upside and 86.95% on the downside.

Moreover, we have a 12.5% cushion to the upside and a 12.5% margin of error to the downside.

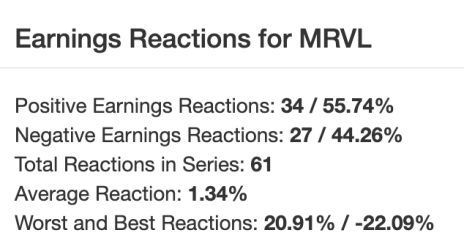

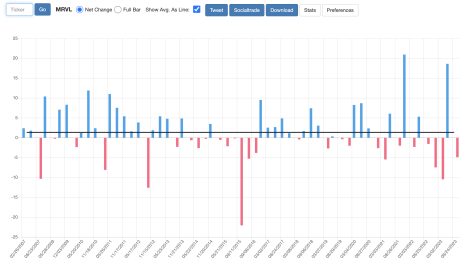

If we look at the earnings reactions since 2/26/2007, we can see that there have only been a few large moves of roughly 10% to the upside and 10% to the downside after an earnings announcement, so the wide margins of error of 12.5% to the upside and 12.5% to the downside of the trade seem appealing … and more importantly, somewhat opportunistic.

Quick Stats

Net Change – At the Opening Bell

Full Bar – Closing Bell

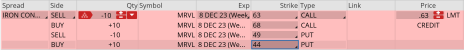

If one wanted to make a trade, below are the potential strikes that make the most sense or are at least a starting point for a trade.

Here is the potential trade (as always, if I decide to place a trade in MRVL, I will send a trade alert with updated data):

Simultaneously:

Sell to open MRVL December 8, 2023, 63 calls

Buy to open MRVL December 8, 2023, 68 calls

Sell to open MRVL December 8, 2023 49 puts

Buy to open MRVL December 8, 2023 44 puts for roughly $0.63 or $63 per iron condor.

Our margin requirement would be roughly $437 per iron condor. Again, the goal of selling the MRVL iron condor is to have the underlying stock stay below the 68 call strike and above the 49 put strike immediately after MRVL earnings are announced.

Here are the parameters for this trade:

- The probability of success – 86.90% (call side) and 86.95% (put side)

- The maximum return on the trade is the credit of $0.63, or $63 per iron condor

- Max return: 14.4% (based on $425 margin per iron condor)

- Break-even level: 63.63 – 48.37

As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

The next Cabot Options Institute – Earnings Trader issue will be

published on December 4, 2023.