Weekly Earnings Commentary

Earnings season is mostly behind us, but there are a few stragglers yet to report on the calendar. Target is on the agenda this week. With a decent IV rank (58.9) and the ability to create a fairly large range outside of the established expected range, Target (TGT) looks like a potential trading opportunity.

The company is due to report prior to the opening bell Tuesday, so if we decide to place a trade look for an alert around mid-day today.

Our total return for this earnings cycle stands at 28.8%, one of our best performing earnings cycles since we initiated Earnings Trader back in mid-July 2022, smack dab in the middle of the most recent bear market.

The portfolio now stands at an all-time high of 97.6% in total returns.

Remember, even though these are short-term trades, this is a long-term strategy – a strategy based on the law of large numbers and statistical probabilities.

ALWAYS remember that risk management is key. If one trade stresses you out your position size is way too large. Pare it back. Position size is the only true way to manage risk using this approach. Yes, in almost every case, we will be able to get out for far less than a max loss, but stop-losses are only secondary to position size when managing risk. So please don’t overlook the importance of choosing an appropriate level of position size. Every investor will have a different level of risk tolerance, but without understanding your own risk-reward per trade, you are surely destined to create unnecessary challenges. Make it easy on yourself.

We’ve made 43 trades in total with a win ratio of 79.1% (34 out of 43 winning trades).

If you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

Weekly Watchlist

Target (TGT)

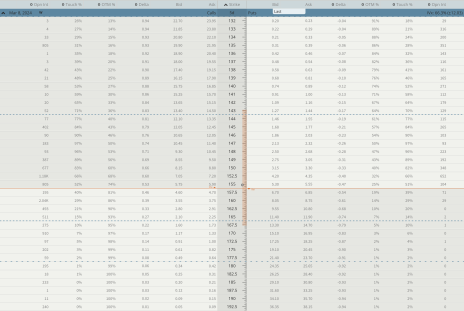

Expected Move or Range: (143-167.5)

Kroger (KR)

Expected Move or Range (47-51.5)

Archer-Daniels Midland (ADM)

Expected Move or Range (47-62)

Top Earnings Options Plays

Here are a few top earnings options plays for this week (3/04-3/08) if you are so inclined:

Images Courtesy of Slope of Hope

Trade Ideas for This Week

As a reminder, you will quickly begin to notice I tend to stick with stocks that have high liquidity as it’s far easier to get in and out of a trade. Medium liquidity offers tradable options, but sometimes the bid-ask spread is wider, which means a greater potential for more price adjustments, making entering and exiting a trade difficult from time to time. Remember, there are roughly 3,200 tradable stocks with options and 11% have medium liquidity while only 3% have what’s considered high liquidity.

Potential Trade Ideas for This Week (Not Official Trade Alerts)

Target (TGT)

Target (TGT) is due to announce earnings Tuesday (3/5) before the opening bell.

The stock is currently trading for 155.29.

- IV Rank: 58.9

Expected Move for the March 5, 2024, Expiration Cycle: 143 to 167.5

Knowing the expected range, I want to place the short call strike and short put strike of my iron condor outside of the expected range, in this case outside of 143 to 167.5.

Since TGT is due to announce Tuesday before the open, I want to go with the March 8, 2024 expiration cycle.

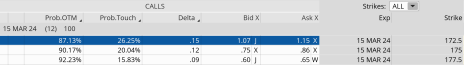

If we look at the call side of TGT for the March 8, 2024, expiration, we can see that selling the 172.5 call strike offers an 87.13% probability of success. The call strike sits just above the expected move, at 167.5.

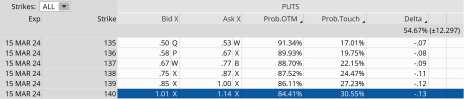

Now let us move to the put side. Same process as the call side. But now we want to find a suitable strike below the low side of our expected move, or 143. The 140 put, with an 84.41% probability of success, works.

We can create a trade with a nice probability of success if TGT stays within the 32.5-point range, or between the 172.5 call strike and the 140 put strike. Our probability of success on the trade is 87.13% on the upside and 84.41% on the downside.

Moreover, we have a 5.3% cushion to the upside and a 5.4% margin of error to the downside.

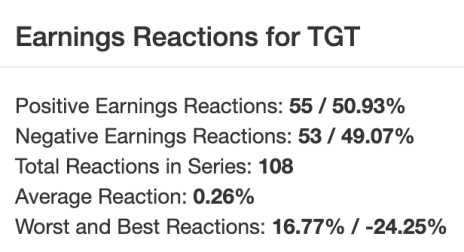

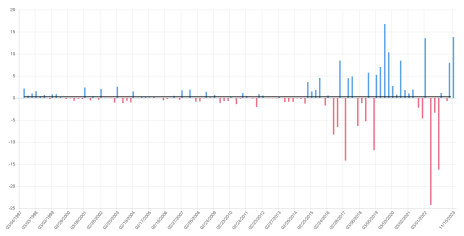

If we look at the earnings reactions since 3/4/1997, we can see that there have only been a few large moves of roughly 8% to the upside and 8% to the downside after an earnings announcement, so the fairly wide margins of error of 11.1% and 9.8% seem appealing … and more importantly, opportunistic.

Quick Stats

Net Change – At the Opening Bell

Full Bar – Closing Bell

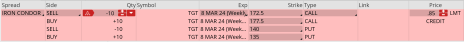

If one wanted to make a trade, below are the potential strikes that make the most sense or are at least a starting point for a trade.

Here is the potential trade (as always, if I decide to place a trade in TGT, I will send a trade alert with updated data):

Simultaneously:

Sell to open TGT March 8, 2024, 172.5 calls

Buy to open TGT March 8, 2024, 177.5 calls

Sell to open TGT March 8, 2024, 140 puts

Buy to open TGT March 8, 2024 135 puts for roughly $0.85 or $0.85 per iron condor.

Our margin requirement would be roughly $415 per iron condor. Again, the goal of selling the TGT iron condor is to have the underlying stock stay below the 172.5 call strike and above the 140 put strike immediately after Target’s earnings are announced.

Here are the parameters for this trade:

1. The probability of success – 87.13% (call side) and 84.41% (put side)

2. The maximum return on the trade is the credit of $0.85, or $85 per iron condor

3. Max return: 20.5% (based on $415 margin per iron condor)

4. Break-even level: 273.35 – 244.15.

As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

The next Cabot Options Institute – Earnings Trader issue will be

published on March 11, 2024.

Copyright © 2024. All rights reserved. Copying or electronic transmission of this information without permission is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. Disclosures: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to our publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Employees of Cabot Wealth Network may own some of the stocks recommended by our advisory services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: are made in regular issues, updates, or alerts by email and on the private subscriber website. Subscribers agree to adhere to all terms and conditions which can be found on CabotWealth.com and are subject to change. Violations will result in termination of all subscriptions without refund in addition to any civil and criminal penalties available under the law.