Weekly Earnings Commentary

I hope everyone had a wonderful New Year!

As we move through another holiday-shortened week, it should be no surprise that there is little in the way of earnings announcements the first week of the year.

As stated last week, earnings season “officially” begins in less than two weeks. On January 12, several of the big banks (BAC, WFC, JPM, C) are due to kick things off. As always, we will look to take on a few trades around that time. Until then, we will patiently wait, sitting on our hands for the earnings calendar to provide us with ample opportunities.

We’ve made 39 trades in total with a win ratio of 76.9% (30 out of 39 winning trades).

If you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

Weekly Watchlist

No stocks on the watchlist this week.

Top Earnings Options Plays

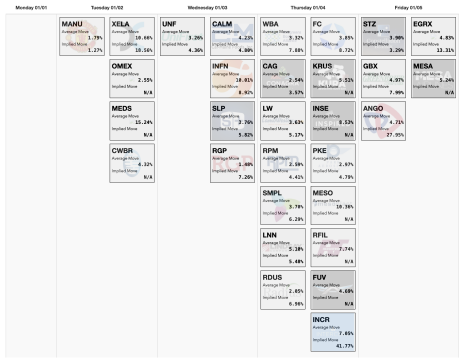

Here are a few top earnings options plays for this week (1/2-1/5) if you are so inclined:

Trade Ideas for This Week

As a reminder, you will quickly begin to notice I tend to stick with stocks that have high liquidity as it’s far easier to get in and out of a trade. Medium liquidity offers tradable options, but sometimes the bid-ask spread is wider, which means a greater potential for more price adjustments, making entering and exiting a trade difficult from time to time. Remember, there are roughly 3,200 tradable stocks with options and 11% have medium liquidity while only 3% have what’s considered high liquidity.

Potential Trade Ideas for This Week (Not Official Trade Alerts)

No potential trades this week.

As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

The next Cabot Options Institute – Earnings Trader issue will be

published on January 8, 2024.