Weekly Earnings Commentary

Before I get started, I want to remind everyone that we will be starting our weekly Friday calls this week. If you wish to attend the subscriber-only call, please click here to sign up.

As I discussed in our first subscriber-only webinar of 2024, the week after the initial big banks announce is slow. Yes, there are a few more big banks that announced prior to the opening bell (GS, MS) this morning, but, as we talked about, we didn’t really want to hold an earnings-based position over the long weekend.

No worries, we won’t be resting on our laurels for long, because next week offers a plethora of potential trades including JNJ, MSFT, V, AXP… and several others. I’ll be going over all of these potential trades, taking questions and much more in our upcoming subscriber-only webinar this Friday.

We’ve made 40 trades in total with a win ratio of 77.5% (31 out of 40 winning trades).

If you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

Top Earnings Options Plays

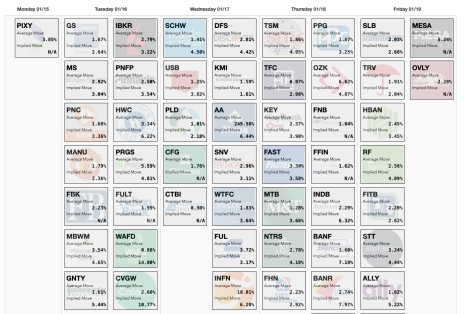

Here are a few top earnings options plays for this week (1/15-1/19) if you are so inclined:

Images Courtesy of Slope of Hope

Trade Ideas for This Week

As a reminder, you will quickly begin to notice I tend to stick with stocks that have high liquidity as it’s far easier to get in and out of a trade. Medium liquidity offers tradable options, but sometimes the bid-ask spread is wider, which means a greater potential for more price adjustments, making entering and exiting a trade difficult from time to time. Remember, there are roughly 3,200 tradable stocks with options and 11% have medium liquidity while only 3% have what’s considered high liquidity.

Potential Trade Ideas for This Week (Not Official Trade Alerts)

As we discussed in our subscriber-only webinar last week, there are no trade ideas for this week. But don’t worry, the following week earnings announcements start in earnest with five to seven potential ideas in the mix.

As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

The next Cabot Options Institute – Earnings Trader issue will be

published on January 22, 2024.