Weekly Earnings Commentary

Earnings season is nearing an end once again, but that doesn’t mean that there aren’t a few opportunities left on the table.

This week we have a few interesting opportunities, with the most intriguing being Lowe’s (LOW). The majority of the other potential trades, while having decent options liquidity, are just too volatile for my liking. Again, even though it has been a slow earnings cycle for trading, it doesn’t mean we should force a trade. Remember, trading is always about quality over quantity.

And even if the trades for this earnings cycle were few and far between, we still locked in total returns of 29.2% with an average return of 5.9%.

If you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

Weekly Watchlist

- Zoom (ZM)

- Lowe’s (LOW)

- Affirm (AFRM)

- Marvell (MVL)

Top Earnings Options Plays

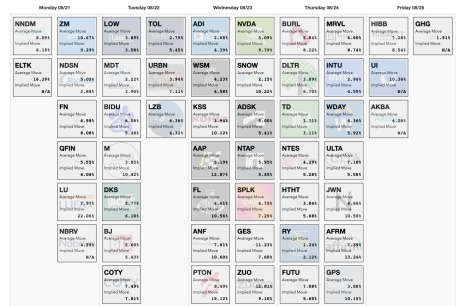

Here are a few top earnings options plays for this week (8/21 to 8/25) if you are so inclined:

Images Courtesy of Slope of Hope

Trade Ideas for Next Week

As a reminder, you will quickly begin to notice I tend to stick with stocks that have high liquidity as it’s far easier to get in and out of a trade. Medium liquidity offers tradable options, but sometimes the bid-ask spread is wider, which means a greater potential for more price adjustments, making entering and exiting a trade difficult from time to time. Remember, there are roughly 3,200 tradable stocks with options and 11% have medium liquidity while only 3% have what’s considered high liquidity.

Potential Trade Ideas for This Week (Not Official Trade Alerts)

Lowe’s (LOW)

Lowe’s (LOW) is due to announce earnings Tuesday before the opening bell.

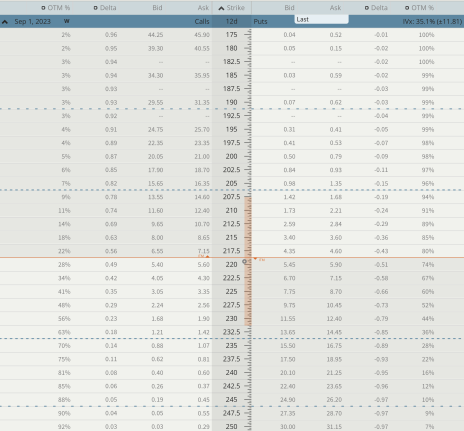

The stock is currently trading for 219.47.

- IV Rank: 30.4

Expected Move for the August 25, 2023, Expiration Cycle: 207.5 to 232.5

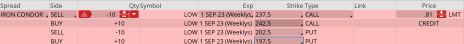

Knowing the expected range, I want to place the short call strike and short put strike of my iron condor outside of the expected range, in this case outside of 207.5 to 232.5.

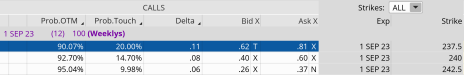

If we look at the call side of LOW for the September 1, 2023, expiration, we can see that selling the 237.5 call strike offers an 90.07% probability of success. The 237.5 call strike sits just above the expected move, or 232.5.

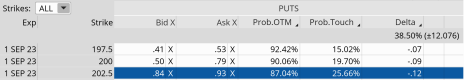

Now let us move to the put side. Same process as the call side. But now we want to find a suitable strike below the low side of our expected move, or 207.5. The 202.5 put, with an 87.04% probability of success, works.

We can create a trade with a nice probability of success if LOW stays within the 35-point range, or between the 237.5 call strike and the 202.5 put strike. Our probability of success on the trade is 90.07% on the upside and 87.04% on the downside.

Moreover, we have an 8.3% cushion to the upside and a 7.7% margin of error to the downside.

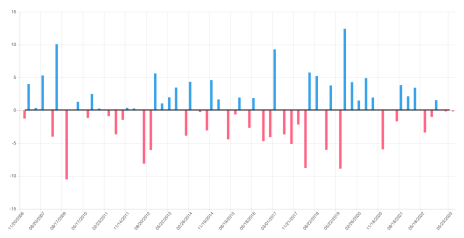

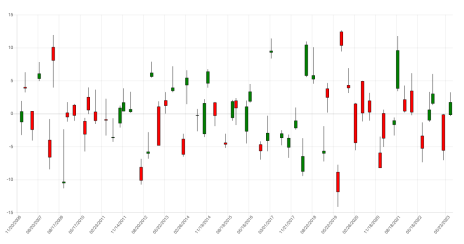

If we look at the earnings reactions since 11/29/2006, we can see that there have been only a few breaches of 5% to the upside or downside after an earnings announcement.

Net Change – At the Opening Bell

Full Bar – Closing Bell

If one wanted to make a trade, below are the potential strikes that make the most sense or are at least a starting point for a trade.

Here is the potential trade (as always, if I decide to place a trade in LOW, I will send a trade alert with updated data on Monday):

Simultaneously:

Sell to open LOW September 1, 2023, 237.5 calls

Buy to open LOW September 1, 2023, 242.5 calls

Sell to open LOW September 1, 2023, 202.5 puts

Buy to open LOW September 1, 2023, 197.5 puts for roughly $0.81 or $81 per iron condor.

Our margin requirement would be roughly $419 per iron condor. Again, the goal of selling the LOW iron condor is to have the underlying stock stay below the 237.5 call strike and above the 202.5 put strike immediately after LOW earnings are announced.

Here are the parameters for this trade:

- The probability of success – 90.07% (call side) and 87.04% (put side)

- The maximum return on the trade is the credit of $0.81, or $81 per iron condor

- Max return: 19.3% (based on $419 margin per iron condor)

- Break-even level: 238.31 – 201.69.

As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

The next Cabot Options Institute – Earnings Trader issue will be published on August 28, 2023.