Weekly Earnings Commentary

Since earnings season began, we’ve been fortunate enough to lock in all three of our earnings trades for winners. Our cumulative totals sit at 17.3% for an average one-day return of 5.8%.

Our latest winner came on Wednesday as we placed a trade in Mastercard (MA). We locked in a profit shortly after the opening bell the following day for a one-day return of 5.3%, mostly due to the volatility crush that occurs immediately following an earnings announcement when most of the near-term, built-in uncertainty in the stock has passed.

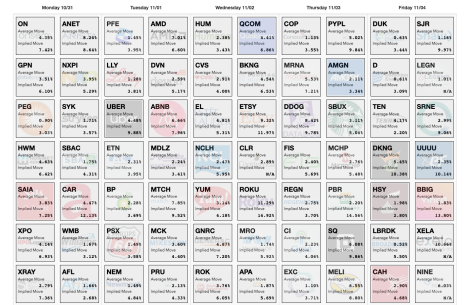

This week the focus shifts to namely Starbucks (SBUX), but a few others, several of which we discussed in last week’s subscriber-only webinar, are also on the watch list. For instance, CVS is due to announce before the opening bell on Wednesday so don’t be surprised to see a trade alert, most likely late in the trading day,

As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

The Week Ahead

Below are several companies that I think could offer a few trading opportunities.

Below are a few more ideas for those of you who tend to be a bit more aggressive.

Top Earnings Options Plays

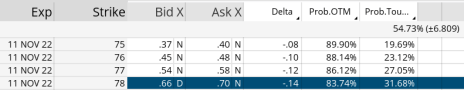

Here are a few top earnings options plays for this week (10/31 to 11/04) if you are so inclined:

Image Courtesy of Slope of Hope

Trade Ideas for Next Week

As a reminder, you will quickly begin to notice I tend to stick with stocks that have high liquidity as it’s far easier to get in and out of a trade. Medium liquidity offers tradable options, but sometimes the bid-ask spread is wider, which means a greater potential for more price adjustments, making entering and exiting a trade difficult from time to time. Remember, there are roughly 3,200 tradable stocks with options and 11% have medium liquidity while only 3% have what’s considered high liquidity.

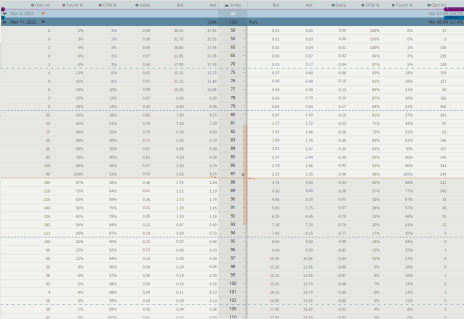

Starbucks (SBUX)SBUX is due to announce earnings Thursday after the closing bell. The stock is currently trading for 87.10.

IV Rank: 72.10

Expected Move for the November 11, 2022, Expiration Cycle: 81 to 93

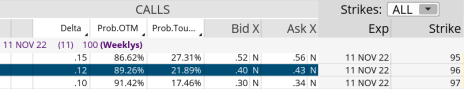

If we look at the call side of SBUX for the November 11, 2022, expiration, we can see that selling the 96 call strike offers an 89.26% probability of success. The 96 call strike sits just above the expected move, or 93. We can define our risk through buying the 99 call, thereby creating a three-strike-wide bear call spread at the 96/99 call strikes.

Now let us move to the put side. Same process as the call side. But now we want to find a suitable strike below the low side of our expected move, or 81. The 78 put, with an 83.74% probability of success, works. Staying with a three-strike-wide spread I can buy the 75 put to define our risk and create a bull put spread at the 78/75 strikes.

We can create a trade with a nice probability of success if SBUX stays within the 18-point range, or between the 96 call strike and the 78 put strike. Our probability of success on the trade is 89.26% on the upside and 83.74% on the downside.

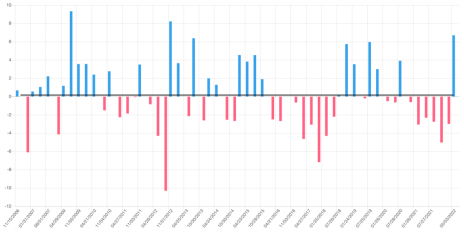

Moreover, we have a 10.2% cushion to the upside and 10.4% margin of error to the downside … well outside every historic earnings reaction in SBUX since 2006 (see below).

Courtesy of Slope of Hope

Here is the trade:

Simultaneously:

Sell to open SBUX November 11, 2022, 96 calls

Buy to open SBUX November 11, 2022, 99 calls

Sell to open SBUX November 11, 2022, 78 puts

Buy to open SBUX November 11, 2022, 75 puts for roughly $0.52 or $52 per iron condor.

Our margin requirement would be $248 per iron condor. Again, the goal of selling the SBUX iron condor is to have the underlying stock stay below the 96 call strike and above the 78 put strike immediately after SBUX earnings are announced.

Here are the parameters for this trade:

- The probability of success – 89.26% (call side) and 83.74% (put side)

- The maximum return on the trade is the credit of $0.52, or $52 per iron condor

- Max return: 21.0%

- Break-even level: 96.52 – 77.48.

The next Cabot Options Institute – Earnings Trader issue will be published on November 7, 2022.