This week is a complete dud when it comes to earnings announcements (which is why this report is so short this week), but no worries, earnings start in earnest the following week with the big banks (JPM, C, WFC, MS, etc.) all due to report on October 14. Moreover, this Friday we will be having our first subscriber-exclusive webinar at noon EST. In addition to going over several trades in the aforementioned bank stocks using our iron condor approach, I will also be introducing my step-by-step approach to short strangles with a few potential trades.

Weekly Earnings Commentary

This week is a complete dud when it comes to earnings announcements (which is why this report is so short this week), but no worries, earnings start in earnest the following week with the big banks (JPM, C, WFC, MS, etc.) all due to report on October 14. Moreover, this Friday, October 7, we will be having our first subscriber-exclusive webinar at noon ET. Click here to sign-up. In addition to going over several trades in the aforementioned bank stocks using our iron condor approach, I will also be introducing my step-by-step approach to short strangles with a few potential trades. It should be a great discussion and wonderful kick-off to what is hopefully a very profitable earnings season for Earnings Trader.

Top Earnings Options Plays

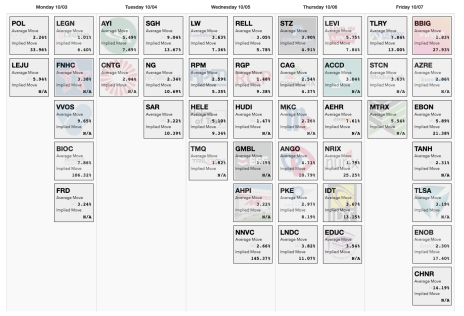

Here are a few top earnings options plays for this week (10/2 to 10/6) if you are so inclined:

The next Cabot Options Institute – Earnings Trader issue will be published on October 10, 2022.