Weekly Earnings Commentary

Earnings season is finally upon us.

This week offers up a few potential trading opportunities, particularly in some of the market stalwarts. Johnson and Johnson (JNJ), AT&T (T), Verizon (VZ) and American Express (AXP) are just a few of the names I’ll be focusing on. Tesla (TSLA) and Netflix (NLFX) are also due to report. While both stocks offer some incredibly healthy options premiums, I tend to stay away from the high-flyers even if the premiums are tempting. And if I do give in to temptation, I always pare back my position size.

As for our trades last week, well, we only had one. And I’m perfectly content with one trade this week as we officially kick off what could be one of the most interesting earnings seasons in a long time.

As most of you know, I came into the week focused on potential trades in JPMorgan (JPM), Citigroup (C) and a few other big banks.

And on Thursday I decided to plunge into our first trade by selling the JPM October 21, 2022 122/118 – 99/95 iron condor for $0.70. Since we went with a four-strike-wide spread our max potential return on the trade was 21.2%.

Since JPM was due to announce earnings prior to the opening bell Friday, I decided to go with the October 21 expiration cycle over the near-term October 14 expiration cycle. Yes, volatility crush is smaller going out the additional week, but I’m able to create a significantly wider range (greater probabilities) for my iron condor while still bringing in a decent amount of premium, which is always my preferred set-up.

So, once I placed the trade, the waiting game commenced. JPM closed pennies shy of 109.37 on Thursday, which gave our iron condor a cushy 7.9% on the upside and 9.5% on the downside.

On Friday morning JPM announced earnings prior to the opening bell and market participants were overly enthused. As a result, JPM opened the trading day 2.4% higher at 112 and continued the push higher for the next seven minutes, hitting an intra-day high of 115.24.

As the trading day progressed, JPM moved steadily lower and our premium continued to erode due to a few factors, namely volatility crush and time decay, but mostly the former.

Implied volatility was 54% at the time of our trade and fell to 47% by the time we got out of the trade. At a glance, that doesn’t seem like much of a difference, but it’s close to a 13% shave off the overall premium … which is exactly what we want to see. And when JPM’s price started to slowly grind lower I decided to take off the trade for a small, one-day profit of 6.7%. I know, it’s not the largest gain. In fact, it’s definitely on the smaller side historically when looking at a scatter plot of my earnings trades going back to 2017. But I’m not about to complain about a one-day profit of 6.7%.

Of course, the temptation to hold on to a trade and seek more gains is always there, and for some investors that is their preference. As long as you understand the risks associated with holding on, I’m perfectly fine with that decision. My preference is to keep things mechanical, as best I can, by keeping my trades limited in duration. We are using near-term expiration cycles, so staying nimble and limiting exposure to risk is the name of the game. Take profits when they present themselves. Remember, it’s all about the law of large numbers. Allow the singles and doubles to add up in your favor, while limiting your overall risk.

As a reminder, we will have a subscriber-exclusive webinar every Friday during earnings season, so make sure to sign up. Here is a link to the next subscriber-exclusive webinar this Friday, October 21.

And of course, as always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

The Week Ahead

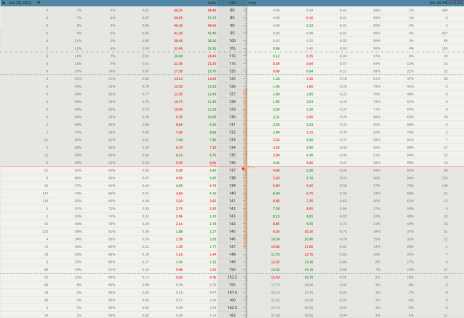

Below are several companies that I think could offer a few trading opportunities.

Below are a few more ideas for those of you who tend to be a bit more aggressive.

Top Earnings Options Plays

Here are a few top earnings options plays for this week (10/17 to 10/21) if you are so inclined:

Trade Ideas for Next Week

American Express (AXP)

AXP is due to announce earnings Friday (10/21) prior to the opening bell. The stock is currently trading for 136.81.

IV Rank: 92.46

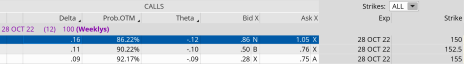

Expected Move for the October 28, 2022, Expiration Cycle: 126 to 147

Knowing the expected range, I want to, in most cases, place the short call strike and short put strike of my iron condor outside of the expected range, in this case outside of 126 to 147.

If we look at the call side of AXP for the October 28, 2022, expiration, we can see that selling the 150 call strike offers an 87.51% probability of success. The 150 call strike sits just above the expected move, or 147. We can define our risk through buying the 155 call, thereby creating a five-strike-wide bear call spread at the 150/155 call strikes.

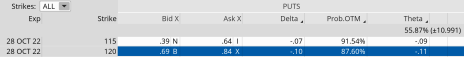

Now let us move to the put side. Same process as the call side. But now we want to find a suitable strike below the low side of our expected move, or 126. The 120 put, with an 87.60% probability of success, works. Staying with a five-strike-wide spread I can buy the 115 put to define our risk and create a bull put spread at the 120/115 strikes.

We can create a trade with a nice probability of success if AXP stays within the 30-point range, or between the 150 call strike and the 120 put strike. Our probability of success on the trade is 86.22% on the upside and 87.60% on the downside.

Here is the trade:

Simultaneously:Sell to open AXP October 28, 2022, 150 calls

Buy to open AXP October 28, 2022, 155 calls

Sell to open AXP October 28, 2022, 120 puts

Buy to open AXP October 28, 2022, 115 puts for roughly $0.70 or $70 per iron condor

Our margin requirement would be $430 per iron condor. Again, the goal of selling the AXP iron condor is to have the underlying stock stay below the 150 call strike and above the 120 put strike immediately after JPM earnings are announced.

Here are the parameters for this trade:

- The probability of success – 86.22% (call side) and 87.60% (put side)

- The maximum return on the trade is the credit of $0.70, or $70 per iron condor

- Max return: 16.3%

- Break-even level: 150.70 – 119.30

Summary

American Express offers a decent opportunity for a trade and one that I will be focusing on as the week progresses. Verizon (VZ) is another stock I like to trade during earnings season if the metrics look good, so don’t be surprised to see at least two trades, if not more, next week.

As you will quickly begin to notice, I tend to stick with stocks that have high liquidity as it’s far easier to get in and out of a trade. Medium liquidity offers tradable options, but sometimes the bid-ask spread is wider, which means a greater potential for more price adjustments, making entering and exiting a trade difficult from time to time. Remember, there are roughly 3,200 tradable stocks with options and 11% have medium liquidity while only 3% have what’s considered high liquidity.

The next Cabot Options Institute – Earnings Trader issue will be published on October 24, 2022.