Weekly Earnings Commentary

Another earnings season is finally behind us.

After two winning trades in Home Depot (HD) and Walmart (WMT) last week our cumulative total for the earnings cycle was 21.7%. That’s an average gain of 3.1% per trade, below our expected return per trade but certainly nothing to sneeze at, especially in this volatile market. I’ll take what can be thought of as paying myself a 3.1% dividend, seven times, over the past month or so. Again, not even close to a home run, but remember, we aren’t playing long ball. Aaron Judge doesn’t interest us. Our goal is to hit singles and doubles with each and very trade we place. We’re taking the Tony Gwynn/Rod Carew approach to trading earnings.

Now that we are entering the doldrums between earnings cycles our weekly webinars will come to a temporary halt. Our next subscriber-only webinar will occur January 13, 2023.

However, as mentioned in our last webinar, I expect to continue to send trade ideas on a weekly basis (potential trade in Costco (COST) next week) and will be focusing most of my attention on our approach to short strangles. As I’ve mentioned numerous times in the past, I expect to integrate short strangles into the fold to offer the potential for a few more trades. Additionally, the strategy will also offer the possibility for an alternative approach for those of you that want to use a higher-probability approach over the risk-defined characteristics (lower probability) of an iron condor.

Anyway, this week is a short one for us as the market takes off Thursday and comes back for a half day Friday. That being said, I hope all of you have a wonderful and safe holiday!

And, as always, if you have any questions please do not hesitate to email me at andy@cabotwealth.com.

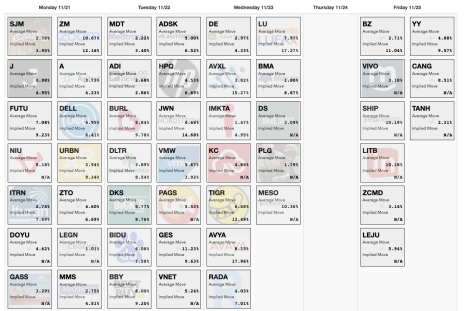

Top Earnings Options Plays

Here are a few top earnings options plays for this week (11/21 to 11/25) if you are so inclined:

Courtesy of Slope of Hope

Trade Ideas for Next Week

No earnings ideas this week.

The next Cabot Options Institute – Earnings Trader issue will be published on November 28, 2022.