As we enter the fourth week of earnings we’ve been averaging only one trade per week. No biggie. We should still see our average of 8-12 trades by the end of the season and with a few key opportunities next week I hope to make at least two, potentially three trades. Of course, Mr. Market will truly decide whether or not we are able to place more than one or two trades next week.

Cabot Options Institute – Earnings Trader Issue: July 29, 2022

As we enter the fourth week of earnings we’ve been averaging only one trade per week. No biggie. We should still see our average of 8-12 trades by the end of the season and with a few key opportunities next week I hope to make at least two, potentially three trades. Of course, Mr. Market will truly decide whether or not we are able to place more than one or two trades next week.

My intent is to focus on Caterpillar (CAT), Starbucks (SBUX) and CVS Health (CVS) and a few others, but again, I’m not going to force anything. Remember, while these are short-term trades, the strategy is considered long-term. With only three trades under our belt, we’ve experienced one winner and two small losers, but hey, when I started trading earnings season back in 2017 using the same strategy I experienced three losing trades out of the gate with losses of 34%, 40% and 60%. Sounds bad, right? Well, four years later our cumulative total was 932.2%, so those initial losses, while no fun, had no bearing on the overall returns. Again, our approach is about allowing the law of large numbers to work itself out knowing that we will experience bouts of sequence risk from time to time.

That being said, we’ve seen some serious outlier moves. For example, the MSFT move was a 1.5 standard deviation move. At the time when we placed the trade the probability of success for MSFT hitting 276 (where it is trading now) by expiration was less than 3%. But hey, these moves happen. And in most cases, when an outlier like this occurs a major loss occurs, but we were fortunate to play it safe, stick to our stop-loss and get out when our iron condor hit $1.30. Our loss on the trade was $0.65, or 14.9%. We can thank the incredible amount of volatility crush that occurred after earnings were announced as implied volatility went from roughly 80% prior to earnings to roughly 42% by the time we exited the trade.

So we’ll get back at it next week knowing that, inevitably, the law of large numbers will start to surface. We just need to keep making more and more trades to allow that to occur. My max losing streak is three losers in a row and that’s occurred twice. I’ve also had one occurrence of two losers in a row; otherwise, we’ve just seen individual losers from time to time. So, it will be interesting to see what the next few weeks bring. There is no doubt it’s been a slow start, but again, we are early in the game and I look forward to seeing what the statistics bring us over the next several weeks.

As a reminder, we will have a subscriber-exclusive webinar every Friday during earnings season, so make sure to sign up. Here is a link to today’s (July 29) webinar at noon ET.

And of course, as always, if you have any questions please do not hesitate to email me at andy@cabotwealth.com.

The Week Ahead

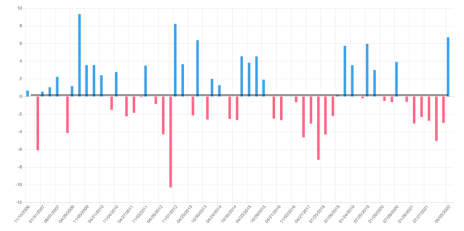

Below are several companies that I think could offer a few trading opportunities next week.

Below are a few more ideas for those of you who tend to be a bit more aggressive.

Top Earnings Options Plays

Here are a few top earnings options plays for next week (8/1 to 8/5) if you are so inclined:

Trade Ideas for Next Week

Starbucks (SBUX)

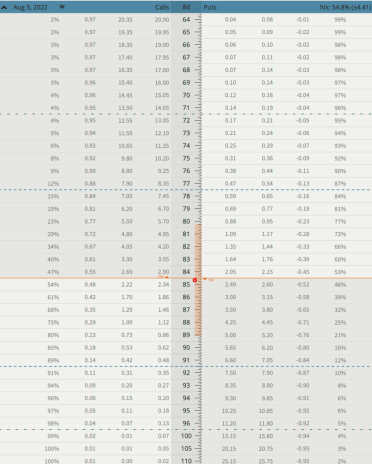

SBUX is due to announce earnings next Tuesday (August 2) after the closing bell. The stock is currently trading for 84.67.

IV Rank: 70.12

Expected Move for the August 5, 2022, Expiration Cycle: 80 to 89

Knowing the expected range, I want to place the short call strike and short put strike of my iron condor outside of the expected range, in this case outside of 80 to 89.

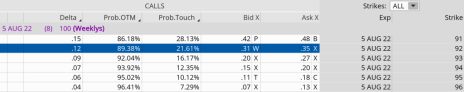

If we look at the call side of SBUX for the August 5, 2022, expiration, we can see that selling the 92 call strike offers an 89.38% probability of success. The 92 call strike sits just above the expected move, or 89. We can define our risk through buying the 96 call, thereby creating a four-strike-wide bear call spread at the 92/96 call strikes.

Now let us move to the put side. Same process as the call side. But now we want to find a suitable strike below the low side of our expected move, or 80. The 76 put, with an 87.50% probability of success, works. Staying with a four-strike-wide spread I can buy the 72 put to define our risk and create a bull put spread at the 76/72 strikes.

We can create a trade with a nice probability of success if SBUX stays within the 16-point range, or between the 92 call strike and the 76 put strike. Our probability of success on the trade is 89.38% on the upside and 87.50% on the downside.

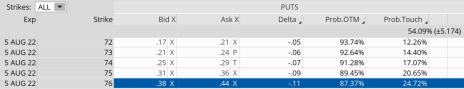

Moreover, we have an 8.66% cushion to the upside and 10.24% margin of error to the downside…well outside every historic earnings reaction in SBUX since 2006 (see below).

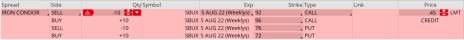

Here is the trade:

Simultaneously:

Sell to open SBUX August 5, 2022, 385 calls

Buy to open SBUX August 5, 2022, 390 calls

Sell to open SBUX August 5, 2022, 300 puts

Buy to open SBUX August 5, 2022, 295 puts for roughly $0.45 or $45 per iron condor

Our margin requirement would be $455 per iron condor. Again, the goal of selling the SBUX iron condor is to have the underlying stock stay below the 92 call strike and above the 76 put strike immediately after SBUX earnings are announced.

Here are the parameters for this trade:

- The probability of success – 89.38% (call side) and 87.50% (put side)

- The maximum return on the trade is the credit of $0.45, or $45 per iron condor

- Max return: 12.7%

- Break-even level: 92.45 – 75.55

Summary

SBUX offers a decent opportunity for a trade and one that I will be focusing on next week, along with several others. That being said, there are various other opportunities that should come our way next week so be prepared for at least two alerts, potentially more if all goes well. Of course, Mr. Market will dictate our decisions.

The next Cabot Options Institute – Earnings Trader issue will be published on August 5, 2022.

About the Analyst

Andy Crowder

Andy Crowder is a professional options trader, researcher and Chief Analyst of Cabot Options Institute. Formerly with Oppenheimer & Co. in New York, Andy has leveraged his investment experience to develop his statistically based options trading strategy which applies probability theory to option valuations in order to execute risk-controlled trades. This proprietary strategy has been refined through two decades of research and real-world experience and has been featured in the Wall Street Journal, Seeking Alpha, and numerous other financial publications. Andy has helped thousands of option traders learn and implement his meticulous rules-driven options trading strategies through highly attended conferences, one-on-one coaching, webinars, and his work as a financial columnist. He currently resides in Bolton Valley, Vermont and when he’s not trading, teaching and writing about options, he enjoys spending time with his wife and two daughters, backcountry skiing, biking, running and enjoying all things outdoors.