Weekly Earnings Commentary

As earnings season comes to a close, we still have several opportunities ahead of us.

The holiday-shortened week starts with the potential success or failure of our Home Depot (HD) trade placed late in Friday’s trading session. Due to the market closure on Monday and HD’s earnings announcement prior to the opening bell Tuesday, we needed to place a trade on Friday.

My guess (and hope) is that we will be out of the trade before this issue goes out. Of course, let’s hope we are able to add another winning trade to the mix.

Our open position going into Tuesday is the February 24, 2023, 345/340 – 290/285 iron condor. We sold the iron condor for $0.70. My hope is that we can buy it back for $0.35 or less, lock in a profit and move on. Hopefully the market cooperates and opens up right in the middle of our 50-point range, or 315. HD closed Friday’s session at 317.95.

As a reminder, there will be no more Friday webinars until around mid-April when earnings season ramps back up. Until then expect to see a few potential trades on a week-to-week basis in the weekly issues, some of which I plan on acting on.

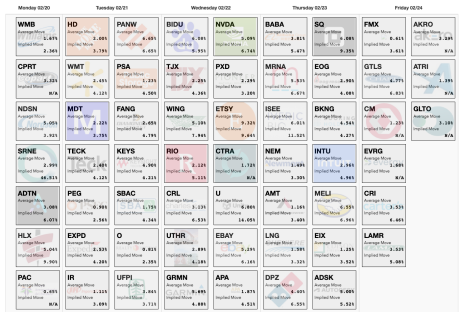

Weekly Watchlist

- Nvidia (NVDA)

- Baidu (BIDU)

- eBay (EBAY)

- Alibaba (BABA)

We discussed numerous trades in our weekly subscriber-only webinar going through each trade in a step-by-step manner. In addition to our HD trade, my hope is that we can make at least one more trade this week. Our average number of trades per earnings season is approximately eight to 10 trades.

If you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

Top Earnings Options Plays

Here are a few top earnings options plays for this week (2/20-2/24) if you are so inclined:

Trade Ideas for Next Week

As a reminder, you will quickly begin to notice I tend to stick with stocks that have high liquidity as it’s far easier to get in and out of a trade. Medium liquidity offers tradable options, but sometimes the bid-ask spread is wider, which means a greater potential for more price adjustments, making entering and exiting a trade difficult from time to time. Remember, there are roughly 3,200 tradable stocks with options and 11% have medium liquidity while only 3% have what’s considered high liquidity.

Potential Trade Ideas for This Week

Nvidia (NVDA)

NVDA is due to announce earnings Wednesday after the closing bell. The stock is currently trading for 213.88.

IV Rank: 36.1

Expected Move for the March 3, 2023, Expiration Cycle: 195 to 235

Knowing the expected range, I want to place the short call strike and short put strike of my iron condor outside of the expected range, in this case outside of 195 to 235.

If we look at the call side of NVDA for the March 3, 2023, expiration, we can see that selling the 255 call strike offers a 92.90% probability of success. The 255 call strike sits just above the expected move, or 235.

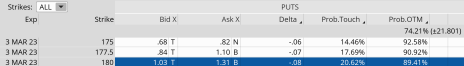

Now let us move to the put side. Same process as the call side. But now we want to find a suitable strike below the low side of our expected move, or 195. The 180 put, with an 89.41% probability of success, works.

We can create a trade with a nice probability of success if NVDA stays within the 75-point range, or between the 255 call strike and the 180 put strike. Our probability of success on the trade is 92.90% on the upside and 89.41% on the downside.

Moreover, we have a 19.2% cushion to the upside and a 15.8% margin of error to the downside.

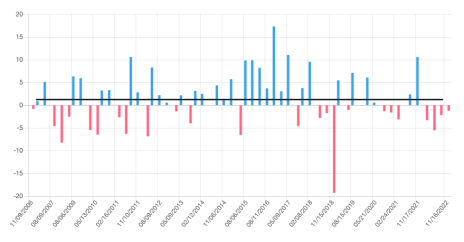

If we look at the earnings reactions since 11/9/2006, we can see that there have only been a few breaches of 8% to the upside or downside after an earnings announcement.

As a result, an iron condor looks plausible. However, I would like to widen my current range if and when I make a trade this week. As always, IF I decide to place a trade in NVDA, I will send a trade alert with updated data.

Here is the potential trade (as always, if I decide to place a trade in NVDA, I will send a trade alert with updated data):

Simultaneously:

Sell to open NVDA March 3, 2023, 255 calls

Buy to open NVDA March 3, 2023, 260 calls

Sell to open NVDA March 3, 2023, 180 puts

Buy to open NVDA March 3, 2023, 175 puts for roughly $0.75 or $75 per iron condor.

Our margin requirement would be roughly $425 per iron condor. Again, the goal of selling the NVDA iron condor is to have the underlying stock stay below the 255 call strike and above the 180 put strike immediately after NVDA earnings are announced.

Here are the parameters for this trade:

- The probability of success – 92.90% (call side) and 89.41% (put side)

- The maximum return on the trade is the credit of $0.75, or $75 per iron condor

- Max return: 17.6% (based on $425 margin per iron condor)

- Break-even level: 255.75 – 179.25.

As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

The next Cabot Options Institute – Earnings Trader issue will be published on

February 27, 2023.