Weekly Earnings Commentary

We’re just shy of a month away from earnings season, but that doesn’t mean that potential trading opportunities don’t exist. This week we actually have three notable earnings releases in stocks with highly liquid options.

On Tuesday, after the close, Nike (NKE) will report earnings followed by Carnival Cruise Lines (CCL) Wednesday morning. And to top off the week, Micron (MU) will release earnings after the closing bell Wednesday.

All three, highly liquid stocks, have implied volatilities in the 60% to 100% range. Moreover, each stock also has an IV rank well above normal. And after looking at the options for the December 23, 2022 expiration cycle some decent opportunities exist. As always, I’ll send out an alert if I decide to open a trade.

If you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

Top Earnings Options Plays

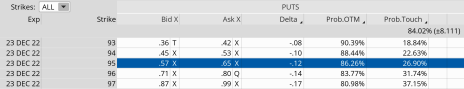

Here are a few top earnings options plays for this week (12/19 to 12/23) if you are so inclined:

Courtesy of Slope of Hope

Trade Ideas for Next Week

As a reminder, you will quickly begin to notice I tend to stick with stocks that have high liquidity as it’s far easier to get in and out of a trade. Medium liquidity offers tradable options, but sometimes the bid-ask spread is wider, which means a greater potential for more price adjustments, making entering and exiting a trade difficult from time to time. Remember, there are roughly 3,200 tradable stocks with options and 11% have medium liquidity while only 3% have what’s considered high liquidity.

Nike (NKE)

NKE is due to announce earnings Tuesday after the closing bell. The stock is currently trading for 105.95.

IV Rank: 57.6

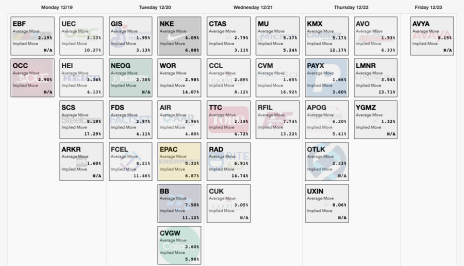

Expected Move for the December 23, 2022, Expiration Cycle: 98 to 114

Knowing the expected range, I want to place the short call strike and short put strike of my short strangle outside of the expected range, in this case outside of 98 to 114.

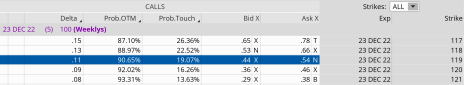

If we look at the call side of NKE for the December 23, 2022, expiration, we can see that selling the 119 call strike offers a 90.65% probability of success. The 119 call strike sits just above the expected move, or 114.

Now let us move to the put side. Same process as the call side. But now we want to find a suitable strike below the low side of our expected move, or 98. The 95 put, with an 86.26% probability of success, works.

We can create a trade with a nice probability of success if NKE stays within the 24-point range, or between the 119 call strike and the 95 put strike. Our probability of success on the trade is 90.65% on the upside and 86.26% on the downside.

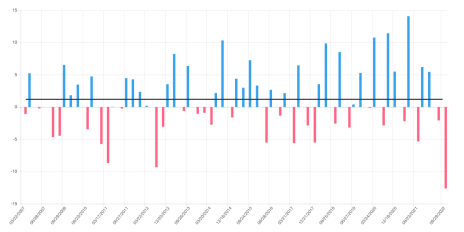

Moreover, we have a 12.2% cushion to the upside and 10.4% margin of error to the downside … well outside of almost every historic earnings reaction in NKE since 2007 (see below).

Courtesy of Slope of Hope

Here is the potential trade (as always, if I decide to place a trade in NKE, I will send a trade alert with updated data):

Simultaneously:

Sell to open NKE December 23, 2022, 119 calls

Sell to open NKE December 23, 2022, 95 puts for roughly $1.10 or $110 per short strangle.

Our margin requirement would be roughly $1,060 per short strangle. Again, the goal of selling the NKE short strangle is to have the underlying stock stay below the 119 call strike and above the 95 put strike immediately after NKE earnings are announced.

Here are the parameters for this trade:

- The probability of success – 90.65% (call side) and 86.26% (put side)

- The maximum return on the trade is the credit of $1.10, or $110 per short strangle

- Max return: 10.4% (based on $1,060 margin per short strangle)

- Break-even level: 120.10 – 93.90

As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

The next Cabot Options Institute – Earnings Trader issue will be published on

December 27, 2022.