Weekly Earnings Commentary

Earnings season kicks off this week with several of the big banks due to announce towards the latter part of the week.

On Friday, prior to the opening bell, JPMorgan Chase (JPM), Wells Fargo (WFC) and Citigroup (C) are due to announce and will be the focus of our attention this week. I’ve discussed below a potential trade in JPM, but it wouldn’t surprise me if Citigroup and Wells Fargo enter the trading fray this week. That being said, we’ve had decent success with JPM since starting Earnings Trader, with 3 out of 3 winning trades for an average one-day return of 5.3%, so I will most likely stick to the script this week.

If you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

Weekly Watchlist

- Citigroup (C)

- Delta Air (DAL)

- JPMorgan Chase (JPM)

- Wells Fargo (WFC)

Top Earnings Options Plays

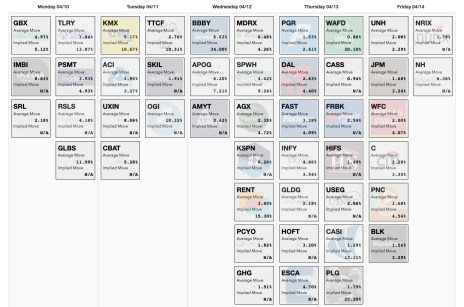

Here are a few top earnings options plays for this week (4/10 to 4/14) if you are so inclined:

Images Courtesy of Slope of Hope

Trade Ideas for Next Week

As a reminder, you will quickly begin to notice I tend to stick with stocks that have high liquidity as it’s far easier to get in and out of a trade. Medium liquidity offers tradable options, but sometimes the bid-ask spread is wider, which means a greater potential for more price adjustments, making entering and exiting a trade difficult from time to time. Remember, there are roughly 3,200 tradable stocks with options and 11% have medium liquidity while only 3% have what’s considered high liquidity.

Potential Trade Ideas for This Week

JPMorgan Chase (JPM)

JPMorgan Chase (JPM) is due to announce earnings Friday before the opening bell.

The stock is currently trading for 127.51.

- IV Rank: 38.7

Expected Move for the April 21, 2023, Expiration Cycle: 121 to 134

Knowing the expected range, I want to place the short call strike and short put strike of my iron condor outside of the expected range, in this case outside of 121 to 134.

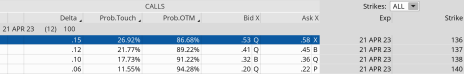

- If we look at the call side of JPM for the April 21, 2023, expiration, we can see that selling the 136 call strike offers an 86.68% probability of success. The 136 call strike sits just above the expected move, or 134.

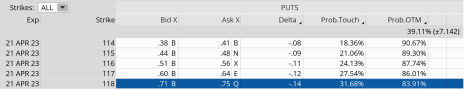

Now let us move to the put side. Same process as the call side. But now we want to find a suitable strike below the low side of our expected move, or 121. The 118 put, with an 83.91% probability of success, works.

We can create a trade with a nice probability of success if JPM stays within the 18-point range, or between the 136 call strike and the 118 put strike. Our probability of success on the trade is 86.68% on the upside and 83.91% on the downside.

Moreover, we have a 6.7% cushion to the upside and a 7.4% margin of error to the downside.

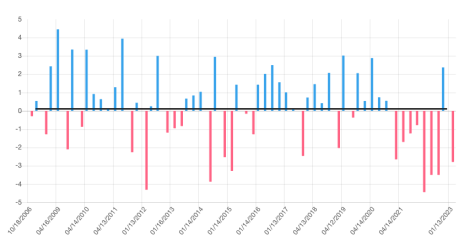

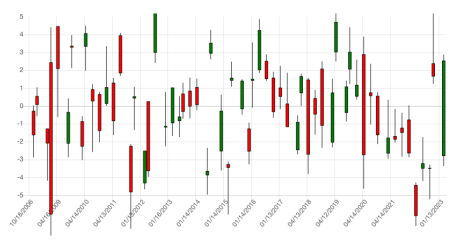

If we look at the earnings reactions since 10/18/2006, we can see that there have been only a few breaches of 4% to the upside or downside after an earnings announcement.

Net Change – At the Opening Bell

Full Bar – Price Movement Throughout the Day

If one wanted to make a trade, below are the potential strikes that make the most sense or are at least a starting point for a trade. I will say that my hesitation with JPM is liquidity. The bid-ask spread is a bit wide for my liking and coming in with size might move markets.

Here is the potential trade (as always, if I decide to place a trade in JPM, I will send a trade alert with updated data):

Simultaneously:

Sell to open JPM April 21, 2023, 136 calls

Buy to open JPM April 21, 2023, 140 calls

Sell to open JPM April 21, 2023, 118 puts

Buy to open JPM April 21, 2023, 114 puts for roughly $0.68 or $68 per iron condor.

Our margin requirement would be roughly $332 per iron condor. Again, the goal of selling the JPM iron condor is to have the underlying stock stay below the 136 call strike and above the 118 put strike immediately after JPM earnings are announced.

Here are the parameters for this trade:

- The probability of success – 86.68% (call side) and 83.91% (put side)

- The maximum return on the trade is the credit of $0.68, or $68 per iron condor

- Max return: 20.5% (based on $332 margin per iron condor)

- Break-even level: 136.68 – 117.32.

As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

The next Cabot Options Institute – Earnings Trader issue will be published on April 17, 2023.