This week, all everyone cares about is the banking system, and so I’ve been thinking about it a lot.

I continue to believe that this banking crisis is manageable and NOT systemic.

Here’s how I see it…

According to the FDIC, there were $620BN of unrealized losses as of year-end 2022.

There is $2.1 Trillion of tier 1 capital as of Q4 2022. Tier 1 Capital as a percentage of risk-weighted assets is 14.25%.

If we assumed that all $620BN of unrealized losses become realized, tier 1 capital will shrink to $1.5BN or 10.04% of risk-weighted assets.

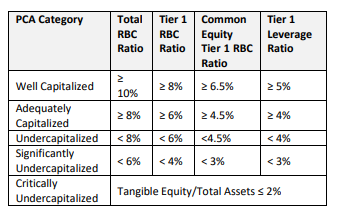

The threshold to be considered well capitalized according to the FDIC is 8%.

Thus, even in a draconian scenario, the U.S. banking system appears well capitalized.

Finally, I’ve looked through all the bank recommendations on my Cabot Micro-Cap Insider recommendation list, and unrealized losses appear manageable across the board.

While my belief is the current crisis is manageable, I do want to stay humble and recognize that I could be missing something (if you think I am, let me know!).

After all, I’m not a banking expert.

In terms of updates this week, there were several that I wanted to highlight (full updates below):

1) Currency Exchange (CURN) reported another excellent quarter.

2) P10 (PX) bought back 100,000 shares from an insider at an 8% discount to the market.

3) Zedge (ZDGE) reported a disappointing quarter.

4) Esquire Financial (ESQ) reported some insider buying.

5) William Penn (WMPN) reported some insider buying.

The next issue of Cabot Micro-Cap Insider will be published on Wednesday, April 12. As always, if you have any questions, please email me at rich@cabotwealth.com.

Changes This Week

No changes

Updates

Cogstate Ltd (COGZF) reported disappointing fiscal 1H 2023 results on February 27. Revenue declined 15% y/y due to timing of clinical trials which can be quite lumpy and difficult to project. For the full fiscal year, management expects revenue to be down 6% to 9%. While this is disappointing, the long-term outlook for the company is very strong given development in the Alzheimer’s market and future demand for Cogstate’s cognitive test. One other interesting tidbit is Cogstate was approached as an acquisition candidate and, while the deal fell through, it does signal that the company has strong strategic value. Finally, the company announced a share buyback program for $13MM which represents ~5% of shares outstanding. This is a nice positive given where the shares are trading. Original Write-up. Buy under 1.80

Copper Property Trust (CPPTL) paid out $0.106699 per trust certificate on March 9. This distribution doesn’t include any proceeds from asset sales and implies a 12% yield while trust holders wait for more assets to be sold with proceeds to be distributed. Copper Property Trust continues to look attractive. Original Write-up. Buy under 14.00

Currency Exchange International (CURN) reported another excellent quarter on March 15. Revenue grew 32% to $16.5MM, beating consensus expectations by ~$1MM. While we have grown accustomed to 100%+ revenue growth, typical seasonality is returning to the business (Q1 is typically the weakest quarter while Q3 is typically the strongest). Banknote revenue grew 26% while Payments revenue increased 60%. Currency Exchange’s valuation looks attractive at 9x forward earnings and 7x forward free cash flow. Original Write-up. Buy under 16.00

Epsilon Energy (EPSN) had no news this week but has been lagging the market due to weak natural gas prices. Nonetheless, I believe the natural gas weakness will be short-lived and that Epsilon remains a compelling long-term play. Epsilon reported an excellent quarter on November 10. Revenue increased 6% sequentially. In the quarter, Epsilon generated $9.6MM of net income and $11.2MM in free cash flow. This is quite significant for a company with a market cap of $130MM. The company continues to buy back shares and pay dividends. Due to the strong cash generation in the quarter, Epsilon currently has $40MM of cash on its balance sheet and no debt. The stock continues to look attractive. Original Write-up. Buy under 8.00

Esquire Financial Holdings (ESQ) reported on March 15 that its CFO bought 1,500 shares in the open market. This is reassuring given the current banking crisis. The company reported Q4 results on January 25. Net income increased 18%. The company generated an industry-leading ROA and ROE of 2.8% and 24%, respectively. Loan growth and strong underwriting are driving the excellent results. Non-performing loans remain at 0%. Despite strong fundamentals, Esquire trades at just 10x forward earnings. Original Write-up. Buy under 45.00

IDT Corporation (IDT) reported another solid quarter on March 8. Consolidated revenue decreased 7% due to continued tough comps, but NRS continues to grow like crazy (+103%) and net2phone does as well (+30%). The company generated $23.2MM of consolidated EBITDA. Thus, it’s trading at 6.2x consolidated annualized EBITDA. So the stock now looks cheap on both a consolidated and SOTP basis. Given challenging market conditions for high-growth companies, IDT’s subsidiaries won’t be spun off soon, but we know that ultimately, they will be monetized either through a sale or through a spin-off. The investment case remains on track. Original Write-up. Buy under 45.00

Kistos PLC (KIST: GB) had no news this week. It reported an operational update on January 18. By my math, Kistos generated €100MM in the second half of 2022, or €200MM on an annualized basis. As such, Kistos is trading at a price to free cash flow multiple of 1.6x. Further, Kistos has 40% of its market cap in cash. Management stated that the regulatory environments in the Netherlands and the U.K. have made investment decisions more difficult (excess profit tax). Nevertheless, the company is evaluating acquisitions outside of the Netherlands and the U.K. It is also considering returning cash to shareholders. Kistos continues to look compelling to me. Original Write-up. Buy under 7.50

Liberated Syndication (LSYN) is working to gain liquidity for shareholders. I spoke to the CEO on February 17 and got an update. He is pursuing any and all liquidity options for investors including: 1) partnering with a SPAC, 2) merging with another public NOL shell, 3) raising money through an IPO, and 4) taking on private equity. I don’t have a sense of timing in terms of when LSYN shareholders can expect liquidity, but I know it is a big focus for the company. From a financial perspective, Libsyn continues to grow strongly. Revenue grew from $42MM in 2021 to $57MM in 2022. On a pro forma basis (full-year contribution from the acquisition of Julep) revenues are over $60MM. Profitability is down as the company is focused on expanding into the podcasting advertising market which has lower profitability than the hosting business. Still, I’m optimistic that Libsyn has a bright future. Original Write-up. Hold

Merrimack Pharma (MACK) had no news this week. It is a biotech company that has no employees. It relies on contractors to minimize costs. Its sole purpose is to receive milestone payments from Ipsen related to the drug Onivyde. Onivyde will likely be approved for first-line metastatic small-cell lung cancer in early 2024 which will trigger a $225MM royalty payment. Merrimack has committed to distributing any royalty proceeds to investors. I expect Merrimack to distribute $15 per share to investors within ~15 months, representing more than 125% of its current share price. Additional upside can be achieved through future milestone payments. Finally, insiders are buying stock in the open market. Original Write-up. Buy under 12.50

M&F Bancorp (MFBP) reported quarterly results on February 10. EPS increased 115% to $0.82. Return on equity increased to 34% from 12.2% a year ago. As expected, M&F is benefiting from new funds from the Emergency Capital Investment Program. M&F’s balance sheet remains strong with 0.2% non-performing loans. Stockholders’ equity represents 26% of total assets. The investment case is on track. Despite an appreciating stock price, M&F is trading at just 7.7x annualized earnings. I expect EPS to grow to $4.74 in 2025. Assuming M&F continues to trade at its average P/E multiple of 9.3x, the stock should hit 44.00 by 2025, implying significant upside. Original Write-up. Buy under 21.00

Medexus Pharma (MEDXF) announced on March 8 that it has secured new credit facilities amounting to $58.5MM. The interest rate for the facilities is only 8.58%, which is slightly surprising considering WBD recently issued debt at 6.4%. The new facilities include a $35 million loan, of which $30MM will be used to repay long-term debt, and an additional $5MM that can be used to pay off debentures. Additionally, there is a possibility of accessing an extra $20MM of uncommitted capital. Medexus plans to use this capital to repay convertible debentures in cash, which could potentially halve the dilution. Overall, this is a big positive. All in all, my conviction level remains high. The stock’s valuation looks cheap. Original Write-up. Buy under 3.50

NexPoint (NXDT) had no news this week. It filed its 10-Q to report earnings on November 14. The results looked good. Operating cash flow is healthy. NAV as of September 30, 2022, is $28.17 so the stock is still trading at a big discount to fair value. The company generated $0.55 of funds from operations in the quarter. As such, it’s trading at ~7x, a discount to peers who trade closer to 12x. NexPoint has underperformed recently, but it remains a high-conviction idea. Original Write-Up. Buy under 17.00

Opera (OPRA) reported an excellent quarter on February 27. Revenue grew 33%, beating consensus expectations by 7%. EPS of $0.27 beat consensus expectations by $0.70. The company is expecting revenue growth of 15% and EBITDA growth of 12%. This seems very conservative, which is the company’s typical approach to guidance. The investment case remains on track. Original Write-Up. Buy under 8.00

P10 Holdings (PX) filed a form 4 statement on March 16 that seemed to indicate that an insider is selling. But it appears that the company repurchased those shares at an 8% discount to the market (privately negotiated transaction). What appears like a negative is actually a positive. P10 announced an excellent quarter on March 6. Fee-paying assets under management increased 23% y/y. Revenue increased 32% and adjusted EBITDA grew 29%. P10 continues to benefit from secular tailwinds in the private equity industry. Despite strong growth, P10 trades at just 12.9x EBITDA and just 13x cash earnings. This is too cheap a valuation. The investment case is on track. Original Write-up. Buy under 15.00

RediShred (RDCPF) had no news this week and will report year-end 2022 results in March. The company announced good quarterly results on November 27. Revenue grew 50% y/y to $14.7MM CAD (47% constant currency growth). EBITDA increased 27% to $3.6MM CAD. On an organic basis, EBITDA grew 13% y/y. Organic growth is being driven by increased demand for shredding by businesses. Higher fuel costs and driver costs hurt margins. However, the company plans to pass through price hikes which will help offset these headwinds. RediShred is also active on the acquisition front. The stock continues to look incredibly cheap at a 5.1x EV/EBITDA multiple and a 7.4x price to free cash flow multiple. I continue to see 100% upside over the next 12 months and significantly more upside looking out a few years. Original Write-up. Buy under 3.50

Transcontinental Realty Investors (TCI) had no news this week. It disclosed its quarterly earnings on November 10. The sale of the joint venture (JV) has closed, and Transcontinental reported that it intends to use $182.9MM of the proceeds to “invest in income-producing real estate, pay down debt and for general corporate purposes.” The company hasn’t disclosed what it intends to do with the second installment of proceeds from the JV sale ($203.9MM). The company continues to look attractive with 96% of its market cap in cash. Insiders own 86% of the company and could make an imminent move to buy out remaining shareholders at a large premium to the current stock price. Original Write-up. Buy under 45.00

Truxton (TRUX) sold off this week in sympathy with the fallout from Silicon Valley Bank. However, Truxton should experience no impact from the SVB disaster. It reported Q4 earnings on January 26. For the full year, diluted EPS increased 15% to $5.02. Credit quality and loan growth continue to look good. Most importantly, Truxton authorized a $5MM share repurchase, raised its dividend by 12%, and declared a $1 per share special dividend. Truxton continues to look attractive at 14x earnings. This isn’t the most exciting stock, but it’s a slow and steady winner. Original Write-up. Buy under 75.00

Unit Corp (UNTC) had no news this week. It announced on March 1 that its CEO is resigning but will remain Chairman of the Board. While management transition is usually not good, I’m not concerned in this case. Phil Frohlich was named interim CEO. His firm (Prescott Capital) owns over 30% of shares outstanding. As such, I’m confident that Unit’s capital allocation strategy will not change (lots of dividends and share repurchases). Unit will pay a $2.50 dividend in Q2. This works out to a ~20% yield. Unit continues to look attractive at ~4x free cash flow. Original Write-up. Buy under 65.00

William Penn (WMPN) reported that its CEO bought 50,000 shares on the open market at a price of 10.68. This is encouraging given the current banking crisis. William Penn is a micro-cap “thrift” bank that is extremely cheap. Most “thrifts” sell themselves three years after their thrift conversation (acquisitions are prohibited before then). This anniversary will be in 12 months (March 2024). At that point, I expect the company to sell itself for a 50% premium to its current price (based on typical thrift acquisition premiums). Finally, insiders are buying shares on the open market and the company is buying back its own shares aggressively. Downside is low given the stock is trading below liquidation value. Original Write-up . Buy under 12.50

Zedge, Inc. (ZDGE) reported a disappointing quarter on March 15. Revenue grew 1% to $7MM while adjusted EBITDA declined 63% to $1.4MM. Fears of a recession and a pullback in advertising are negatively impacting Zedge’s business. As a result, the management team has put in place a plan to cut $2.5MM to $3.0MM in expenses which will enable Zedge to operate at a breakeven level. Fortunately, Zedge has $13MM of net cash on its balance sheet representing 50% of its market cap. As such, the company is well capitalized to ride out the downturn. Importantly, the company is using the current downturn to buy back stock. From November 1, 2022 to January 31, 2023, the company has bought back 318,000 shares at a price of 2.15 per share. Zedge’s valuation looks attractive at 2.4x EBITDA. Original Write-up. Buy under 6.00

Stock | Price Bought | Date Bought | Price on 3/21/23 | Profit | Rating |

Cogstate Ltd (COGZF) | 1.7 | 4/13/22 | 1 | -41% | Buy under 1.80 |

Copper Property Trust (CPPTL) | 12.93 | 8/11/22 | 10.5 | -3% | Buy under 14.00 |

Currency Exchange (CURN) | 14.1 | 5/11/22 | 17.5 | 24% | Buy under 16.00 |

Epsilon Energy (EPSN) | 5 | 8/11/21 | 5.08 | 2% | Buy under 8.00 |

Esquire Financial Holdings (ESQ) | 34.11 | 10/10/21 | 38 | 11% | Buy under 45.00 |

IDT Corporation (IDT) | 19.37 | 2/10/21 | 34.03 | 76% | Buy under 45.00 |

Kistos PLC (KIST) | 4.79 | 7/13/22 | 2.78 | -42% | Buy under 7.50 |

Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.75 | 23% | Hold |

M&F Bancorp (MFBP) | 19.26 | 11/9/22 | 26.3 | 37% | Buy under 21.00 |

Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 1.01 | -43% | Buy under 3.50 |

Merrimack Pharma (MACK) | 11.99 | 1/11/23 | 11.6 | -3% | Buy under 12.50 |

NexPoint Diversified Real Estate Trust (NXDT) | 14.15 | 1/12/22 | 10.24 | -23% | Buy under 17.00 |

Opera Ltd. (OPRA) | 7.04 | 2/8/23 | 8.49 | 21% | Buy under 8.00 |

P10 Holdings (PX)** | 2.98 | 4/28/20 | 9.57 | 221% | Buy under 15.00 |

RediShred (RDCPF) | 3.3 | 6/8/22 | 2.81 | -15% | Buy under 3.50 |

Transcontinental Realty Investors (TCI) | 40.22 | 10/13/22 | 44 | 9% | Buy under 45.00 |

Truxton Corp (TRUX)* | 72.25 | 12/8/21 | 69.5 | -1% | Buy under 75.00 |

Unit Corp (UNTC) | 57.44 | 12/14/22 | 41.05 | -9% | Buy under 65.00 |

William Penn Bancorp (WMPN) | 11.91 | 3/8/23 | 11.59 | 6% | Buy under 12.50 |

Zedge (ZDGE) | 5.73 | 3/9/22 | 1.95 | -66% | Buy under 6.00 |

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in KIST:GB, LSYN, MEDXF, PX, IDT, APVO, NXDT, COGZF, RDCPD, TCI, ZDGE, and MFBP. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members.