Energy Continues to Look Attractive

Today’s I’m NOT going to be recommending an energy name.

But I wanted to use this introduction to share why I continue to be bullish on the sector.

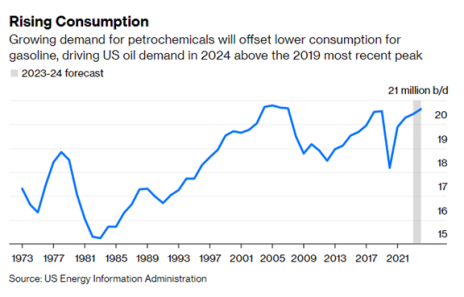

First, let’s start with demand. It continues to grow despite headwinds from increased penetration from electric vehicles.

Yes, eventually demand for oil and gas will shrink.

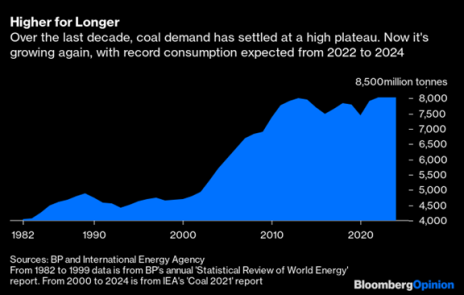

But demand for coal – the dirtiest fossil fuel of them all – is still growing.

That bodes well for oil and gas demand.

Meanwhile, capital expenditures in the oil and gas sector have declined precipitously despite higher prices.

New drilling is required to replace existing oil and gas production, but new drilling is minimal.

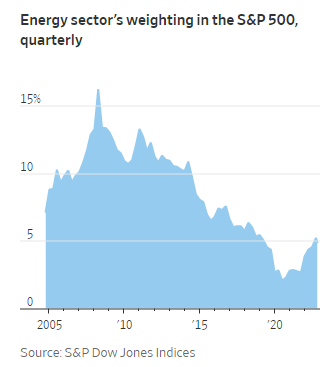

Finally, despite energy’s strong performance, its weight in the S&P 500 is at the low end of its historical range.

The CEO of Chevron summed it up well on a recent earnings call:

“I do think that investors have reacquainted themselves with the fundamentals of the energy business...our sector through 3 quarters of 2022 represented 10% of S&P 500 earnings. By market cap, it’s only 5% of the S&P 500 so I think there’s still upside.”

I’m currently recommending Unit Corp (UNTC), Kistos PLC (GB: KIST) and Epsilon Energy (EPSN).

I believe all three remain compelling.

OK, now let’s move on to something completely different.

As you know, I love the micro-cap space because it allows us to invest in growth companies at value prices.

I’ve repeated this ad nauseum.

Well, today I have another “growth at a value price” stock.

The company is growing like crazy and returning cash to shareholders through massive buybacks and special dividends.

Better yet, it has high insider ownership.

Without further ado, let me introduce you to Opera Limited (OPRA).

New Recommendation- Opera Limited: Rapid Growth with Hidden Assets

Company: Opera Ltd.

Nasdaq: OPRA

Price: 6.45

Market Cap: $576 million

Price Target: 13.00

Total Return Potential: 100%

Recommendation: Buy under 8.00

Recommendation Type: Rocket

Executive Summary

Opera is a niche web browser company that has been growing at a 20% CAGR. The company has been generating gobs of cash and using it to reward shareholders with buybacks (over 20% of shares outstanding) and special dividends. Finally, the company has minority investments worth ~40% of its current market cap that will be monetized in the near future. Despite these attributes, the stock trades at just 5.7x EBITDA. It’s a classic growth for a value price situation that is only available to micro-cap investors. Finally, insider ownership is high. I see 100% upside.

Overview

Background

Opera Limited was founded in 1996 in Norway.

Its main product is a web browser business (think Safari or Chrome) that is popular in Europe and Africa. It has 321 million monthly active users.

The web browser business was taken private in 2016 by Yahui Zhou for $600MM. It was relisted on the NASDAQ in 2018 and now trades under the symbol OPRA.

Opera’s web browser business generates revenue from Google and Yandex whenever anyone searches through their browser search bar and also from affiliate advertising on their browser.

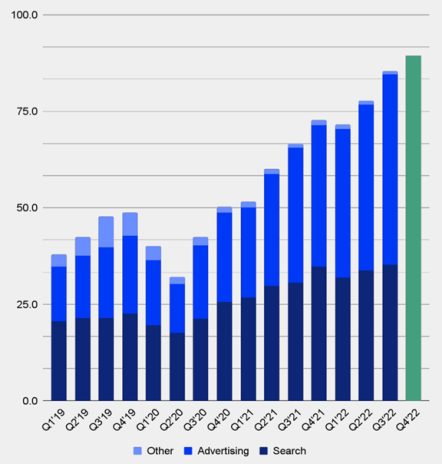

Opera’s web browsing business has been growing consistently.

But Opera’s strategy has been to launch adjacent products to its existing user base to accelerate growth.

The primary areas of focus are News and Gaming.

And the strategy has been a success, as shown by revenue growth below.

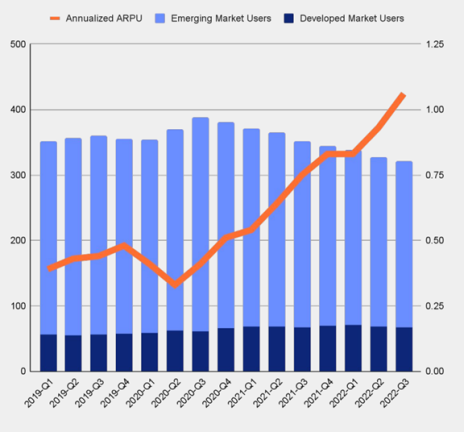

Opera has been focused on more profitable markets since 2019 and that focus is generating high average revenue per unit (ARPU).

Outlook

Opera’s strategy is to leverage its large browser user base to launch new products.

In a lot of ways, Opera reminds me of IAC Inc. (IAC) or IDT Corp. (IDT). Both of these companies use their core business to create or invest in new adjacent businesses. And then those businesses are spun off or monetized.

Opera’s gaming business and news business was built organically from its Browser business.

Opera also incubated two other businesses that are now independent.

Nanobank

Opera incubated a fintech micro-lending business in India and Kenya. That business was merged with Mobi Magic to form Nanobank (Opera’s stake was 42% in the new business).

Opera monetized its stake to a private equity investor for $127MM.

OPay

Opera incubated OPay, a leading money mobile wallet in Nigeria.

OPay raised external capital from Softbank and other institutional investors.

Opera monetized 29% of its stake in OPay for $50MM but holds a 6.5% stake in the business that is worth $128MM if one uses the last private round of funding for OPay of $2BN.

Core Business

Historically, Opera has grown revenue at a 17% CAGR while simultaneously spinning off and monetizing separate divisions.

Going forward, I expect revenue to grow in the high teens and EBITDA margins to expand from 18% currently to the mid-to-high 20% range.

Just to highlight the margin expansion opportunity, Opera had an EBITDA margin of 38% in 2018.

Since then, the company has aggressively invested to incubate and grow other businesses. As these businesses scale, margins should migrate higher.

Insider Ownership

As Cabot Micro-Cap Insider subscribers know, insider ownership is high on my checklist and is critical when investing in micro-caps.

In the case of Opera, insiders almost own too much of the stock.

Yahui Zhou owns 73.76MM shares of stock, or a whopping 83% of shares outstanding.

The risk is that Zhou tries to take the company private at a minimal premium to where the stock currently trades.

While this is a risk that cannot be overlooked, a couple factors give me confidence that this won’t happen:

1) The company recently bought 360 Security’s stake (23.4MM shares) in Opera for $5.50 per share. At the time of the transaction, the purchase price was significantly above Opera’s stock price. Why would Zhou agree to proceed with this transaction at a premium to the current stock price if he thought he could just buy out all minority shareholders at a discount to the current price?

2) Opera has been aggressively returning cash to shareholders via share buybacks and a special dividend. Why would Zhou agree to this capital allocation policy if he has nefarious plans? If he has nefarious plans, it would have made more sense for him to keep the cash on the company’s balance sheet to reward himself.

In total, I’m impressed with Zhou’s capital allocation ability. Not only the share buybacks and special dividend, but also the ability to incubate businesses and then spin them offer to be monetized.

Nonetheless, we must all be wary about potential corporate governance issues.

Valuation and Price Target

There are two important pieces to the Opera valuation: the core business and the minority investments.

Let’s start with the core business.

I expect Opera to report earnings within the next couple of weeks.

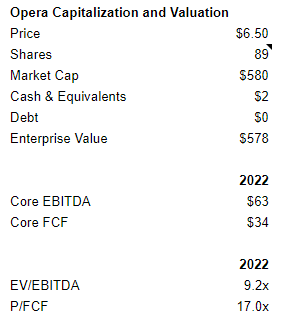

2022 Guidance is for 29% revenue growth and 125% EBITDA growth.

As such, Opera is trading at 9.1x 2022 EBITDA and 17x free cash flow.

Seems pretty cheap for a business that is growing the top line by 29%.

It’s hard to pinpoint an appropriate valuation – 15x EBITDA doesn’t sound crazy, but at that valuation multiple Opera is worth 10.75.

But the great thing about Opera is that it has additional valuable assets.

Let’s start with receivables.

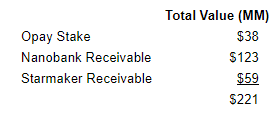

Opera sold two businesses recently: Nanobank and StarMaker.

Nanobank

- This business was sold in March 2022 (as discussed above) for $131.7MM. $8.5MM has been received and the remaining $132.4MM will be collected over the next 4 years.

StarMaker

- This business was sold in April 2022 for $87.5MM. $28.4MM has been collected and $59.3MM will be collected over the next 4 years.

That leads us to OPay (also discussed above).

OPay is a mobile money wallet that is primarily based in Nigeria.

It was incubated within Opera before raising external capital from institutional investors including Softbank.

Opera monetized 29% of its stake for $50MM in 2021, but retains a 6.4% stake in the business. Based on Softbank’s latest investment at a $2BN valuation, that 6.4% stake is worth $128MM.

I’m going to discount this valuation by 70% given the Softbank investment was made near the peak of pre-IPO mania (to be conservative). Therefore, I will assume it’s worth $38MM.

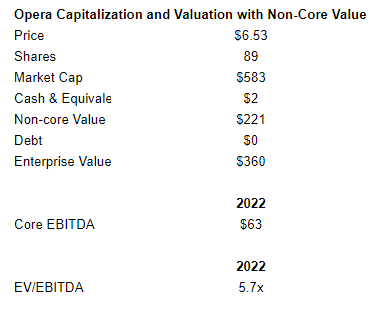

Adding up the value of the receivables and the OPay stakes leaves $221MM of “non-core” value.

This “non-core” value represents 38% of Opera’s current market cap.

If we incorporate this “non-core” value into Opera’s enterprise value, the stock is trading at an EV/EBITDA multiple of just 5.7x.

This seems way too cheap, especially given that that company has chosen to aggressively return cash to shareholders via buybacks and special dividends when it receives liquidity.

As such, I would expect more shareholder-friendly actions as Opera harvests its receivables over the next 4 years.

The one final point that I want to highlight is that Opera is investing in other businesses and so margins and free cash flow are artificially depressed. This adds another lever that can eventually accelerate growth.

I’m going to start with a price target of 13.00 which implies a 15x EV/EBITDA multiple (factoring “non-core” value into the enterprise value calculation).

As is always the case, micro-caps are illiquid. Be sure to use limits.

My official rating is Buy under 8.00.

Risks

Majority Shareholder Risk

- Majority shareholder Yahui Zhou owns 83% of shares outstanding and could try to squeeze out minority shareholders. While this risk is valid, I’m encouraged by the company’s capital allocation policies which have rewarded all shareholders on an equal basis.

China Risk

- Zhou is based in China and I’ve heard horror stories about fraud and other malfeasance related to executives based in China. While this is certainly a risk, I’ve gained comfort by Opera’s success growing its businesses (which can be verified independently) and its ability to monetize its assets and return cash to shareholders. Further, the company is based in Oslo, Norway, not in China.

Updates

Changes This Week

Sell Aptevo (APVO) to make room for new recommendation.

Aptevo (APVO) had no news this week, but I’m moving it to sell to make room for my new recommendation. Aptevo is incredibly cheap but it is running out of cash and will eventually have to raise capital. I personally am not going to sell today, but will wait for the stock to (hopefully) spike on positive data. At that time, I will likely exit my position. Sell

Atento S.A. (ATTO) announced that it has raised capital from existing investors in order to strengthen its balance sheet further. Details haven’t been revealed yet, but we will learn more once Atento reports earnings. The stock remains incredibly cheap and is demonstrating progress in its turnaround. Original Write-up. Buy under 10.00

Cogstate Ltd (COGZF) had no news this week. The company will report F1H23 results in late February, and we will get an updated growth outlook for the remainder of the year. Given positive results from Lecanemab from Eisai (Phase 3 data), I expect strong growth in 2023 and beyond. Phase III results from Eli Lilly’s Donanemab should read out in Q2 2023. Positive results would be another catalyst for Cogstate. The Cogstate thesis remains on track. Original Write-up. Buy under 1.80

Copper Property Trust (CPPTL) paid out $0.30 per trust certificate on January 10, 2023. The distribution consists of $0.20 of net sales proceeds. The balance is from net income generated from rental proceeds. Copper Property Trust continues to look attractive. Original Write-up. Buy under 14.00

Currency Exchange International (CURN) reported another excellent quarter on January 23. Revenue increased 96% to $19.7MM, beating consensus by $3.5MM. The company continues to benefit from a booming travel market. The banknotes business grew 108% while the payments business grew 53%. EPS increased to $0.68 in the quarter, up over 100% from $0.25 a year ago. Despite rapid growth, the stock is trading at just 8.7x earnings. The investment case remains on track. Original Write-up. Buy under 16.00

Epsilon Energy (EPSN) had no news this week but has been lagging the market due to weak natural gas prices. Nonetheless, I believe the natural gas weakness will be short lived and believe Epsilon remains a compelling long-term play. Epsilon reported an excellent quarter on November 10. Revenue increased 6% sequentially. In the quarter, Epsilon generated $9.6MM of net income and $11.2MM in free cash flow. This is quite significant for a company with a market cap of $170MM. The company continues to buy back shares and pay dividends. Due to the strong cash generation in the quarter, Epsilon currently has $40MM of cash on its balance sheet and no debt. The stock continues to look attractive. Original Write-up. Buy under 8.00

Esquire Financial Holdings (ESQ) reported Q4 results on January 25. Net income increased 18%. The company generated an industry-leading ROA and ROE of 2.8% and 24%, respectively. Loan growth and strong underwriting are driving the excellent results. Non-performing loans remain at 0%. Despite strong fundamentals, Esquire trades at just 10x forward earnings. Original Write-up. Buy under 42.00

IDT Corporation (IDT) reported another good quarter on December 5. Revenue was down 13% y/y, mainly due to tough comps from last year. The two most important value drivers continue to chug along. NRS revenue grew 107% y/y to $17.6MM. Net2phone subscription revenue increased 33% to $15.5MM. During the quarter, IDT repurchased 203,436 shares (~0.8% of shares outstanding). Eventually, both of these divisions will be monetized (either through a spin-off or an asset sale). The investment case remains on track and my price target is 55 based on an updated sum-of-the-parts analysis. Original Write-up. Buy under 45.00

Kistos PLC (KIST: GB) reported an operational update on January 18. By my math, Kistos generated €100MM in the second half of 2022 or €200MM on an annualized basis. As such, Kistos is trading at a price to free cash flow multiple of 1.6x. Further, Kistos has 40% of its market cap in cash. Management stated that the regulatory environments in the Netherlands and the U.K. have made investment decisions more difficult (excess profit tax). Nevertheless, the company is evaluating acquisitions outside of the Netherlands and the U.K. It is also considering returning cash to shareholders. Kistos continues to look compelling to me. Original Write-up. Buy under 7.50

Liberated Syndication (LSYN) has had no news recently. Libsyn’s plan was to “go public” again in September 2022. Obviously, that didn’t happen. It isn’t too surprising given the market volatility. I’ve reached out to Libsyn’s CEO and hope to catch up with him soon. Libsyn has posted several press releases in the past couple of months. I remain optimistic about Libsyn’s prospects. Once financials are re-filed, I’m looking forward to seeing: 1) How Libsyn’s core hosting business is doing. Podcasting conferences were a key way that Libsyn marketed. When COVID shut down in-person events, it negatively impacted Libsyn’s new customer acquisition. Now that COVID is behind us, I expect the core business to accelerate. 2) Revenue growth for AdvertiseCast. This is an exciting business opportunity. Revenue grew 50% in 2021 for AdvertiseCast, and I expect continued strong growth going forward. 3) The growth of Glow. Libsyn acquired Glow in 2021. Glow enables podcast creators to offer premium shows (think substack but for podcasts). I think this is a big market opportunity. While Libsyn has been a frustrating stock, I think (and hope!) our patience will be rewarded. Original Write-up. Hold

M&F Bancorp (MFBP) had no news this week. M&F is taking advantage of an interesting opportunity (Emergency Capital Investment Program) available to many small banks. As a result, I expect EPS to grow from $1.36 in 2021 to $4.74 in 2025. Assuming M&F continues to trade at its average P/E multiple of 9.3x, the stock should hit 44.00 by 2025, implying significant upside. Original Write-up. Buy under 21.00

Medexus Pharma (MEDXF) announced on January 12 that it expects another record quarter, but that Treosulfan is going to be delayed by at least another 1.5 years. Interestingly, the stock traded up despite this mixed news. I continue to believe Medexus is very cheap without Treosulfan. The next big catalyst will be management addressing the convertible debenture that is due this fall in a non-dilutive manner. Medexus continues to look cheap at 1.1x revenue and 7.6x adjusted EBITDA. The investment case remains on track. Original Write-up. Buy under 3.50

Merrimack Pharma (MACK) had no news this week. It is a biotech company that has no employees. It relies on contractors to minimize costs. Its sole purpose is to receive milestone payments from Ipsen related to the drug Onivyde. Onivyde will likely be approved for first-line metastatic small-cell lung cancer in early 2024 which will trigger a $225MM royalty payment. Merrimack has committed to distributing any royalty proceeds to investors. I expect Merrimack to distribute $15 per share to investors within ~15 months, representing 126% of its current share price. Additional upside can be achieved through future milestone payments. Finally, insiders are buying stock in the open market. Original Write-up. Buy under 12.50

NexPoint (NXDT) had no news this week. It filed its 10-Q to report earnings on November 14. The results looked good. Operating cash flow is healthy. NAV as of September 30, 2022 is $28.17 so the stock is still trading at a big discount to fair value. The company generated $0.55 of funds from operations in the quarter. As such, it’s trading at ~7x, a discount to peers who trade closer to 12x. NexPoint has underperformed recently, but it remains a high-conviction idea. Original Write-Up. Buy under 17.00

P10 Holdings (PX) announced on December 27 that it increased its share repurchase authorization by $20MM (2% of its market cap). P10 is fairly limited in how much stock it can buy back given its low float (high insider ownership), but I view this announcement very favorably. The company is growing like crazy yet trades at just 12.5x adjusted earnings. The investment case is on track. Original Write-up. Buy under 15.00

RediShred (RDCPF) announced good quarterly results on November 27. Revenue grew 50% y/y to $14.7MM CAD (47% constant currency growth). EBITDA increased 27% to $3.6MM CAD. On an organic basis, EBITDA grew 13% y/y. Organic growth is being driven by increased demand for shredding by businesses. Higher fuel costs and driver costs hurt margins. However, the company plans to pass through price hikes which will help offset these headwinds. RediShred is also active on the acquisition front. The stock continues to look incredibly cheap at a 5.1x EV/EBITDA multiple and a 7.4x price to free cash flow multiple. I continue to see 100% upside over the next 12 months and significantly more upside looking out a few years. Original Write-up. Buy under 3.50

Transcontinental Realty Investors (TCI) had no news this week. It disclosed its quarterly earnings on November 10. The sale of the joint venture (JV) has closed, and Transcontinental reported that it intends to use $182.9MM of the proceeds to “invest in income-producing real estate, pay down debt and for general corporate purposes.” The company hasn’t disclosed what it intends to do with the second installment of proceeds from the JV sale ($203.9MM). The company continues to look attractive with 96% of its market cap in cash. Insiders own 86% of the company and could make an imminent move to buy out remaining shareholders at a large premium to the current stock price. Original Write-up. Buy under 45.00

Truxton (TRUX) reported Q4 earnings on January 26. For the full year, diluted EPS increased 15% to $5.02. Credit quality and loan growth continue to look good. Most importantly, Truxton authorized a $5MM share repurchase, raised its dividend by 12%, and declared a $1 per share special dividend. Truxton continues to look attractive at 14x earnings. This isn’t the most exciting stock, but it’s a slow and steady winner. Original Write-up. Buy under 75.00

Unit Corp (UNTC) recently announced a capital return program. It paid a special dividend of $10 per share on January 31. Better yet, the company announced that it will pay a $2.50 per share quarterly dividend starting in Q2. This works out to an 18% yield. Not bad! Unit continues to look attractive at ~4x free cash flow. Original Write-up. Buy under 65.00

Zedge, Inc. (ZDGE) reported Q1 2023 earnings on December 13. Revenue increased 14.5% y/y. However, EBITDA decreased 71% y/y to $1.0MM and operating cash flow decreased 60% y/y to $1.1MM. The decline was due to lower advertising revenue and expenses related to the integration of GuruShots. The quarter was disappointing, but management commentary suggests that advertising rates have already improved. Further, the stock is ridiculously cheap. It trades at 3.0x annualized EBITDA and 9.5x FCF. And it has 66% of its market cap in cash. Original Write-up. Buy under 6.00

Watch List

Amplify Energy (AMPY) is a new name on my watch list. In 2021, one of the company’s pipelines was ruptured off the coast of California, creating a massive oil spill. It turned out the accident was not the fault of Amplify but rather a ship that dragged its anchor across the pipeline. Insurance is going to cover the damages and the pipeline is almost back. Once the pipeline is completely fixed, the company will be gushing free cash flow. Amplify’s valuation looks attractive.

Trinity Place Holdings (TPHS) is a tiny company that owns a ton of New York real estate. Its largest asset, 77 Greenwich (a 90-unit residential condo tower), is in the process of selling its condos. I need to do more work to get a better sense of underlying asset value, but insiders have been buying like crazy and MFP Investors (investment vehicle of Michael Price) is the largest shareholder.

| Stock | Price Bought | Date Bought | Price on 2/7/23 | Profit | Rating |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 2.13 | -93% | Sell |

| Atento SA (ATTO) | 21.57 | 4/14/21 | 4.05 | -81% | Buy under 10.00 |

| Cogstate Ltd (COGZF) | 1.7 | 4/13/22 | 1.38 | -19% | Buy under 1.80 |

| Copper Property Trust (CPPTL) | 12.93 | 8/11/22 | 12.75 | -1% | Buy under 14.00 |

| Currency Exchange (CURN) | 14.1 | 5/11/22 | 19.35 | 37% | Buy under 16.00 |

| Epsilon Energy (EPSN) | 5 | 8/11/21 | 5.83 | 17% | Buy under 8.00 |

| Esquire Financial Holdings (ESQ) | 34.11 | 10/10/21 | 44.57 | 31% | Buy under 42.00 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 31.22 | 61% | Buy under 45.00 |

| Kistos PLC (KIST) | 4.79 | 7/13/22 | 3.78 | -21% | Buy under 7.50 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.75 | 23% | Hold |

| M&F Bancorp (MFBP) | 19.26 | 11/9/22 | 25 | 30% | Buy under 21.00 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 1.38 | -22% | Buy under 3.50 |

| Merrimack Pharma (MACK) | 11.99 | 1/11/23 | 11.92 | -1% | Buy under 12.50 |

| NexPoint Diversified Real Estate Trust (NXDT) | 14.15 | 1/12/22 | 13.31 | -6% | Buy under 17.00 |

| Opera Ltd. (OPRA) | -- | NEW | 6.55 | --% | Buy under 8.00 |

| P10 Holdings (PX)** | 2.98 | 4/28/20 | 11.5 | 286% | Buy under 15.00 |

| RediShred (RDCPF) | 3.3 | 6/8/22 | 3.15 | -5% | Buy under 3.50 |

| Transcontinental Realty Investors (TCI) | 40.22 | 10/13/22 | 45.5 | 13% | Buy under 45.00 |

| Truxton Corp (TRUX)* | 72.25 | 12/8/21 | 70 | -2% | Buy under 75.00 |

| Unit Corp (UNTC) | 57.44 | 12/14/22 | 50 | -11% | Buy under 65.00 |

| Zedge (ZDGE) | 5.73 | 3/9/22 | 2.64 | -54% | Buy under 6.00 |

**Original Price Bought adjusted for reverse split.

* Return calculation includes dividends

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in PX, MEDXF, LSYN, IDT, DMLP, NXDT, KIST, and RDCPF. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on March 8, 2023.