“The approach offers higher estimated long-term returns in the U.S. and Europe over the next decade than at most points over the last 10 years,” Andrew Sheets, Morgan Stanley’s global strategist, said recently.

Sheets was talking about the 60/40 portfolio (60% stocks/40% bonds) generating annual returns of roughly 6% over the next decade. Is that enough of a return for investors to seriously consider the all-weather strategy given the current rate of inflation or even the projected average annual inflation rate?

As I’ve mentioned numerous times in the past, I’m a big proponent of taking a diversified portfolio strategy approach. But I have a different approach, an approach that allows me to make three to five times the average annual rate of return using the same equities that reside in the traditional 60/40 portfolio.

[text_ad use_post='262982']

The strategy? Poor man’s covered calls.

The Poor Man’s Covered Call Discount

By using poor man’s covered calls, I’m able to reduce my capital outlay by 65% to 85%. And with this reduction in capital, I’m able to realistically diversify my approach over a wide range of strategies. In the past, I’ve discussed my All-Weather portfolio, Dogs of the Dow portfolio, Growth/Value portfolio, Contrarian portfolio, Earnings Yield portfolio and several others.

Today, I want to focus on how to build out a portfolio using a poor man’s covered call strategy.

I tend to take a diversified portfolio strategy approach. And by using poor man’s covered calls I can diversify my strategies of choice far easier. I might use poor man’s covered calls in any of the portfolios mentioned above.

The one stalwart is the All-Weather portfolio, which is what I’m going to focus on today.

The All-Weather portfolio is a portfolio that is available to the masses. All investors have access to some form of the risk-parity-based All-Weather Fund that was created by legendary hedge fund manager Ray Dalio and somewhat mimics the traditional 60/40 portfolio mentioned by Morgan Stanley’s finest.

The portfolio is designed to survive all types of market environments. I want to find a few ETFs that work. The selection is harder than you think because we have a few more requirements than just buying the ETF outright. We need to think about an ETF that:

- Falls into one of the asset classes above.

- Has liquid options.

- Offers LEAPS that have roughly 2 years until expiration.

Thankfully, there are choices, but I wouldn’t say they are plentiful. Liquid options markets can be tough in certain asset classes.

We need ETFs that give you the opportunity to buy LEAPS that have at least 2 years in duration. Again, the goal is to buy a LEAPS as far out as possible and continue to sell short-term calls against my LEAPS contracts. Once my LEAPS have roughly 8 to 12 months of life left, I then begin the process of rolling my LEAPS contract out as far as I can and continue the process of selling more premium.

Historically, I have been able to outperform major market indices by 3 to 5 times using a poor man’s covered call approach while simultaneously limiting my downside risk.

Here is an example of how I would initiate a position.

Vanguard Total Stock Market ETF (VTI)

The Vanguard Total Stock Market ETF (VTI) is currently trading for 198.17.

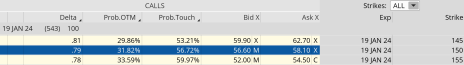

I choose my LEAPS call contract by the delta of the option. I prefer to initiate a LEAPS position by looking for a delta of 0.80. With a delta of 0.79, the January 19, 2024 150 call strike with 543 days until expiration works.

I can buy one options contract, which is equivalent to 100 shares of VTI, for roughly $57.50, if not slightly cheaper. Remember, always use a limit order and never buy at the ask price, which in this case is $58.10.

If we buy the 150 strike call for roughly $57.50, we are out $5,750 rather than the $19,817 I would spend for 100 shares of VTI. That’s a savings on capital of 71.0%. Now we can use the capital saved ($14,067) to work in other ways, preferably to diversify our poor man’s covered call strategy among other stocks and ETFs.

Once we make the initial LEAPS purchase, we can maintain that position and focus on selling near-term call premium against our LEAPS each month – thereby generating income and lowering the original cost basis with each transaction.

I begin the process of selling shorter-term calls against my LEAPS by looking for an expiration cycle with around 30-60 days left until expiration and then aim for selling a strike with a delta ranging from 0.20 to 0.40, or a probability of success between 60% to 85%.

As you can see in the options chain below, the 205 strike call with a delta of 0.35 falls within my preferred range.

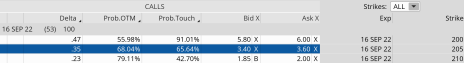

I can sell the 350 call for roughly $3.40, if not higher.

My total outlay for the entire position now stands at $54.10. or $5,410 ($57.50 – $3.40). The premium collected is 5.9% over 53 days. Not a ton of premium, but remember, we are going out 30 days and using an ETF that has, by most comparisons, a low level of implied volatility (IV).

If we were to use a traditional covered call our capital outlay would be $19,477 and our return would be 1.7%.

Also, the 5.9%, or 35.4% annually, is just the premium return; it does not include any increases in the LEAPS contract if the stock pushes higher.

The overall delta of the position will eventually hit a neutral state if VTI continues to move higher over the next 53 days. If it does, we simply buy back our short call and sell more premium. Delta is a major factor in managing poor man’s covered calls and something that I teach in my monthly webinars for subscribers.

So, as you can see above, we have the potential to create 5.9% every 53 days, or approximately 35.4% a year using a fairly conservative ETF like VTI. This is our baseline and should be our expected return in premium, but again this does not include any capital gains from our LEAPS position if VTI trends higher.

My next step would be to add the other four positions that reside in my All-Weather Portfolio using the guidelines mentioned in my VTI example above.

As always, if you have any questions, please feel free to email me or post in the comments section below. And if you haven’t had a chance, please sign up for my free newsletter where I offer options education, research, and trade ideas.

[author_ad]