The U.S. economy is showing modest growth with improvement in capacity utilization, home sales and industrial production, and the bull market continues with the Dow closing above 26,000 yesterday.

We have seen good movements in some of our recommendations this week. Discovery Communications (DISCA) rose 14%, Target (TGT) rose 11% and Lowe’s (LOW) is up 7.5%. On the negative side, Signet Jewelers (SIG) is down -1.6% after the dismal holiday sales at subsidiary Kay Jewelers.

Many of our recommended stocks are nearing their fair value; however, for now, I recommend that you hold them. As I introduce more undervalued stocks in the coming weeks, you may replace some of the fully valued stocks with new stocks.

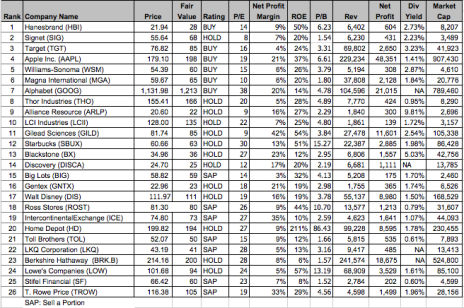

Below are important updates on some of our stocks. Also, please note the valuation-related numbers in the chart below. The fair values will be continuously revised as I receive additional information.

Lowe’s (LOW)

Lowe’s rose more than 5% on Friday after D.E. Shaw started building an activist stake in the stock. In “Lowe’s (LOW) vs. Home Depot (HD): Which is the Better Value Stock?”, which I wrote on December 9, I pointed out that Lowe’s needed to focus on operational improvements, including sales per square feet and same-store growth, to catch up with Home Depot, so I see the involvement of D.E. Shaw as a positive. Lowe’s management is now challenged, as the activist investor will serve as an additional catalyst for Lowe’s to focus on same-store growth rather than global expansion. HOLD.

Apple (AAPL)

There have been a lot of negative sentiments recently circulating about Apple, but they have not impacted the stock much.

First, Apple admitted that some of its iPhones were shutting down unexpectedly because of issues in some older batteries. Apple then released a “software update that improves power management during peak workloads,” but the solution was not entirely effective. This led Apple to reduce the battery cost from $79 to $29, which could reduce future iPhone sales as users could simply upgrade their batteries instead of buying new phones.

Second, some large shareholders of Apple have raised their voice against smartphone addiction by teenagers and demanded Apple address those concerns. CalSTRS and Jana Partners investment group, who own more than $2 billion in Apple stock, said, “The average American teenager who uses a smartphone receives her first phone at age 10 and spends over 4.5 hours a day on it (excluding texting and talking),” and “78 percent of teens check their phones at least hourly and 50 percent report feeling ‘addicted’ to their phones.”

They insisted Apple use precautionary measures in the iOS, where parents can have better control of their children.

None of these concerns affect our long-term view of Apple. BUY.

Magna International (MGA)

Magna debuted Active Air Dam in the 2019 Ram pickup. The aerodynamic system will reduce drag and improve the aerodynamics of pickup vehicles, resulting in fuel savings of one mile per gallon on highways.

Magna also reviewed its 2018-2020 outlook. CEO Don Walker said, “The pace of change in the automotive industry continues to accelerate, and we remain at the forefront, investing to further strengthen our position as an innovator and provider of solutions for our customers. These investments should drive business awards in the future and position us to continue building long-term value for shareholders. We expect to deliver above-market growth through 2020 and beyond driven by our portfolio of products tied to Vehicle Electrification, Light-Weighting, Safety and Autonomous Driving.”

Magna continues to innovate, and our thesis stays strong. BUY.

LCI Industries (LCII)

LCI subsidiary Lippert agreed to acquire Taylormade Group, a marine and industrial supplier. In the December issue’s Watch List, I highlighted the revival of recreational boating industry. Taylor had sales of $150 million last year, with diversified products for boat builders and aftermarket. I consider this development positive news for recreational stocks and LCI Industries. HOLD.

Intercontinental Exchange (ICE)

New York Stock Exchange parent Intercontinental Exchange has announced the launch of a new U.S. stock market, NYSE National, which will be a trading venue and would not invite listing stocks. NYSE National would further diversify ICE’s portfolio of exchanges. However, on December 14, I recommended that you sell a portion as it approached its fair value and I continue to recommend the same. SELL A PORTION.