Market Overview

According to a recent study published by the Federal Reserve, 12% of U.S. adults have used cryptocurrency as either an investment or a way to transact in 2021. This number has increased from the prior year, when only 5% of the population were counted as users.

One of our most bullish theses is the continuation of user adoption. More people globally will turn to cryptocurrency as both a medium of exchange and as an investment. As a result, demand for the highest quality crypto assets will continue to increase due to their advantages over legacy payment systems or physical assets as a store of value.

Despite price declines across global markets, both Bitcoin and Ethereum have remained above $30,000 and $2,000 respectively. One of our portfolio companies, Ethereum Name Service (ENS) just recorded record revenue for the month of May. Bullish catalysts are on the summer horizon as Ethereum looks to make a major upgrade to their network, likely around August. This will help improve scalability for the leading L1 chain, to defend against competition from others like Solana (SOL).

Bitcoin remains the reserve cryptocurrency for defi. While Ethereum is still the leading Layer One blockchain, helping to power a new era of digital commerce.

Traditional markets will find their footing – the Nasdaq is still up 90% over the past five years, despite being down 14.5% this year. BTC is up 1,200% over the same period, the YTD 12.7% decline pales in comparison. BTC is currently holding up better to the downside, while vastly outperforming to the upside. In our view, the best way to gain exposure to this is through the ProShares Bitcoin ETF (BITO). Investing in both equities and cryptocurrency over the long run certainly demonstrates the power compounding can have on your portfolio.

We are currently not recommending investing in any cryptocurrency exchanges like Coinbase (COIN). In our view, competition between other players such as FTX and Uniswap (a defi exchange) has made it difficult to justify an investment in any exchange. OpenSea is the leading NFT marketplace, which may be more difficult for Coinbase to displace than many realize as Coinbase attempts to roll out their own service offering.

As a result, we find it more attractive to focus on other areas of the web3 ecosystem by investing directly in cryptocurrencies themselves (which will benefit from continued network effects), or through investments in traditional companies that are poised to benefit from the continuation of digital trends.

Portfolio Update

Our two portfolios have been conservative to date since the launch of Cabot SX Crypto Advisor to preserve capital during the recent market downturn. We are now beginning to increase exposure to equities and crypto as valuations have declined, making expected future returns higher on a risk-adjusted basis. We are currently recommending only a handful of high-quality assets that we expect to outperform the broader markets over a longer horizon.

For our crypto “pure play” portfolio, we are currently offering recommendations to begin positions in Ethereum (ETH), Polygon (MATIC), and Ethereum Naming Service (ENS). These positions are largely predicated on the continued success of the Ethereum network. Ethereum is the global, industry-leading Layer One blockchain solution for distributed computing projects.

Ethereum enables creators to build and engage in digital commerce through the use of smart contracts, a technology created by Ethereum to allow for blockchain based transactions to take place at scale. Ethereum continues to dominate all other blockchain projects in terms of fees generated on the network (revenue proxy) and total engagement. ERC-20 is the industry standard for tokenized assets, as the world becomes increasingly digital, more people have turned to use the Ethereum network.

Crypto Portfolio

Ethereum (ETH)

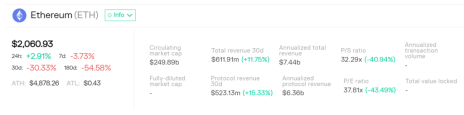

The Ethereum market cap has declined while the fundamentals continue to improve with total protocol revenue increasing by 15%. NFT sales generated hundreds of millions in late April alone, as Yuga Labs released a round of new “Otherdeed” NFTs for their virtual metaverse project.

Revenue and earnings are very similar in the world of defi because expenses are relatively low. ETH is trading at a P/E ratio of 37.8, which is favorable relative to other growth names given the incumbent nature of the Ethereum blockchain continuing to deliver value across gaming, NFTs, and new web and mobile apps.

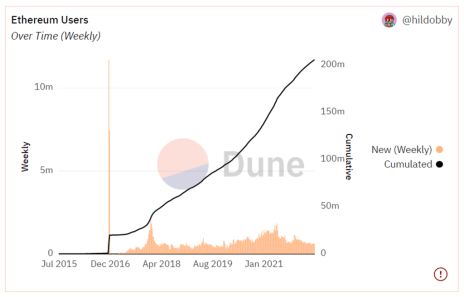

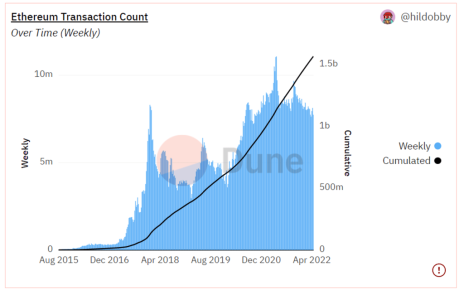

Ethereum is continuing to experience growth in key metrics like users, transactions and fees generated on the network.

Ethereum network transaction volume is increasing as more projects continue to build on the platform, attracting more users.

Ethereum remains the industry leader, demonstrating high switching costs, as projects continue to choose ETH to run their decentralized applications. Recommendation – BUY A QUARTER

Ethereum Name Service (ENS)

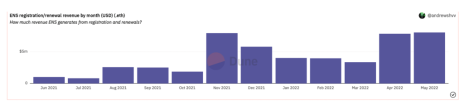

We are increasing our recommendation in ENS to BUY A HALF based on increasingly positive fundamentals. ETH domains are trading as NFT’s – and they are quickly rising the ranks to compete with huge names like Yuga Labs. On May 2, ENS domains accounted for $6 million in trading volume on OpenSea, with over $34 million in trading volume over the past month. May is now an all-time high for registrations, renewals, and revenue (Source: Nick.Eth, lead developer).

Ethereum Name Service (ENS) aims to make it easier for users to operate on Ethereum. ENS is similar to GoDaddy, allowing investors to purchase a domain name for their public address and web address. ENS aims to become the go-to naming protocol by making web3 usernames that can be utilized across multiple blockchain networks over time. This process is what many describe as interoperability – moving across blockchains (for example, Ethereum blockchain and Bitcoin blockchain). These domains can be bought and sold across the blockchain!

Users and businesses are used to traditional web addresses. Users of blockchain technology will likely prefer what they already know instead of having to utilize a long phrase of letters and numbers. ENS will help to overcome this friction and improve the user experience.

Companies are increasingly beginning to offer “sign in with Ethereum.” ENS is helping improve this authentication process for companies.

Valuation

ENS is now trading at a 7.6x price/sales ratio, well below its historical average and the historical multiple for software, which often trades around 20x P/S. In our view, today represents an attractive entry point for ENS token.

The ENS governance token (crypto), created on the Ethereum blockchain, enables participants to propose changes within the organization, much like voting rights are afforded to members of a traditional company board.

ENS has a low supply of 100 million tokens, making it an attractive investment if adoption continues to increase – buying pressure will move the price of ENS quickly. Recommendation – BUY A HALF (of total intended position)

Polygon (MATIC)

Ernst & Young, a member of the “big four” public accounting firms currently auditing numerous public companies is working with Polygon on Project Nightfall. They are aiming to make some of their clients’ Ethereum information private, which could be more suitable for large companies’ specific use cases. Due to competitive advantage, many companies do not desire their information posted to a public blockchain. EY is using Polygon to help with this large project that could apply to things like supply chain management or NFT marketplaces and aims to be finished with the project by 2023. This could give EY an advantage over competitors such as Deloitte, in their ability to service companies looking to gain exposure to web3.

Polygon is a Layer Two scaling solution for the Ethereum network. Polygon helps to alleviate congestion and reduce latency and costs for running projects on ETH.

Key Metrics

- More than 19,000 decentralized applications now on its network, a 500% increase from 3,000 dApps in October.

- Polygon now serves over 8,000 monthly active teams, up from over 6,000 in January and just a few thousand in October.

- 65% of the teams were built entirely on Polygon, whereas 35% were built on Ethereum.

- Processed over 3.4 billion total transactions.

- 135 million unique user addresses.

- Over $5 billion in assets.

A key catalyst for Polygon adoption and acceleration has been partnerships – Polygon has forged ahead with industry leaders like Facebook/Meta Platforms (FB), EY (consulting), and Alchemy (web3 infrastructure).

Since partnering with Alchemy, the number of Polygon apps has increased by more than 95x. Alchemy provides key support in web3 infrastructure and platform capabilities, working alongside Polygon to resolve and prevent problems as they occur at the developer level. This partnership has served as a valuable flywheel and competitive advantage for MATIC.

Turning to trading dynamics, over 650k MATIC tokens have been removed from circulation since their recent network upgrade at the beginning of 2022. These key growth and trading metrics coupled with the recent MATIC price decline has made MATIC an attractive, long-term, risk-adjusted investment opportunity at today’s price level. Recommendation – BUY A QUARTER

| Ticker | Original Weight | Price | Price at Rec | Performance | Rating |

| ETH | 15.0% | 1,981.00 | 3,444.22 | -42.48% | BUY A QUARTER |

| ENS | 2.50% | 13.10 | 10.22 | 28.18% | BUY A HALF |

| MATIC | 1.25% | 0.66 | 0.678 | -3.39% | BUY A QUARTER |

| APE | — | 7.90 | — | — | WATCH |

| SOL | — | 50.09 | — | — | WATCH |

Equity Portfolio

ProShares Bitcoin Strategy ETF (BITO)

Bitcoin is digital property. BTC is quickly becoming the reserve currency of the digital era, as other DeFi protocols, traditional companies, and institutional investors continue to purchase Bitcoin to serve both as a form of collateral and a store of wealth. The inherent properties of BTC make it a highly desirable asset in today’s period of high inflation. BTC has 1/10 the market capitalization of gold.

Fidelity recently announced that they are adding the ability to purchase Bitcoin in 401k accounts. This is a significant move by the industry giant. Currently, 23,000 companies use Fidelity to administer their retirement plans. This is extremely bullish for the crypto asset class, as current investor exposure to BTC is under a 5%.

In our view, the easiest and best way to gain exposure to BTC is through BITO in a traditional brokerage account. Recommendation – BUY A QUARTER

Arista Networks (ANET)

Arista Network designs and sells multilayer network switches to deliver software-defined networking for large datacenter, cloud computing, high-performance computing environments. ANET is positioned to benefit form workloads transitioning to the cloud. Acceleration in the digital economy, partially powered by increasing web3 and cryptocurrency adoption will benefit Arista.

According to the IDC 2021 Report, 200G-400G switches are growing at 70% due to hyperscale and cloud providers continuing to build out larger data center footprints. Companies have increasingly shifted workloads from on-premise data centers onto the cloud, utilizing primarily AWS, Azure or Google as server providers. Data growth has been exponential, and as a result, companies are looking for scalable solutions to reduce internal dependency on hardware update cycles. However, companies still prefer to have infrastructure on premise within their own data centers for security, data governance, and lower latency. This is often performed through the AWS Outposts solution and requires switching devices like the ones that Arista provides. As early as 2018, there has been a push to 400G infrastructure to increase network speed and performance. Recommendation – BUY A QUARTER

| Ticker | Original Weight | Price | Price at Rec | Performance | Rating |

| Proshares Strategy Bitcoin ETF (BITO) | 2.5% | 18.05 | 25.93 | -30.39% | BUY A QUARTER |

| Arista Networks (ANET) | 2.5% | 102.38 | 105 | -2.50% | BUY A QUARTER |

| Concord Acquisition (CND) | — | 9.95 | — | — | WATCH |

| Galaxy Digital (GLXY.TO) | — | 7.85(CAD) | — | — | WATCH |

| Nvidia (NVDA) | — | 168.98 | — | — | WATCH |

| Unity (U) | — | 41.03 | — | — | WATCH |

Watch List

Solana (SOL) – more centralized but powerful Layer One blockchain solution focused on gaming and NFT applications.

Nvidia (NVDA) – industry leading designer of GPU, datacenter semiconductors, AI and software for a wide range of industries.

Bored Ape Yacht Club (APE) – ETH-based Layer Two cryptocurrency used to power the Bored Ape Yacht Club’s emerging metaverse ecosystem.