Market Overview

ENS is the GoDaddy of Defi. In this week’s market update we will highlight this lesser-known investment opportunity.

First, we will dig into the current market environment and highlight what is going on in crypto.

We will continue to deliver a rigorous and honest overview of the current investing landscape. Crypto blue chips have traded lower along with the broader market, so we want to emphasize patience. Market leaders like Bitcoin and Ethereum have demonstrated significant staying power – making it through the recent market contractions in both 2017 and 2020 only to return to all-time highs. We view this current downward pressure in valuation as the same, and in the long run, we expect best-in-class cryptocurrencies to outperform other assets over the next five years.

Although the Nasdaq is currently down 26% in the past six months, it is also up 91% for the past five years. It is important to keep everything in perspective. Many high-quality companies have significant cash on their balance sheets, funds have raised enormous amounts of capital to deploy, and we are still in a highly favorable period in history for technological development at scale. We are awaiting conclusive Fed guidance and a break in inflation. When it does, things will turn around. Focus on quality names and capital preservation.

Both Cabot SX Crypto Advisor model portfolios have remained largely in cash to date, and we are staying highly engaged to identify asymmetric investment opportunities that will create substantial long-term value over a longer-term hold period. Simply put, we are waiting for the right opportunity to put cash to work in the market and build larger positions.

Although prices have moved lower, our fundamental investment theses have not changed, we remain clear-eyed and bullish on crypto adoption and the power of disruptive innovation through blockchain technology. We firmly maintain the viability of crypto as an asset class despite the recent bout of volatility. In recent weekly updates and monthly issues, we have maintained the view that tech, bonds, and housing are all currently facing significant valuation pressures. Let’s get into why!

The current market rout resulted from several factors:

- Fear that the Federal Reserve will raise interest rates in swift succession in increments above previously stated guidance. At possibly .50 (with something like a .75 hike at the next meeting). However, the Fed has also maintained a willingness to be accommodative and is currently looking at a .25-.50 basis point hike.

- The market has taken a different view. According to Bloomberg, the market is now pricing in 9 rate hikes for this year. Current expectations are that the Federal Funds rate may be close to 3% by the end of the year.

- Inflation has remained high because of covid-related shutdowns in China, war in Europe and general demand exceeding available output. According to the American Trucking Association, the industry was short a record 80,000 drivers in 2021. 70% of domestic goods are trucked.

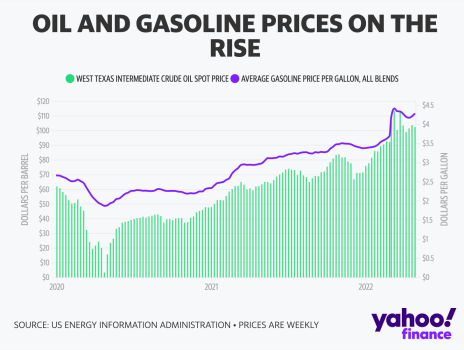

- Gas prices are elevated with 66% of households saying they are looking to make changes to their driving patterns (Source: Maru Public Opinion Survey). This is likely bolster demand for EVs, specifically Tesla (TSLA), as the company is better positioned to take market share due to their vertically integrated supply chains and in-house production. TSLA also owns Bitcoin and has taken a favorable stance on cryptocurrency adoption.

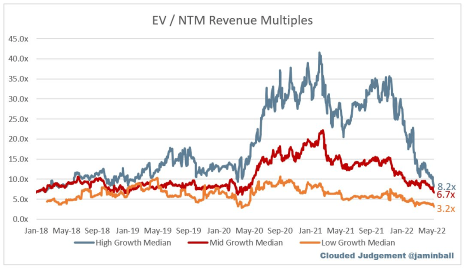

- In 2021, valuations across the board were historically high, with both public and private software companies trading over 20x forward revenue, well above their historical average. According to Jamin Ball, at Altimeter Capital, median software is now trading at pre-covid levels of 6.7X forward revenue despite many individual names displaying positive operating income growth.

- Leveraged selling pressure. Financial markets are highly interconnected. During selloffs, investors often enter capital preservation mode. To avoid margin calls and forced liquidation, portfolios are trimmed to avoid future losses. A good recent example of this is Bill Ackman at Pershing Square. Pershing recently took a multibillion-dollar equity position in Netflix. When Netflix announced a miss on subscriber growth, Ackman quickly exited his position and admitted the current narrative has changed his investment thesis. The current market environment also likely factored into this decision, as it is simply not positioned to the upside. So, Pershing acted quickly to avoid future losses from the newly initiated position despite their previously bullish stance on the company.

Positive Takeaways

- According to CNBC, expectations for gas price increases fell to 5.2%, a 4.4% drop.

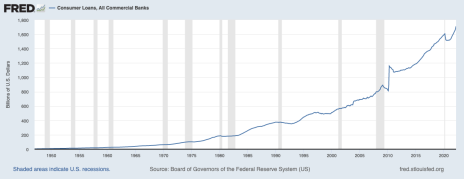

- Respondents also are more secure in their jobs as only about 11% expect to lose their employment over the next 12 months. This is positive for the demand side of the U.S. economy (we rely largely on consumer demand and services), suggesting we are not about to fall off a consumer spending cliff. Consumers continue to borrow and spend.

- The Fed understands raising interest rates too aggressively risks stoking a major recession, crushing wealth. A contrarian view is beginning to emerge that there is upside if the Fed raises rates less aggressively than currently expected.

What actions are sophisticated investors taking?

At the Berkshire Hathaway annual meeting, Warren Buffet told listeners that Berkshire recently purchased $50 billion worth of stocks so far this year – buying names like Chevron and Activision Blizzard. The current environment is more favorable for the Oracle of Omaha to do deals, as he prefers to remain disciplined and not overpay for companies. Buffet sticks to his principles and makes investments when he feels comfortable in doing so, preferring to simply wait for long periods until finding values he finds to be attractive.

Today, we should be thinking like Warren Buffet. He amplified our own stance here at Cabot SX Crypto Advisor – we seek to identify differentiated investments with substantial long-term value and purchase them to hold over a longer time horizon. Investing for the long run is the only way to create personal wealth and overcome inflation.

At Cabot, we are not rushing in to buy, but we want to express that the coming months are going to open significant opportunities to purchase many high-quality companies! Preserve capital to purchase these names at a discount. In the long run, companies that can generate cash flow and provide real utility to customers and users bounce back much faster and continue to deliver value to shareholders despite short-term price volatility.

Demand for semiconductors is not going away. Businesses are still in desperate need of cyber security and cloud services. Increasingly, more companies are hiring globally online – looking at cryptocurrency to pay these employees. See Deel! A high-growth digital onboarding company that recently adopted crypto! Deel is currently at a $100 million annual revenue run rate, the fastest in history (even above Slack) to reach that rate!

Conclusion

In the most recent public webinar, Cabot SX Crypto Advisor recommended a more advanced strategy in addition to purchasing BITO (to gain exposure to BTC) – this suggestion was to short MARA directly or use put options. MARA is a Bitcoin miner that has negative gross margins and little path to profitability due to increasing competition and declining mining incentives. This trade has helped to offset the overall market carnage.

What is the purpose of Web3?

Community building. It is helpful to think of cryptocurrency, defi, web3 and NFTs all in the context of community building. These names are all in reference to the same general ethos – helping power creator economies with digitally native network currencies.

On the Room Where it Happens Podcast, with Greg Isenberg and Sahil Bloom, Alexis Ohanian, the co-founder of Reddit describes the power behind community building and believes that NFTs and crypto will help drive the next iteration of this powerful organic process.

When Alexis started Reddit, he would sell physical merchandise. These t-shirts were a great way for supporters to vote with their dollar and offered a form of advertising for Reddit. NFTs are a more powerful example of this because they transfer economic utility to the user/buyer of the NFT for a longer lifetime value. Owning that NFT can unlock powerful rewards and the possibility of resale at a price above cost.

If you support a project or community by purchasing an NFT, this has real economic value derived from the fellow supporters of that growing community. See Bored Ape Yacht Club. Successful NFT projects are ones that exhibit scarcity and have real communities behind them. Some of the world’s largest music artists and companies like Nike are all looking at ways to incorporate using NFTs.

Staking Overview (Intro to Crypto Dividends)

Given recent inflation there is another way to generate returns using crypto. Owners of large amounts of Ethereum (ETH) have a greater chance to harness economies of scale – processing large batches of transactions for the Ethereum network to earn cryptocurrency. ETH is moving to this “Proof of Stake” model, where network validators stake (or lock in) a portion of their ETH to participate in oversight of the blockchain. In return, these computers receive rewards in ETH for maintaining the network.

For services performed, ETH is earned. To participate, you must stake.

Therefore, there is an incentive for these operators to grow their pool of ETH. Staking your ETH to a community pool is a way to help them scale. In return, you are paid 5% yield on your investment in addition to price appreciation by staking.

Check out Lido! (Source: Pete Huang, Coinbase)

New Opportunities Added to the Watchlist

Ethereum Naming Service (ENS)

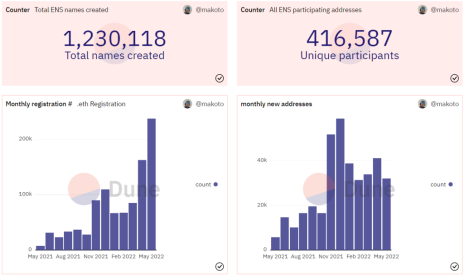

We are currently seeing a surge in the purchase of Ethereum address names as opposed to using wallet addresses with letters and numbers. People want customizable names just like traditional web addresses! To do so, people are turning to ENS to purchase these domains on ETH much like GoDaddy does for traditional web browsing.

We want to highlight this opportunity early.

People are also selling these purchased domain names at a profit on OpenSea! Holders of these names formed their own Discord channel called 10K club.

Source: https://dune.com/makoto/ens

At a market cap of $285 million and a recent price floor of $14 this project offers favorable risk reward dynamics; we will continue to monitor the data before recommending a new position!

If ENS can maintain their current monthly revenue run rate of between $7-8 million USD, the project is trading around 3.3x sales.

Portfolio Update

We remain largely in cash and have not initiated any new positions as cryptocurrency markets have declined along with the broader indices. We continue to proactively research and analyze these companies and projects to highlight best-in-class investment opportunities. Several of our companies, including COIN and NVDA, have upcoming earnings releases, which we will actively monitor and scrutinize. Owning best-in-class businesses and web3 projects remains the best way to generate return on investment over a longer period.

Terra (LUNA)

LUNA has been pushed downward significantly, trading around $50. We remain bullish on the long-term viability of the project and stablecoins in general. We are currently looking for broader markets to stabilize before building up more of our position and will alert you when we enter a new position.

Demand for crypto stablecoins such as UST and USDT continue to rise. In periods of volatility, traders increasingly move between stablecoins and crypto assets. This represents part of our bullish overall thesis that LUNA benefits not only from increased trading but can outperform during periods of volatility. Recommendation - BUY

Ethereum (ETH)

Ethereum is the leading global layer one blockchain. Ethereum powers a new ecosystem of decentralized web projects where creators can launch art, games, and content while also retaining ownership of their own data and custody of their own appreciating digital assets. Smart contracts power this ecosystem and remain the fundamental value driver of ETH.

Like Bitcoin, ETH is regulated by the CFTC and is a safer cryptocurrency investment when compared to other alt coins that may demonstrate properties of a security. That is why today, we own ETH in addition to BTC and recommend it as part of every portfolio. Recommendation – HOLD

ProShares Bitcoin Strategy ETF (BITO)

The decline in the price of Bitcoin has brought down BITO. Since first recommending the investment BITO has traded down to $20.

Investor adoption of BTC and other cryptocurrency assets remains highly favorable, and we believe it is valuable to accumulate this position over time as institutions like Fidelity have added Bitcoin as an option for 401k plans. We look to increase exposure to BTC by owning this ETF. Owning BITO is a cheaper and easier alternative to purchasing Bitcoin. Recommendation – BUY A QUARTER (of total intended position)

Coinbase Global, Inc (COIN)

The Company will report earnings May 10, after market close. In our view, Coinbase has captured a significant share of the highly lucrative U.S. crypto market. Through their thoughtful approach to listing cryptocurrencies, and a general willingness to engage with U.S. regulators, Coinbase has become a leading exchange for both retail and institutional investors. Unless the company publishes significantly poor financial results, which would be unexpected, we view the chance to own Coinbase at a 60% discount to IPO price as a favorable risk/reward investment.

We continue to diligently monitor the company and will update you following the earnings release.

As noted last week, we are not recommending increasing exposure to this name until the stock forms a tradeable base, despite being valued at 8X EV/EBITDA – a historically low valuation for any well-performing company let alone an industry leader. COIN represents an attractive alternative to owning digital assets outright and will continue to benefit from their increasing adoption. Recommendation – HOLD

| Ticker | Original Weight | Price | Price at Rec | Performance | Rating |

| LUNA | 20.0% | 46.96 | 105.98 | -55.69% | BUY |

| ETH | 15.0% | 2,270.68 | 3,444.22 | -34.07% | HOLD |

| SOL | — | 65.09 | — | — | WATCH |

| MATIC | — | 0.83 | — | — | WATCH |

| APE | — | 9.30 | — | — | WATCH |

| ENS | — | 13.74 | — | — | WATCH |

| CASH (USD) | 65.0% | — | — | — |

Equity Portfolio

| Ticker | Original Weight | Price | Price at Rec | Performance | Rating |

| Coinbase (COIN) | 2.5% | 83.51 | 142.5 | -41.40% | HOLD A QUARTER |

| Proshares Strategy Bitcoin ETF (BITO) | 2.5% | 19.23 | 25.93 | -25.84% | BUY A QUARTER |

| Concord Acquisition (CND) | — | 9.94 | — | — | WATCH |

| Galaxy Digital (GLXY.TO) | — | 9.97 | — | — | WATCH |

| Nvidia (NVDA) | — | 169.50 | — | — | WATCH |

| Unity (U) | — | 50.38 | — | — | WATCH |

| CASH (USD) | 95.0% | — | — | — |

Watch List

Nvidia (NVDA)

Nvidia remains on our watch list. This is setting up a generational buying opportunity to own the company with the single biggest exposure to the digitization of our material world. Nvidia is embarking down a bold new chapter in the history of the company.

Demand for AI, software and datacenters means that semiconductors are the new oil powering our digital economy. This process will remain robust for years to come. Nvidia’s graphics cards are best in class.

The company’s fundamentals are incredibly strong, with revenue and EBITDA both growing well over 50% y/y. The only other large cap company putting up these types of numbers is TSLA.

On a technical basis, the stock is not yet oversold. We are patiently awaiting our chance to purchase the stock at a significant discount.

In our view, when the stock begins to form a tradeable base over the next several months, it should be bought. We will keep you appraised. NVDA is poised to outperform the broader market over the next five years.

Concord Acquisition Corp (CND)

Concord Acquisition Corp is merging with Boston-based stablecoin provider Circle Internet Financial. The stated Enterprise Value is $9 billion, which represents a significant discount to the market capitalizations of other stablecoins that are currently trading well above this valuation. Circle is also demonstrating significant growth, as their U.S. stablecoin USDC, has reached over $52 billion in circulation. USDC remains stable and is backed by cash and cash equivalents similar to banks.

We are waiting for the consummation of the merger, as previous de-SPAC entities have traded lower following the completion of their respective mergers. If this is indeed the case, we will be looking to initiate a position in the equity at a discount.

Galaxy Digital Holdings Ltd (GLXY)

Founded by Mike Novogratz, Galaxy Digital describes itself as the bridge between crypto and institutional investors. Galaxy Digital is a merchant bank that invests across a variety of crypto asset classes including layer one blockchains and gaming. The Company’s net income and total assets have been increasing significantly along with broader trends of increasing crypto adoption. We are currently analyzing GLXY’s business model along with other merchant banks to discount risks before making any recommendation.

Crypto

Bored Ape Yacht Club (APE)

Recently, the Bored Ape Yacht Club raised $350 million in an NFT sale on the Ethereum network. This community is an NFT industry leader and has demonstrated significant pricing power in the sale of digital assets. The IP and art created in this community reminds us of Pixar or Disney projects in their infancy, and the runway ahead is huge. By holding APE, people can vote and participate in royalty profits. We are currently analyzing the project through the lens of the Howey test and will publish more information in the upcoming May issue.

Others

We continue to actively monitor Solana (SOL) and Polygon (MATIC) for the right time to buy. These are highly scalable blockchain solutions that are likely to represent significant return on investment when the time is right to buy. In addition, we still are watching Unity (U), an industry leader in graphics software.