Market Update

Following the fed summit at Jackson Hole, global markets retreated as investors try to understand the pace of interest rate increases.

Interest represents the time value of money. Borrowers rent money and pay interest for its use.

Raising the interest rate impacts the present value of cash flows as you are dividing by a larger number… The higher the discount rate, the lower the present value of future cash flows. That is why growth stocks generally take a hit during periods of rising rates. Equity investors are looking to be paid back sooner in shorter term corporate credit markets.

The stock market is all about looking to the future, as you are investing in companies for a holding period.

Moreover, “growth stocks” invest heavily in sales and marketing and stock-based compensation to turbocharge revenues. Their aim is often to grow revenue quickly and take market share. They do this so that in the future they can begin to generate more sizable sums of net income during a state of maturity.

This quest for growth sets the company on a course that will impact its share price significantly if the company is public. If the company cuts guidance on sales the stock will drop. If it is spending significant sums of money without generating revenue at a higher rate, share price will drop. If the company begins to borrow money at high rates of interest for liquidity to offset these costs, share price will drop.

You get the point. If your company strategy is predicated on growth and that is the message issued to investors, you must continue to grow, or investors will be unhappy. Furthermore, how you grow also matters – there is an expectation to use money prudently, while also optimizing for key outcomes. This is a difficult balancing act.

Crypto

Our cryptocurrency picks are holding up well. We view this environment as a favorable time to add to or begin to accumulate a position in the most valuable digital currencies. These currencies like Bitcoin and Ethereum are regulated by the CFTC as commodities. Commodities generally perform well during periods of high inflation and rising rates. In our view, the Ethereum ecosystem represents the best asset to generate returns over a longer holding period.

This is because Ethereum (ETH) is a platform technology with a built-in digital currency. To operating on the Ethereum network, participants transact using ETH. As this network grows over time, the value of the native currency will continue to increase.

Polygon (MATIC) and Ethereum Name Service (ENS) will also benefit significantly from the continued growth of the Ethereum ecosystem.

For more information on Ethereum, I encourage you to explore their website: https://ethereum.org/en/

Stock Portfolio – OKTA Update

Okta, Inc provides cloud software that helps firms manage and secure user authentication into applications, and for developers to build identity controls into applications, Web services and devices. The appointment of Emilie Choi to the Okta board signifies the company is likely to push further into digital assets through identity ownership. Choi is the President and COO of Coinbase!

“It’s clear that identity is at the heart of every industry and every digital interaction. I look forward to working with Okta as the company executes on its mission of freeing anyone to safely use any technology and creating a world where your identity belongs to you,” said Choi (Source: link).

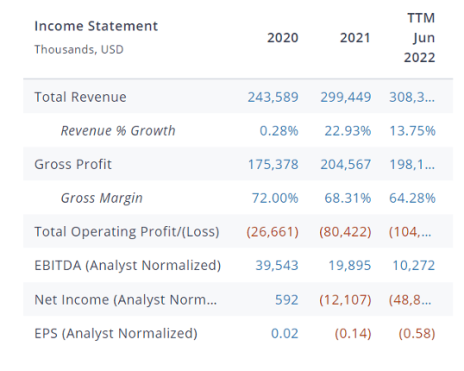

Comp: Thoma Bravo announced their acquisition of Ping Identity (NYSE: PING) for $2.8 billion in cash or around 9x revenue. According to Pitchbook, here is how their income statement stacks up.

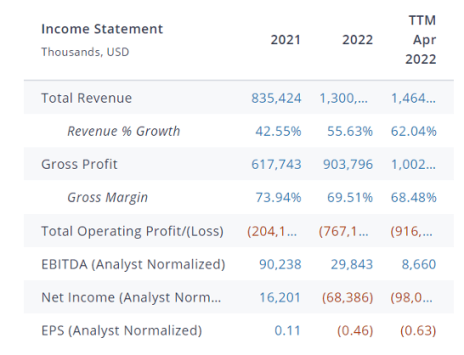

OKTA is also trading around 9x sales despite higher normalized EBITDA and faster revenue growth. The Company expects to generate around $4 billion in revenue by 2026. See OKTA financials below:

Prior to co-founding Okta, Todd McKinnon, was the Vice President of Salesforce.

“We’re actually cash flow positive,” says Mr McKinnon. “We don’t need any more investment. We don’t need to raise money or go to the capital markets. We have been self-funding for many years. But, because of the way subscription revenue works, we are not profitable from the accounting perspective...With this recurring revenue base building up over time, we can be big and be very profitable at scale.”

Crypto Portfolio

| Ticker | Initial Weight | Price | Price at Rec | Performance | Rating |

| ETH | 18.0% | 1,531.36 | 3,444.22 | -55.54% | BUY A HALF |

| ENS | 7.00% | 12.35 | 10.22 | 20.84% | BUY A HALF |

| MATIC | 7.00% | 0.81 | 0.678 | 18.94% | BUY A HALF |

| APE | — | 4.90 | — | — | WATCH |

| SOL | — | 31.53 | — | — | WATCH |

| HNT | — | 6.13 | — | — | WATCH |

| STEPN | — | 0.6697 | — | — | WATCH |

| AVAX | — | 19.00 | — | — | WATCH |

| LINK | — | 6.56 | — | — | WATCH |

Equity Portfolio

| Ticker | Initial Weight | Price | Price at Rec | Performance | Rating |

| Proshares Strategy Bitcoin ETF (BITO) | 2.50% | 12.31 | 25.93 | -52.53% | BUY A QUARTER |

| Arista Networks (ANET) | 2.50% | 121.55 | 105.00 | 15.76% | BUY A QUARTER |

| Nvidia (NVDA) | 2.50% | 158.01 | 188.20 | -16.04% | BUY A QUARTER |

| Okta Inc. (OKTA) | 2.50% | 89.8 | 95 | -5.47% | BUY A HALF |

| Block Inc. (SQ) | — | 67.78 | — | — | WATCH |

| Concord Acquisition (CND) | — | 10.04 | — | — | WATCH |

| CrowdStrike (CRWD) | — | 192.05 | — | — | WATCH |

| Galaxy Digital (GLXY.TO) | — | 6.91(CAD) | — | — | WATCH |

| Proshares Short Bitcoin ETF (BITI) | — | 38.6 | — | — | WATCH |

| Unity (U) | — | 44.43 | — | — | WATCH |