Becoming a great investor stems from a passion for learning. Learning new things is what gets me up every morning.

In Cabot SX Crypto Advisor, I will always make my best attempt to distill information concisely and clearly to you the audience so that you can make more informed, independent decisions.

This type of character development transcends assets and instead enables us to develop a rigorous, analytical framework. Sound and lucrative investments take conviction and time to compound. Therefore, concrete theses must be built piece by piece from solid research to identify great businesses and the correct holding period.

Introducing Cabot SX Crypto Advisor

Becoming a great investor stems from a passion for learning. Learning new things is what gets me up every morning.

In Cabot SX Crypto Advisor, I will always make my best attempt to distill information concisely and clearly to you the audience so that you can make more informed, independent decisions.

This type of character development transcends assets and instead enables us to develop a rigorous, analytical framework. Sound and lucrative investments take conviction and time to compound. Therefore, concrete theses must be built piece by piece from solid research to identify great businesses and the correct holding period.

Our Investment Thesis

As the inaugural publication of Cabot SX Crypto Advisor kicks off, it is important for our readers to understand why we are covering the sector and how we view the evolving landscape.

Here we will cover the underlying technological innovations that power the web3 ecosystem. We will explain how these technologies create the opportunity for readers to directly invest in cryptocurrencies through mediums like Coinbase.

We will cover topics such as: What is a wallet? What is a Blockchain? From the human perspective and as an investor, why should I care?

Understanding the language and key terms can unlock interest. Learning the language can seem daunting at first, which is why we are going to break it down in a way that should make new investors feel more comfortable.

Fundamentals

With Cabot SX Crypto Advisor we are beginning with a top-down investment approach using fundamental research to identify attractive large and growing markets.

Next, we dissect the industry verticals and categorize them. This creates a landscape from which to perform bottom-up analysis on individual companies.

We seek to identify asymmetric investments – those that can increase in value by orders of magnitude over the next several years while demonstrating lower levels of idiosyncratic risk than other investments.

These companies or organizations must demonstrate significant competitive advantages over other market entrants. They must provide real intrinsic value in the form of positive network effects, human utility, and scale. They must be driving their innovation through efficient unit economics. Finally, they must display the characteristics of a platform, not a one trick pony.

We identify and track leading indicators including but not limited to: investor base (cap table), founders and management team, track record of results on the implementation of stated initiatives, developer interest and valuation.

We never stop asking questions and formulate these ideas based on real conversations with industry experts and the best available data.

We show deference to history and respect the power of pattern recognition.

Strategy

At Cabot SX Crypto Advisor, we do not make adjustments to our portfolio based on news of the day. We adjust our weighting only if critical information fundamentally changes the investment thesis at our portfolio companies.

An example of this would be if we began to see a meaningful trending decline in activity on Solana (a competing blockchain and cryptocurrency) after the implementation of the Ethereum network update.

We would identify the change in circumstances based on the best available data and could then decide to adjust our weighting.

Furthermore, we could decide to adjust our weighting based on changes to the regulatory environment. Currently, we do not feel that regulatory risk poses a significant threat to the crypto ecosystem. Cryptocurrencies have been iterating since 2009 … and are now becoming more ingrained in society, which will make them harder to stifle with significant regulation. In fact, we see more upside from the implementation of new regulatory guidance, for example – spot ETF adoption.

Market Update

Macro headlines have rattled markets – from rightful fears of rampant inflation to interest rate pressures, wars to inverted yield curves – these all create uncertainty.

The markets always move for a reason, you just may not be aware of why.

It also becomes a question of holding period. Are these factors that are pressing us today really going to impact the decisions of organizations six months from now? How about a year? Or three years? It quickly becomes a deliberate calculation and a matter of comfort level. How exposed are my investments to certain types of risks and for how long? Can I seize on this opportunity of others discounting present factors and generate a higher rate of return over time? The market has been more efficient in the long run – understanding valuation provides a framework for a ship otherwise adrift on the ocean.

Historically, even the worst events impacting the globe and the United States have been overcome – this is a testament to our citizens and the ability of our country to come together when it matters most.

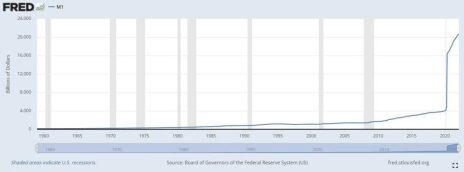

From an investment standpoint, recessions have been among the best times to buy assets. It shows the dislocation of the stock market from the real economy. Why you ask? Historically, if the fed provides support through easier monetary policy, markets discount this impact in real time far quicker than the effects are felt in the real economy. Liquidity moves markets – follow the flows.

Increase in Money Supply - M1

Now let’s turn to crypto.

Crypto Markets

Best-in-class crypto assets have rallied off their recent low, which were certainly a buying opportunity.

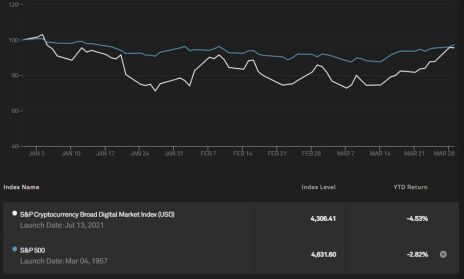

The S&P Cryptocurrency Broad Digital Market Index is down -4.5% YTD as compared to the S&P 500 which is down -2.8%.

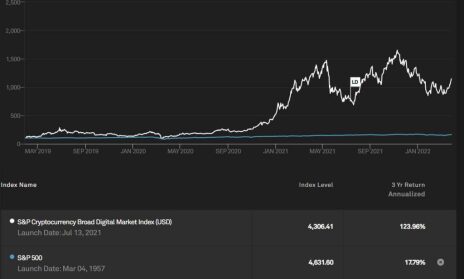

Overall, the S&P Crypto Index is up 124% over the past three years making crypto the best performing asset class by a wide margin.

New Recommendations & Portfolio Update

Terra (LUNA)

Terra is a much-needed solution for the crypto economy. To understand Terra, we must first understand what a Stablecoin is and provide some brief history behind their development.

For years, Tether has been the industry leading Stablecoin in terms of market capitalization. Tether is denominated on major exchanges as USDT.

Tether’s usefulness lies in its price stability – just as the name describes. The intent is for the cryptocurrency to remain stable at $1.00 USDT.

Tether provides liquidity to crypto markets by serving as a medium of exchange to facilitate the trading of Bitcoin (BTC) and Ethereum (ETH) and others.

Since trading crypto became largely dependent on a single Stablecoin – Tether – this consolidated and centralized dependence posed significant risk to the overall system in the event of Tether reporting any major problem.

As a result, other Stablecoin projects have arisen. The major alternatives to Tether are Terra (UST) and Circle (USDC). This broadening of the crypto monetary base is critical for the evolution of cryptocurrencies.

Why Terra (LUNA)?

So where does LUNA come in and how is it still part of the Terra ecosystem? The cryptocurrency LUNA was also released at the same time as UST by the developers of Terra.

LUNA serves a very important purpose. UST achieves its price stability and peg to $1.00 using LUNA. Terra is fundamentally different when compared to other Stablecoins like Tether or Circle!

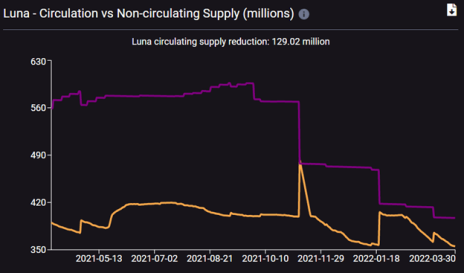

Terra maintains the peg of its cryptocurrency Stablecoins (UST and others) through an algorithm. This smart-contract algorithm decreases the supply of LUNA to mint new UST.

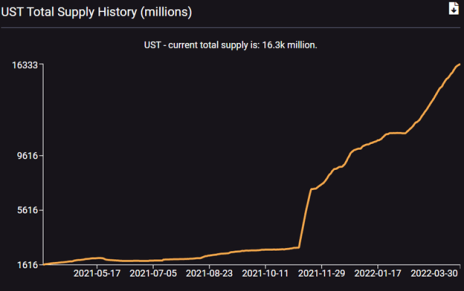

Supply of LUNA decreases as demand for UST increases. Price has correspondingly moved much higher as more Terra UST continues to be adopted. UST is now the fourth largest Stablecoin by market cap (Source: CoinMarketCap, 2022).

LUNA has been the best performing crypto asset of the past two months despite macro headwinds. LUNA has also been among the best performing crypto assets of the past two years by orders of magnitude.

It is up 183.45% in the past six months alone.

Terra just raised $1 billion dollars in a token sale of its cryptocurrency LUNA to private investors (Source: Luna Foundation, Feb 22, 2022). These cash proceeds will be used to purchase Bitcoin (BTC) as a new form of forex reserve.

As a result, buying LUNA today also provides you with a cheaper way to gain exposure to BTC, which is currently $47,529 USD.

Valuation

The current market cap of LUNA is $38 billion – significantly lower than other Layer One solutions (the primary tokens of the blockchain itself) like ETH at $408 billion.

Furthermore, UST – Terra’s Stablecoin – has a market cap of $16 billion. As more merchants adopt UST and users choose to transact in UST, more UST will be minted, further catalyzing the price of the LUNA token.

Based on the caliber of management and financial backers, we see significant upside in LUNA.

For additional reading material, please refer to our Reserve Currency of the Digital Age report.

Investment Matrix

| Platform | Yes |

| Scalable | Yes |

| Differentiated | Yes |

| Competitive Advantage | Yes |

Ethereum (ETH)

Created by Vitalik Buterin in 2015, Ethereum is now the leading Layer One blockchain for crypto commerce. The underlying value of Ethereum stems from the deployment of smart contracts, the Ethereum Virtual Machine (EVM).

The Ethereum blockchain network has its own native currency – Ether (ETH).

Ethereum is undergoing a transformational “Beacon Chain” update that is likely to result in significant price appreciation.

Ethereum is transitioning from Proof of Work to Proof of Stake. This means that the Ethereum blockchain will have a different governance structure and should improve the network’s ability to transact more efficiently at scale. This update should improve the overall experience for the end users and lower transaction costs (Source: Ethereum Update).

NFTs (Non-Fungible Tokens)

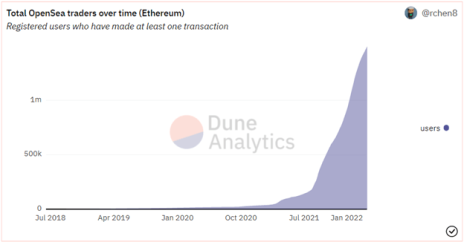

The majority of NFT transactions are denominated in Ethereum and transacted on Open Sea. The explosion in the NFT market has further increased the demand for ETH.

Valuation

Ethereum’s market cap is certainly large, but we believe there is still significant upside over the next decade. Ethereum generated $10.7 billion in 2021 network revenue, which dwarfs all other crypto projects by comparison. It is not even close.

ETH is trading at a 38x trailing Price/Sales ratio.

This is reasonable in comparison to other software valuations. Given the foundational layer of ETH and revenue expected to increase with time, ETH remains an industry leader and is a buy.

Investment Matrix

| Platform | Yes |

| Scalable | Yes |

| First Mover | Yes |

| Competitive Advantage | Yes |

New Recommendations

Buy

| Ticker | Weight | Price | Price at Rec | Performance |

| Terra (LUNA) | 20% | 105.98 | Today’s rec | -- |

| Ethereum (ETH) | 15% | 3,444.22 | Today’s rec | -- |

| Cash (USD) | 65% | -- | -- | -- |

Cryptocurrencies trade continuously; prices are recorded as of the prior business day’s market close. Prices pulled from CoinMarketCap - https://coinmarketcap.com/

Watch List

Along with our LUNA and ETH recommendations, we also have two additions to our crypto watch list.

Solana (SOL) makes this issue’s watch list as a scalable Layer One blockchain solution. Solana offers advantages over other blockchains through its high transactions per second speed and scalability. The increasing rate of development of new projects on Solana has been impressive, leading to further demand for its native network currency SOL. It is our belief here at Cabot that Solana will continue to harness powerful network effects. With a low circulating supply, high total value staked, and desirable competitive advantages – Solana meets our criteria for a platform investment.

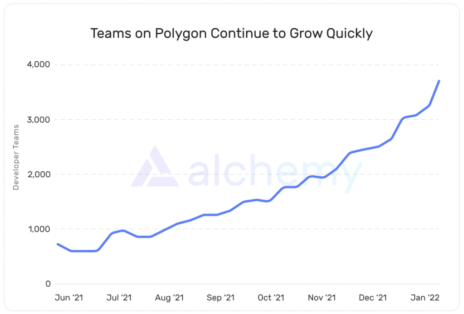

Polygon (MATIC) is a Layer Two scaling solution for Ethereum. What does this mean? Polygon is a technology platform that helps the Ethereum network to connect and scale. It runs in parallel. Polygon aims to improve certain limitations of the Ethereum platform – most importantly high transaction fees, and processing speed. These improvements help developers who are focused on projects such as gaming, which require additional throughput.

Polygon has helped power over 7000 decentralized apps according to their website.

Polygon PoS adoption is growing exponentially, the network now has more than 130 million unique addresses and over 2.67 million monthly active users (Source: Polygon).

MATIC is an ERC-20 token, which means that it is compatible with other Ethereum cryptocurrencies. In exchange for securing and validating the network, participants earn MATIC!

On February 7th 2022, Polygon raised $450 million through a private token sale of its native currency MATIC. The funding round was led by Sequoia Capital, with participation from SoftBank, and Tiger Global Management.

You have a unique opportunity to own an asset at similar prices to early stage investors.

Watch List

| Ticker | Price | Performance YTD |

| Solana (SOL) | 136.28 | -22% |

| Polygon (MATIC) | 1.695 | -34% |

Cryptocurrencies trade continuously; prices are recorded as of the prior business day’s market close. Prices pulled from CoinMarketCap - https://coinmarketcap.com/

Stocks With Web 3.0 Exposure

Picks and Shovels

In upcoming issues, we will highlight in detail how to gain exposure to Defi (an umbrella term for decentralized finance) through investments in traditional U.S. equities that each have strong correlation to broader crypto market trends.

Watch List

For our inaugural issue we have two equity picks for our watch list.

Nvidia (NVDA) is a pioneer in computer graphics processing, and their GPU chips are highly sought after for both rendering virtual worlds and mining cryptocurrencies. The company has doubled revenues over the last three years and boasts triple the revenue of the next largest PC GPU supplier while also focusing on ESG policies and using AI to optimize their product pipeline.

Coinbase (COIN) is the largest publicly traded cryptocurrency exchange in the world, with over 60 million users and that trade billions of dollars in cryptocurrency every day. Shares are significantly below their IPO price (came public in April 2021), but Coinbase offers a user-friendly experience that will be critical for mainstream adoption of crypto.

| Ticker | Price | Performance YTD |

| Nvidia (NVDA) | 267.12 | -11.3% |

| Coinbase (COIN) | 186.95 | -25.5% |

Future Topic Review

- Regulatory Frameworks

- Environmental Impact

Footnotes + Learning Center

- River - Bitcoin Learning Center

- Coinbase - Crypto Questions, Answered

CoinDesk –

a) Foundation Focused on UST Stablecoin Raises $1B in LUNA Sale

b) What Is LUNA and UST? A Guide to the Terra Ecosystem- Intro to Ethereum - Intro to Ethereum

- Dune Analytics - Open Sea: Ethereum

The next Cabot SX Crypto Advisor issue will be published on April 19, 2022.