We want to take a moment to highlight breadth across the overall markets. Many individual stocks are down well over 50%, while indices have remained more stable. Why? The composition of the S&P 500 is weighted heavily towards mega-cap technology companies. Stocks like Apple, Amazon, and Google remain near all-time highs, bolstered by the overall current flight to quality. Investors remain enticed by buybacks, splits, and fundamental cash flow generation.

Many investors are simply asking themselves: what do I buy right now if anything at all?

Demand for unprofitable assets has fallen off precipitously.

Introduction & Market Update

We want to take a moment to highlight breadth across the overall markets. Many individual stocks are down well over 50%, while indices have remained more stable. Why? The composition of the S&P 500 is weighted heavily towards mega-cap technology companies. Stocks like Apple, Amazon, and Google remain near all-time highs, bolstered by the overall current flight to quality. Investors remain enticed by buybacks, splits, and fundamental cash flow generation.

Many investors are simply asking themselves: what do I buy right now if anything at all?

Demand for unprofitable assets has fallen off precipitously.

Late-stage companies, like Instacart, are seeing significant multiple compression during recent fundraising rounds. The company’s valuation was recently cut from $39 billion to $24 billion (Source: Reuters, PitchBook).

Top investors who are on the board of prominent early-stage companies are now making the recommendation to take a hard look at cash burn multiples to ensure that if you can afford to wait to raise capital, do so, until broader markets stabilize (Source: David Sacks). Stabilization will come from a clear leveling of inflationary pressure and concrete interest rate increases over the next several months.

Respected CEO of Snowflake, Frank Slootman, speaks openly in both interviews and published literature that times exactly like we face today are exactly the moments when leaders should look to press hard, take market share, and define themselves as a best-in-class organization.

Respectively, the same rigorous process should be taken when constructing a portfolio. Ask the hard questions. Companies with high operating expenditures and declining revenue growth rates will take years to return to their highs if ever.

Conversely, companies with robust competitive advantages, strong business models (exhibited through pricing power, recurring revenue, and increased demand for the product), those that are continuing to deliver real value to customers, should be bought. These types of companies also should lack significant exposure to interest rate risk and commodities.

Fear-induced paralysis is not a strategy. Neither is short-sighted axing of quality companies.

Treasuries are currently un-investible. According to the U.S. Bureau of Labor and Statistics, prices on all items have risen on average 8.5%. All items less food and energy have risen 6.5%. (There are hopeful signs seen from declining used car prices and manufacturing inputs).

More specifically, real yields on U.S. treasuries are negative because they are not keeping pace with inflation. Bond prices were driven to all-time highs bolstered from buying by the Federal Reserve. The Fed is now going from being the single biggest buyer of bonds to becoming a net seller.

This makes owning current U.S. treasuries one of the most crowded trades in history.

Betting on rising interest rates, falling bond prices, and positioning yourself to be short the housing market all look like asymmetric trades.

Where does that leave crypto?

Commodities have been the best performing asset class along with early-stage venture, and crypto.

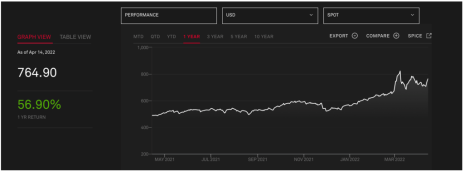

S&P GSCI Index

In real time, we are seeing the evolution of crypto as a viable asset class. Investors are continuing to look to crypto for broader portfolio diversification as well as beta exposure.

This means that in periods of high inflation and rising rates, like today, crypto assets like Bitcoin should bifurcate and trade independently of other markets like the S&P 500. Why?

Bitcoin has the properties of a commodity. To put it simply, it is digital gold.

As the industry matures, BTC is increasingly being held as collateral by other projects including our recommendation, LUNA.

According to research done by institutional asset manager, Pantera Capital, Bitcoin shows higher degrees of correlation for a period of 71 days surrounding broader market corrections.

Afterwards, Bitcoin, and other digital assets, once again begin to trade more independently.

This current environment is a real test for crypto assets in terms of how they are viewed by market participants.

It is increasingly clear that crypto serves as a valuable piece of your portfolio and is one that can significantly outperform other asset classes over the next five years given this environment.

New Recommendations & Portfolio Update

Coinbase Global, Inc (NYSE: COIN) – BUY A QUARTER

Investment Highlights

- Coinbase is trading at 7.5x TTM free cash flow

- COIN generates 3B in TTM normalized EBITDA

- Trading at 9.4x TTM analyst normalized EBITDA

- Q4 21 Operating Income $1B vs $309M y/y

- Morningstar Equity Research – Price Target: $210

To put the current valuation of Coinbase into perspective, private equity investors cannot buy a quality technology company today in the lower middle market for less than 12x, let alone a profitable industry leader with a proven track record.

This makes the valuation of Coinbase incredibly cheap on a historical basis given that across all industries, average Enterprise Value to EBITDA multiples for the last ten years of private transactions are around 11x (Source: PitchBook).

Early-stage venture deals see an even higher step up in valuation, while most companies are positioned for growth and are unprofitable for years before a public market exit.

Company Overview

Coinbase is the leading U.S. based cryptocurrency exchange. They are a pure-play software company and do not offer a cryptocurrency of their own. The company’s history of regulatory compliance, strong investor base, and founder-led track record, have propelled Coinbase to take significant U.S. market share. Other competitors have not had the same success inside the highly coveted U.S. market. We believe that Coinbase’s significant first-mover advantage positions the company to expand its core line of product offerings and remain highly profitable moving forward.

Much of Coinbase’s success can be attributed to their intuitive mobile app interface. The design of their mobile app makes it easier for customers to deposit fiat currencies and purchase crypto.

Price Catalysts

Coinbase and FTX have made massive foray into investments, leading financing rounds in numerous early-stage companies. These investments serve to generate a positive flywheel effect for the future of their businesses, as emerging companies find product-market-fit and launch their own community tokens or cryptocurrencies to eventually be listed on Coinbase.

Importantly, Coinbase is launching Coinbase One, a new subscription service with $0 trading fees, $1 million in account protection, and 24/7 customer support desk. The service will reportedly cost $30 per month and is beginning to be rolled out across the United States.

According to their website, Coinbase has 89 million verified users, and supports 11,000 institutions. Coinbase ended 2021 with about 11.4 million monthly transacting users. If 10% of these Coinbase monthly users adopt Coinbase One, this could unlock $410 million per year in annual recurring revenue. This would further diversify Coinbase revenue streams and unlock share price appreciation through software multiple comps.

Furthermore, Coinbase has already announced plans to launch their own NFT marketplace. This will allow users to purchase, mint, and showcase digital assets. Given that many users already use Coinbase as their primary cryptocurrency wallet, trading NFTs in the same location is a logical next step. By performing all of these activities in one “super app,” it is highly plausible that Coinbase will take market share from incumbent NFT marketplace, OpenSea. This development will further diversify Coinbase income streams and demonstrate that Coinbase continues to build an all-encompassing platform.

Technical Analysis

With a low tradable public float of 160 million shares coupled with only 47% held by institutions, the company also exhibits highly favorable trading dynamics that could lead to significant price appreciation once the stock demonstrates a stronger base.

Coinbase received an IPO reference price of $250 and began its IPO debut day trading at $340 per share. Today’s price is $148.

3 Month Chart

TTM squeeze indicator is beginning to come off the lows, while MACD is also rising back towards zero. We need to see the blue line trending closer to zero to initiate a position. However, at these levels future growth has already been heavily discounted. We believe it makes sense to begin to think about starting a position.

This thinking is affirmed by large buy volume shown as green bars here on the chart. We have seen significant large buy orders, suggesting that larger institutions have begun buying.

1 Year Chart

On a one-year chart, technical indicators are not as favorable. The blue MACD line is continuing in a downward trend and TTM squeeze indicator has not begun to flip positively.

Why is this important? Other traders and algorithms follow the technicals and are programmed to. So, although they are far from perfect science, they are helpful when coupled with a strong overall investment thesis and committed hold period discipline.

If you are looking to trade the stock, do so with a tight stop loss.

As a result, we only recommend beginning a position in Coinbase at these levels, not taking a full position. Coinbase represents an attractive risk adjusted investment over a longer 5-year time horizon. BUY A QUARTER

For the purposes of our equity portfolio, a full position represents a 10% stake, and recommendations will be consistent with other Cabot advisories (e.g., BUY, BUY A HALF, HOLD, SELL).

However, there may be instances in which a larger stake is warranted. Those opportunities will be presented with an OVERWEIGHT rating, which is unique to this advisory, and should be taken to mean an additional quarter stake beyond a “full” position.

Risks

Crypto exchanges like Coinbase rely on the continued prosperity of blockchain technology adoption. According to company filings, Coinbase derives the majority of its revenue from transaction fees on trading volume.

Notes

In our view, COIN will continue in their international expansion and onboard significant monthly active users. Recent articles about their difficulties expanding into India are overblown and are already priced in. Furthermore, COIN has significant dry powder and demonstrates the ability and willingness to purchase competitors.

Portfolio Update

Terra - LUNA

In the few weeks since we first recommended – Terra (LUNA), price has taken a dip along with the overall market. LUNA price retreated to $83 and has since rebounded to $90 following our recent market update alert.

In our view, this represents a favorable buying opportunity to continue to build a position.

We are not trading the token and intend to hold LUNA over a significant longer-term horizon due to its characteristics as a highly valuable layer one monetary platform.

3 Month Chart

Indicators are favorable, LUNA is seeing increased buying today as noted by the large green candles.

1 Year Chart

Huge buy candle here. Near the lows on both MACD and TTM squeeze, looks like it has found support and is about to run back to $100.

Ethereum - ETH

ETH is the industry leading, layer one blockchain. Ethereum powers almost all NFTs minted today as well as hundreds of decentralized applications. The blockchain project is the pioneer of smart contracts, which are the single biggest development creating real economic value today in web3.

Since we first recommended ETH, price has dipped. We see this as an opportunity to continue to build your position.

With impending network upgrades, and continuing widespread adoption, ETH has a very low tradeable supply relative to large-cap technology share counts.

As the platform layer of DeFi, we recommend staying patient and continuing to look to purchase and build a position in Ethereum.

3 Month Chart

1 Year Chart

Price is trying to bottom. It will be bullish if ETH can continue to make “higher lows” based on the most recent bottom around $2,650.

I am much more positive on ETH, contrary to the other headlines and traders calling for crypto calamity. Price does not want to stay below $3,000.

In 12 months, ETH will be higher than it is today.

Current Portfolio

| Ticker | Original Weight | Current Weight | Price | Price at Rec | Performance | Rating |

| LUNA | 20.0% | 17.7% | 88.71 | 105.98 | -16.3% | BUY |

| ETH | 15.0% | 13.8% | 3,004.26 | 3,444.22 | -12.8% | BUY |

| CASH (USD) | 65.0% | 68.5% | — | — | — |

Watch List

| Ticker | Price | Performance YTD |

| Solana (SOL) | 101.21 | -40% |

| Polygon (MATIC) | 1.39 | -45% |

Stock With Web 3.0 Exposure

Equity Portfolio

| Ticker | Original Weight | Current Weight | Price | Price at Rec | Performance | Rating |

| Coinbase (COIN) | 2.5% | — | — | New Rec | — | BUY A QUARTER |

| CASH (USD) | 97.5% | — | — | — | — |

Watch List

Unity Technologies (NYSE: U) is on takeover watch. We believe the Company is well positioned as an industry leader for software development, gaming, automotive, and architecture. Large strategic buyers like MSFT, ADSK, FB would all like to buy Unity.

I do not believe the company will sell for less than it deserves, especially in the current market environment. However, I do believe this puts a significant backstop in the share price. Investors appear very willing to purchase shares at the $80 level.

Nvidia (NYSE: NVDA) is back to $210 support levels and appears to be trading in a range as investors digest chip inventories. Given such large total addressable markets that NVDA has the potential to tap into, we are keeping the company on our watch list and will look to initiate a position in the coming weeks.

NVDA is the only large cap technology company outside of Tesla exhibiting over 50% revenue and EBITDA growth. At a market cap of $542 billion, the company has significant long-term upside and likely becomes a multi-trillion-dollar titan.

| Ticker | Price | Performance YTD |

| Nvidia (NVDA) | 217.83 | -27.7% |

| Coinbase (COIN) | 145.16 | -42.2% |

Footnotes

The first BTC approved futures ETF has seen record trading volume.

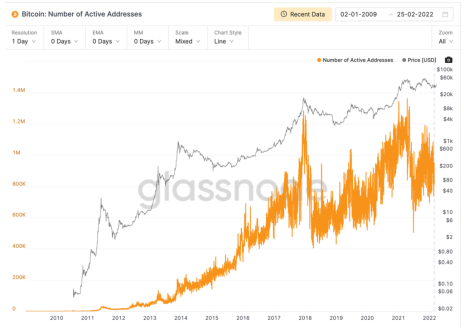

Increasing Number of Active BTC Owners

Another interesting point to take note of here – the recent dip doesn’t look so bad when compared with the historical gains.

People are choosing to own BTC, a lot more of it. This metric is a proxy for user growth and adoption. It is highly accurate and verifiable from public blockchain data.

BTC Futures ETF Flows

Open interest in futures contracts is increasing relative to market cap, which has been a powerful, historical early buy signal.

The next Cabot SX Crypto Advisor issue will be published on May 17, 2022.