- -$400 million USD in Bitcoin sent to exchanges for sale (not bullish)-BTC dropped by $1,000 immediately following last week’s CPI data (inflation)-The higher CPI data means a larger rate hike by the Federal Reserve on Sept. 21-ETH Merge was largely a buy the rumor sell the news event as prices ran up ahead of the Merge but have now declined-September historically is not a good month for investors. In fact, since 1950, September has been the worst-performing month of the year for stocks across all major averages.

Cabot SX Crypto Issue: September 20, 2022

Intro & Market Overview

- $400 million USD in Bitcoin sent to exchanges for sale (not bullish)

- BTC dropped by $1,000 immediately following last week’s CPI data (inflation)

- The higher CPI data means a larger rate hike by the Federal Reserve on Sept. 21

- ETH Merge was largely a buy the rumor sell the news event as prices ran up ahead of the Merge but have now declined

- September historically is not a good month for investors. In fact, since 1950, September has been the worst-performing month of the year for stocks across all major averages.

Fidelity, Schwab and Citadel Launch Crypto Exchange

These three giants have teamed up to launch EDX Markets, a cryptocurrency exchange, with further backing from Sequoia Capital, Paradigm, and Virtu – all leading private investors. This announcement is coming on the heels of reports that Fidelity will offer Bitcoin trading directly through their brokerage service. Investors could then view their Bitcoin holdings alongside traditional investment accounts. This product would be in addition to their launch of a Bitcoin 401(k). Furthermore, Fidelity also published a paper titled Bitcoin First, in which they outlined their bullish thesis for the asset.

The Lindy Effect

Despite the so-called “winter” as assets have not performed well, crypto is benefitting from something called the Lindy Effect. This is a theory that says the longer a non-perishable thing survives, the more likely it will survive in the future. For example, iconic songs that we hear all the time are more likely to continue to be played when compared to recent hits because these classics have demonstrated longevity.

The longer Bitcoin and Ethereum lead the cryptocurrency market, the more ingrained they become and the harder they are to replace or eradicate. As silly or as simple as this sounds, it becomes truer every day. Both BTC and ETH are first movers for their respective purposes. Bitcoin is a scarce, digital, commodity than can be stored and held indefinitely. It has a fixed supply governed by the code that powers it.

Ethereum, on the other hand, is a technology platform that provides the base layer of all decentralized finance. This Layer One blockchain powers most successful cryptocurrency projects using Ethereum smart contracts. Ethereum created their own programming language called Solidity!

Key Elements:

- Security

- Decentralization

- Scalability or scarcity.

These two blockchains represent important technological creations. Each has demonstrated the ability to replace other “centralized” databases. For example, people can now transact over the internet, using Bitcoin or Ethereum and that data is not held on a bank server, it is instead held on an immutable public blockchain that keeps a record of the transaction data and will not be sold to third parties.

From a perspective of longevity, it makes sense to allocate a portion of your portfolio to crypto assets.

Data Observations

Some new data is out from Tomasz Tunguz, Managing Director of Redpoint Ventures.

- 5 million daily active cryptocurrency wallets, with 80 percent of these being Ethereum, Binance, Polygon and Solana

- Centralized exchanges like Coinbase, Binance, and FTX globally manage 100 million active wallets

- Trading volumes across crypto markets are currently down around 60%

- $250 million is still flowing into Layer Two solutions each month

- ETH smart contract rate per month has remained flat but is not declining .

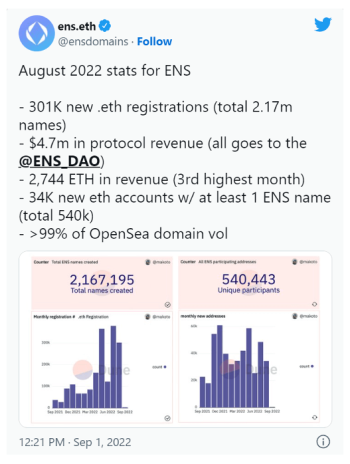

Despite this data, Ethereum Name Service (ENS) continues to outperform almost all other crypto projects.

ENS has 99 percent of the Ethereum domain name market …

Unstoppable Domains was just valued at $1 billion in a private $65 million dollar Series A funding round led by Pantera Capital. Unstoppable is registering websites with extensions such as .crypto .bitcoin .blockchain etc. They claim to have over $80 million in sales at an undisclosed take rate.

This recent raise is bullish for ENS, trading at only $300 million in market cap despite a monopoly on the .eth market, which is the largest blockchain ecosystem. ENS also runs a subscription service that will generate more stable and recurring revenue over time when compared to Unstoppable Domains, which does not operate a model like GoDaddy.

My estimates suggest that ENS is trading at just 4X forward revenue.

ENS has been less volatile when compared to other crypto tokens. It has traded in a range between 13-16, suggesting relative strength and price stability.

Investors who are buying early blockchain domain names are picking up extremely valuable pieces of digital real estate. This appears to be far more fruitful when compared to buying land in a metaverse …

For example, University of Pennsylvania professor Matt Blaze bought crypto.com in 1993 and sold it in 2018 for $12 million.

ENS domains are retaining and appreciating in value across secondary NFT markets such as OpenSea.

Blockchain “Dividend Stocks”

We’re digging into two reputable blockchains offering staked annual yields that exceed inflation. These are being explored for future inclusion in the watch list or portfolio.

- Polkadot (DOT) – 14.8% nominal yield, 28-day lockup

- Cosmos (ATOM) – 18.9% nominal yield, 21-day lockup

Portfolio Update

In our view, the Fed’s posture on interest rates continues to be the biggest barrier to beginning a new bull market. As rates continue to rise, we are seeing outflows from equity and crypto markets. However, meaningful signs of inflation reduction in the form of lower CPI will prompt huge inflows. Therefore, it does not make sense to pull all your risk assets out of the market. Instead, it makes sense to be patient as we move through the back half of this year holding a long-term portfolio of best-in-class assets. Markets are built for short-term gyration and long-term gain.

We remain extremely bullish on MATIC, ENS, and ETH based on fundamental data, and we think these names have shown significant relative strength to the broader market. They have been leaders into rallies and shown less downside on bearish days. Continue to remain patient as the macro environment sorts itself out.

Crypto Portfolio

| Ticker | Initial Weight | Price | Price at Rec | Performance | Rating |

| ETH | 18.0% | 1,362.37 | 3,444.22 | -60.44% | BUY A HALF |

| ENS | 7.00% | 13.72 | 10.22 | 34.25% | BUY A HALF |

| MATIC | 7.00% | 0.77 | 0.678 | 13.20% | BUY A HALF |

| APE | — | 6.09 | — | — | WATCH |

| SOL | — | 32.81 | — | — | WATCH |

| HNT | — | 4.71 | — | — | WATCH |

| STEPN | — | 0.624 | — | — | WATCH |

| AVAX | — | 17.21 | — | — | WATCH |

| LINK | — | 7.66 | — | — | WATCH |

Equity Portfolio

| Ticker | Initial Weight | Price | Price at Rec | Performance | Rating |

| Proshares Strategy Bitcoin ETF (BITO) | 2.50% | 12.00 | 25.93 | -53.72% | BUY A QUARTER |

| Arista Networks (ANET) | 2.50% | 114.94 | 105.00 | 9.47% | BUY A QUARTER |

| Nvidia (NVDA) | 2.50% | 133.82 | 188.20 | -28.89% | BUY A QUARTER |

| Okta Inc. (OKTA) | 2.50% | 58.91 | 95 | -37.99% | BUY A HALF |

| Block Inc. (SQ) | — | 63.71 | — | — | WATCH |

| Concord Acquisition (CND) | — | 10.05 | — | — | WATCH |

| CrowdStrike (CRWD) | — | 175.39 | — | — | WATCH |

| Galaxy Digital (GLXY.TO) | — | 6.94(CAD) | — | — | WATCH |

| Proshares Short Bitcoin ETF (BITI) | — | 38.37 | — | — | WATCH |

| Unity (U) | — | 36.86 | — | — | WATCH |

The next Cabot SX Crypto Advisor issue will be published on October 18, 2022.

About the Analyst

Ian Beaudoin

Ian Beaudoin is Chief Analyst of Cabot SX Crypto Advisor.

Ian provides deep insights into emerging disruptive technologies, covering cryptocurrency, blockchain, play-to-earn gaming, fintech, and the venture ecosystem. He has independently invested in and traded cryptocurrencies, securities, and derivatives since 2015 and actively seeks to identify asymmetric investment opportunities in both public and private markets through fundamental research, event driven strategies, mean reversion, and arbitrage.

Ian also serves as the Senior Analyst at Hyperion Capital Partners.