Intro & Market Overview

Last week we added JPMorgan Chase (JPM) to our buy list based on their foray into blockchain technology. The stock is up 10% since that recommendation! This week we are adding Google, also known as Alphabet (GOOG), which is their holding company.

We have been riding out some of the most challenging market conditions in recent years – keep the faith and continue to invest in long-term winners. Companies that operate durable B2B business models perform mission-critical services for their customers and still represent high-quality investments. With inflation running hot, these businesses rely on areas like cloud computing, software, and digital payments more than ever to keep track of key performance data. These platforms empower business leaders to run the best operations possible in any environment.

Alphabet (NYSE: GOOG)

Google just announced a new deal with Coinbase (COIN) that will allow customers to pay for cloud services using digital currencies such as Bitcoin (BTC) and Ethereum (ETH). They expect this service to begin in the early part of 2023. Initially, this will be offered to a specific set of customers who are already using Coinbase integrations. Over time, Google expects to take more payments in crypto. To put this into perspective, only 5% of the world is invested in cryptocurrencies – many of them are retail investors or venture capital firms – B2B adoption is our main bull thesis here at Cabot SX Crypto Advisor. As such, announcements such as these are extremely notable and will certainly move the needle for others who are now asking “Google is doing this, should we?”

This partnership is also huge for Coinbase. Today, a large portion of their revenue stems from fees from retail trading volume. However, when COIN can demonstrate further revenue diversification through Coinbase Commerce – the company’s business partnerships division – that will be a key moment serving as a potential catalyst for Coinbase stock. In summary, it is too early to invest in Coinbase after the IPO valuation, but keep an eye on the company. They continue to dominate most of the U.S. market.

Recommendation: BUY A QUARTER (NYSE: GOOG, GOOGL)

Ethereum Name Service (ENS) Update

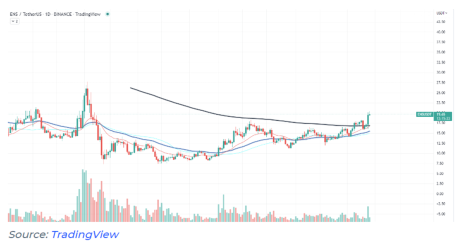

This has been one of our best performers. We first identified ENS at the $9 level, it is now trading close to $20. ENS is the best way to gain low-cost exposure to Ethereum (ETH). ENS continues to dominate the Ethereum domain name market where more and more businesses and individuals continue to sign up and purchase these domains. ENS domains are one of the only NFT projects trading on OpenSea to retain their value despite crypto prices declining along with global markets. That is a real sign of strength.

ENS has been trading almost double the average volume over several days.

Impact of China on NVDA and Semi Stocks

The recent selloff has wiped away two years of gains, taking the price of Nvidia (NVDA) back to 2020 levels. Despite the price adjustment over the same period, NVDA has grown revenue and income from operations above 50%, year in and year out. This means the company will be one of the first stocks investors flock to buy when inflation data continues to subside and we see an end to interest rate increases. That’s why at this level Nvidia remains a buy. NVDA powers everything from gaming to datacenters for cloud computing. They sit at the heart of key industries, and I don’t expect that to change anytime soon.

Recently, the U.S. government further imposed restrictions on semiconductor exports to China. This move prevents U.S. citizens from working with or supplying key technology to Chinese companies over concern for their use in military applications. As a result, semiconductor stocks have taken a hit. According to guidance from the company, only 6% of Nvidia’s revenue for datacenter GPUs comes from China. Therefore, these restrictions are unlikely to hamper Nvidia’s growth prospects. Instead, we see the continued growth of cloud computing giants serving as a catalyst for the stock.

In fact, this move is more protectionist than a detriment. Now, global companies will have a hard time buying Chinese-made technologies that could compete with NVDA over concerns of U.S. backlash. Examples of this are already in play considering recent moves to remove all Huawei technology from U.S. communications systems over concerns of spying by the Chinese government.

Crypto Portfolio

| Ticker | Initial Weight | Price | Price at Rec | Performance | Rating |

| ETH | 18.0% | 1,325.54 | 3,444.22 | -61.51% | BUY A HALF |

| ENS | 7.00% | 19.15 | 10.22 | 87.38% | BUY A HALF |

| MATIC | 7.00% | 0.83 | 0.678 | 22.98% | BUY A HALF |

| APE | — | 4.51 | — | — | WATCH |

| SOL | — | 30.80 | — | — | WATCH |

| HNT | — | 4.54 | — | — | WATCH |

| STEPN | — | 0.5869 | — | — | WATCH |

| AVAX | — | 16.01 | — | — | WATCH |

| LINK | — | 7.23 | — | — | WATCH |

Equity Portfolio

| Ticker | Initial Weight | Price | Price at Rec | Performance | Rating |

| Alphabet (GOOGL) | 2.50% | 99.97 | 99.97 | — | BUY A QUARTER |

| Arista Networks (ANET) | 2.50% | 104.56 | 105.00 | -0.42% | BUY A QUARTER |

| JPMorgan (JPM) | 2.50% | 115.86 | 107.73 | 7.55% | BUY A QUARTER |

| Nvidia (NVDA) | 2.50% | 118.88 | 188.20 | -36.83% | BUY A QUARTER |

| Okta Inc. (OKTA) | 2.50% | 52.03 | 95 | -45.23% | BUY A HALF |

| Proshares Strategy Bitcoin ETF (BITO) | 2.50% | 12.05 | 25.93 | -53.53% | BUY A QUARTER |

| Block Inc. (SQ) | — | 55.92 | — | — | WATCH |

| Concord Acquisition (CND) | — | 10.07 | — | — | WATCH |

| CrowdStrike (CRWD) | — | 151.61 | — | — | WATCH |

| Galaxy Digital (GLXY.TO) | — | 6.31(CAD) | — | — | WATCH |

| Proshares Short Bitcoin ETF (BITI) | — | 37.92 | — | — | WATCH |

| Unity (U) | — | 30.88 | — | — | WATCH |