Cabot Options Institute Quant Trader – Alert (IWM)

Russell 2000 ETF (IWM)

Okay, it’s time to get back in the saddle.

After recently locking in profits on our SPY June 16, 2023, 430/435 bear call spread, it’s time to look towards selling some premium for the July 21, 2023, expiration cycle with 56 days until expiration (dte).

I’m going to start today by selling an iron condor in IWM and intend on adding, at least, two more trades next week for the same expiration cycle. As always, I’ll be focusing on a bear call spread and bull put spread to keep the portfolio somewhat balanced.

Our recent profit in SPY marks 29 out of 33 winning trades since we started Quant Trader just under one year ago. Moreover, our total return is now hovering around 150%. We could not be happier with the performance so far, especially given the returns in the overall market over the same time frame.

That being said, don’t get overconfident and decide to alter your risk-management approach. Proper risk management is what truly separates those that are successful over the long term versus those that continue to be challenged.

Russell 2000 (IWM)

With the Russell 2000 ETF (IWM) trading for 176.20, I want to place a short-term iron condor going out 56 days. As always, my intent is to take off the trade well before the July 21, 2023, expiration date.

IV: 24.0%

IV Rank: 13.6

Expected Move (Range): The expected move (range) for the July 21, 2023, expiration cycle is from 165 to 188.

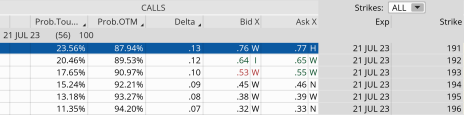

Call Side:

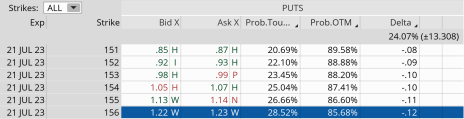

Put Side:

The Trade

Simultaneously:

- Sell to Open IWM July 21, 2023, 191 call strike

- Buy to Open IWM July 21, 2023, 196 call strike

- Sell to Open IWM July 21, 2023, 156 put strike

- Buy to Open IWM July 21, 2023, 151 put strike … for a total of $0.79. (As always, the price of the spread can vary from the time of the alert, so please adjust accordingly if you wish to take on a position.)

*Our margin of error is roughly 8.4% to the upside and more than 11.5% to the downside over the next 56 days.

Delta of spread: -0.05

Probability of Profit: 87.94% (upside) – 85.68% (downside)

Probability of Touch: 23.56% (call side) – 28.52% (put side)

Total net credit: $0.79

Total risk per spread: $421

Max return: 18.8%

Risk Management

Since we know how much we stand to make and lose prior to order entry we can precisely define our position size on every trade we place. Position size is the most important factor when managing risk, so keeping each trade at a reasonable level (I use 1% to 5% per trade, smaller accounts tend to use a higher percentage, closer to 10%) allows not only the Law of Large Numbers to work in your favor … it also allows you to sleep well at night.

I tend to set a stop-loss that sits 1 to 2 times my original credit. Since I’m selling the 196/191 – 156/151 iron condor for roughly $0.79, if my iron condor reaches approximately $1.58 to $2.37, I will exit the trade. As always, I will keep you updated on the status of the position as it progresses and send any necessary updates.