Cabot Options Institute Quant Trader – Alert (SPY)

SPDR S&P 500 ETF (SPY)

With all of our short-term overbought measures in extreme territory I want to add a bear call spread to the mix for the August expiration cycle. While I look at overbought extremes as simply weight of evidence, it’s hard to pass up a trade when we are seeing overbought extremes coupled with several other market indicators that are screaming a short-term extreme is here.

Yes, I know we already have some bearish exposure in the QQQs, but we will quickly get out of our 375/380 bear calls if the QQQs continue to ramp. Given the short-term extremes my stop-loss in our QQQ bear call spread sits at $2.30 (getting very close).

Again, we’ve already seen an extended move in all of the major indices and with so many short-term extremes hitting the market we can’t ignore our approach of selling high-probability vertical spreads, especially when the ETFs we follow hit extremes like what we are seeing at the moment. Does this mean a guaranteed winner? Of course not. But we certainly shouldn’t ignore the potential opportunity.

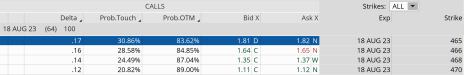

So, with SPY trading for 442.50, I want to place a short-term bear call spread going out 64 days and outside of the expected range to the upside, or 461. My intent is to take off the trade well before the August 18, 2023, expiration date.

IV: 15.84%

IV Rank: 3.3

Expected Move (Range): The expected move (range) for the August 18, 2023, expiration cycle is from 425 to 461.

Call Side:

The Trade

Simultaneously:

Sell to Open SPY August 18, 2023, 465 call strike

Buy to Open SPY August 18, 2023, 470 call strike for a total of $0.70 (As always, the price of the spread will vary, so please adjust accordingly.)

Delta of spread: -0.05

Probability of Profit: 83.62%

Probability of Touch: 30.86%

Total net credit: $0.70

Total risk per spread: $4.30

Max return: 16.3%

Risk Management

Since we know how much we stand to make and lose prior to order entry, we can precisely define our position size on every trade we place. Position size is the most important factor when managing risk, so keeping each trade at a reasonable level allows not only the Law of Large Numbers to work in your favor … it also allows you to sleep well at night.

I tend to set a stop-loss that sits 1 to 2 times my original credit. Since I’m selling the 465/470 bear call for roughly $0.70, if my bear call reaches approximately $1.40 to $2.10, I will exit the trade. As always, I will keep you updated on the status of the position as it progresses and send any necessary updates.