On Wednesday we placed our first trade, a bear call spread in SPY at the 440/445 call strikes. My goal is to place at least two more trades, if not more, next week as we begin to build out the portfolio to hopefully five to eight positions. Of course, we’re not going to force trades. As always, we will patiently wait until a trade makes sense. That being said, with implied volatility remaining high across the board, we shouldn’t have any issues finding some underlying stocks and ETFs to wrap a few high-probability strategies around.

Cabot Options Institute – Quant Trader Issue: June 3, 2022

On Wednesday we placed our first trade, a bear call spread in SPY at the 440/445 call strikes. My goal is to place at least two more trades, if not more, next week as we begin to build out the portfolio to hopefully five to eight positions. Of course, we’re not going to force trades. As always, we will patiently wait until a trade makes sense. That being said, with implied volatility remaining high across the board, we shouldn’t have any issues finding some underlying stocks and ETFs to wrap a few high-probability strategies around.

Speaking of volatility, the VIX has come in 30% since hitting the mid-30s in mid-May. The investor’s fear gauge is currently trading at 24.72. But as long as the volatility index stays above 18, we can continue to sell premium without much thought.

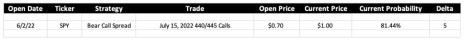

Current Positions

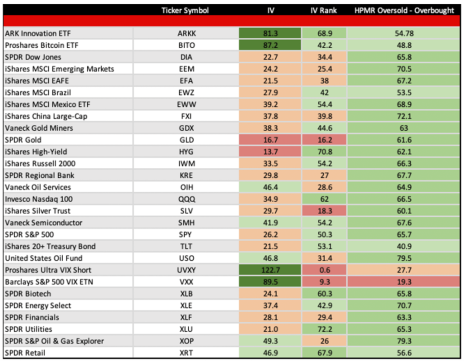

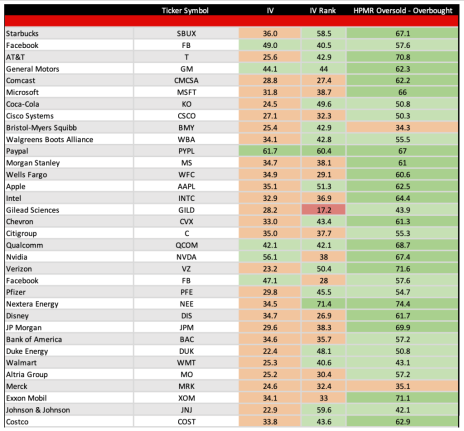

Weekly High Probability Mean Reversion Indicator

Below is my watch list of ETFs and stocks with the most liquid options for the week of June 6, 2022.

Here are the various levels I use to determine if an ETF is in an oversold or overbought state.

- Very Overbought – a reading greater than or equal to 80.0

- Overbought – greater than or equal to 60.0

- Neutral – between 40 to 60

- Oversold – less than or equal to 40.0

- Very Oversold – less than or equal to 20.0

I also include the current implied volatility (IV) and IV Rank. I look for an IV rank above 40, preferably higher.

ETF Watch List

Stock Watch List

Weekly Trade Discussion: Open Positions

Bear Call Spread: SPY July 15, 2022 440/445 calls

Original trade published on 6-2-2022 (click to see original alert)

Current Comments: At the time of the trade SPY was trading for 410.57. We sold the July 15, 2022 440/445 bear call spread for $0.70 with an 86.56% probability of success. At the time the high side of the expected move was 436.

SPY is now trading for 417.39. As you can see in the image below our probability of success is 81.44% and our probability of touch is 26.10%. The spread is currently trading for roughly $1.00.

As it stands, our trade is in good shape. But it’s early in the trade…real early. If the market continues to trend higher and the delta of our 440 call strike (which is currently 0.20) hits 0.30 to 0.35, I will look to potentially make an adjustment. And if we see a decent pullback and we can take $0.35 out of the trade, if not more, I’ll gladly take some profits and move on to the next opportunity.

Until then we patiently sit back and wait for time decay, otherwise known as theta decay, to work its magic.

Call Side

Next Live Analyst Briefing with Q&A

Our first live analyst briefing with Q&A is scheduled for June 15, 2022 at 1 p.m. ET. I will be discussing the options market, giving a detailed look at open positions, strategies used, and a follow up with live questions and answers. But, I also want to take some time to go through the ins and outs of the service and what to expect going forward, so I’ll probably go a little longer than usual, possibly upwards of 45 minutes to an hour, potentially longer if we have lots of questions…and I hope we do. Register here.

The next Cabot Options Institute – Quant Trader issue will be published on June 10, 2022.

About the Analyst

Andy Crowder

Andy Crowder is a professional options trader, researcher and Chief Analyst of Cabot Options Institute. Formerly with Oppenheimer & Co. in New York, Andy has leveraged his investment experience to develop his statistically based options trading strategy which applies probability theory to option valuations in order to execute risk-controlled trades. This proprietary strategy has been refined through two decades of research and real-world experience and has been featured in the Wall Street Journal, Seeking Alpha, and numerous other financial publications. Andy has helped thousands of option traders learn and implement his meticulous rules-driven options trading strategies through highly attended conferences, one-on-one coaching, webinars, and his work as a financial columnist. He currently resides in Bolton Valley, Vermont and when he’s not trading, teaching and writing about options, he enjoys spending time with his wife and two daughters, backcountry skiing, biking, running and enjoying all things outdoors.