Weekly Commentary

Given our recent string of losses I thought it would be appropriate to discuss sequencing risk and how important it is to understand how it impacts a high-probability strategy. Sequencing risk is a major component in the world of statistically based, high-probability options strategies – which is why I always emphasize why position size is so important.

Position size allows us to calculate how many consecutive losses would need to occur to lose a specific amount of capital in our overall trading account. Sequence of returns is the inherent risk that a trader could experience several losses in a row. Knowing that the sequence of returns is a math-based reality, our chosen position size helps to lessen the impact of a string of potential losing trades.

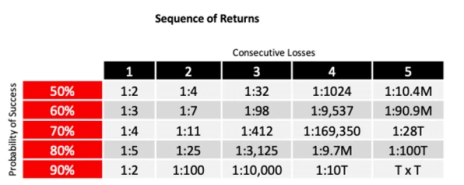

The following table demonstrates the statistics of experiencing consecutive losses based on your chosen probability of success at the time of entering a trade. As you will quickly notice, as the probability of success increases, the likelihood of consecutive losses diminishes exponentially.

So, for example, if I were to consistently use a risk-defined options strategy like an iron condor with a delta of 0.20 or a probability of success of 80%, there is a 4% chance of losing two trades in a row and 0.03% chance of losing five trades in a row. So, knowing this info, we have the ability to plan accordingly by choosing a realistic position size based on the probability of success of our trade.

I can’t emphasize enough just how important position size is when trading, especially when using a high-probability approach. We ALL should think of ourselves as risk managers first and traders second. If you are able to follow this mindset, you will have a much better chance of being successful over the long term.

Remember, statistically based trading is simply a game of math. We are trading high-probability strategies here, so we know we have an advantage over the long term, but we must have a sound understanding of how to manage sequence risk accordingly. Position size is probably the most important factor, so don’t ignore it.

I realize the prior exercise is fairly simplistic. Again, it only begins the important discussion of risk management. Without some form of risk management, emotions take over.

And emotions are the enemy. Hindsight never exists in the present. We must realize that we will be wrong on occasion.

Being privy to this allows us to prepare accordingly. We know over the long term that having a defined stop-loss will only serve to benefit the performance of our respective portfolios. More importantly, we always know when to sell. Of course, all of the above assumes that we prefer the straight percentage stop-loss.

If you want to be a successful trader/investor over the long term, then taking the time to figure out an appropriate position-sizing plan is imperative. Please, please, please do not overlook this important concept.

You will not regret it.

As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

Current Portfolio

| Open Date | Ticker | Strategy | Trade | Open Price | Current Price | Current Probability | Delta |

| 12/1/2023 | SPY | Bear Call | January 19, 2024 475/480 | $0.75 | $0.89 | 79.63% | -0.07 |

| Open Date | Closed Date | Ticker | Strategy | Trade | Open Price | Closing Price | Return |

| 6/2/2022 | 6/13/2022 | SPY | Bear Call Spread | July 15, 2022 440/445 | $0.70 | $0.05 | 14.94% |

| 6/8/2022 | 6/17/2022 | XOP | Bear Call Spread | July 15, 2022 190/195 | $0.70 | $0.04 | 15.21% |

| 6/22/2022 | 7/13/2022 | SPY | Bear Call Spread | July 29, 2022 405/410 | $0.75 | $0.35 | 8.70% |

| 6/30/2022 | 7/25/2022 | IWM | Iron Condor | August 19, 2022 195/200 - 145/140 | $0.70 | $0.34 | 7.76% |

| 7/8/2022 | 7/28/2022 | GLD | Bull Put Spread | August 19, 2022 155/150 | $0.60 | $0.16 | 9.65% |

| 7/14/2022 | 8/11/2022 | SPY | Iron Condor | August 19, 2022 417/412 - 335/330 | $0.70 | $4.10 | -68.00% |

| 8/1/2022 | 8/29/2022 | SPY | Bear Call Spread | September 16, 2022 439/444 | $0.70 | $0.07 | 14.42% |

| 8/11/2022 | 8/29/2022 | DIA | Bear Call Spread | September 23, 2022 350/325 | $0.75 | $0.08 | 15.47% |

| 8/11/2022 | 9/8/2022 | IWM | Iron Condor | September 23, 2022 220/215 - 173/168 | $0.77 | $0.57 | 4.17% |

| 9/7/2022 | 9/9/2022 | QQQ | Bull Put Spread | October 21, 2022 260/255 | $0.62 | $0.30 | 6.84% |

| 9/9/2022 | 9/15/2022 | SPY | Bear Call Spread | October 21, 2022 430/435 | $0.75 | $0.25 | 11.11% |

| 9/13/2022 | 10/17/2022 | IWM | Iron Condor | October 21, 2022 208/203 - 163/158 | $0.77 | $0.30 | 10.40% |

| 10/3/2022 | 10/25/2022 | SPY | Bull Put Spread | November 18, 2022 325/320 | $0.54 | $0.09 | 9.89% |

| 10/4/2022 | 11/2/2022 | IWM | Iron Condor | November 18, 2022 198/203 - 143/138 | $0.64 | $0.32 | 6.84% |

| 10/6/2022 | 11/2/2022 | SPY | Bear Call Spread | November 18, 2022 412/416 | $0.43 | $0.28 | 3.90% |

| 11/16/2022 | 11/28/2022 | IWM | Iron Condor | December 16, 2022 205/200 - 162/157 | $0.75 | $0.24 | 11.36% |

| 11/10/2022 | 12/6/2022 | SPY | Bear Call Spread | December 16, 2022 420/425 | $0.65 | $0.14 | 11.36% |

| 12/1/2022 | 12/6/2022 | SPY | Bear Call Spread | January 20, 2023 435/440 | $0.67 | $0.18 | 10.86% |

| 12/13/2022 | 12/15/2022 | SPY | Bear Call Spread | January 20, 2023 430/435 | $0.54 | $0.17 | 7.99% |

| 12/7/2023 | 1/6/2023 | IWM | Iron Condor | January 20, 2023 202/198 - 160/156 | $0.70 | $0.06 | 19.00% |

| 1/4/2023 | 2/1/2023 | IWM | Iron Condor | February 17, 2023 200/195 - 154/149 | $0.65 | $2.00 | -27.00% |

| 1/6/2023 | 2/2/2023 | SPY | Bear Call Spread | February 17, 2023 415/420 | $0.60 | $2.50 | -38.00% |

| 2/2/2023 | 2/15/2023 | SPY | Bear Call Spread | March 17, 2023 440/445 | $0.63 | $0.15 | 10.62% |

| 2/10/2023 | 2/22/2023 | DIA | Bear Call Spread | March 31, 2023 355/360 | $0.70 | $0.17 | 11.86% |

| 2/2/2023 | 3/1/2023 | IWM | Iron Condor | March 17, 2023 175/180 - 215/220 | $0.72 | $0.51 | 4.38% |

| 3/6/2023 | 3/13/2023 | DIA | Bear Call Spread | April 21, 2023 350/355 | $0.85 | $0.17 | 15.74% |

| 2/23/2023 | 3/28/2023 | SPY | Iron Condor | April 21, 2023 435/430 - 350/345 | $0.80 | $0.15 | 14.94% |

| 3/23/2023 | 4/11/2023 | DIA | Bear Call Spread | April 21, 2023 338/443 | $0.62 | $2.05 | -28.60% |

| 3/23/2023 | 4/19/2023 | IWM | Iron Condor | May 19, 2023 196/191 - 147/142 | $0.83 | $0.23 | 13.64% |

| 4/12/2023 | 4/21/2023 | DIA | Bear Call Spread | May 19, 2023 350/355 | $0.82 | $0.44 | 8.23% |

| 4/21/2023 | 5/2/2023 | SPY | Iron Condor | June 16, 2023 440/435 - 365/360 | $0.95 | $0.63 | 6.84% |

| 4/24/2023 | 5/10/2023 | DIA | Bear Call Spread | June 16, 2023 354/359 | $0.72 | $0.22 | 11.11% |

| 5/5/2023 | 5/24/023 | SPY | Bear Call Spread | June 16, 2023 430/435 | $0.72 | $0.35 | 7.99% |

| 6/15/2023 | 6/22/2023 | SPY | Bear Call Spread | August 18, 2023 465/470 | $0.70 | $0.24 | 10.13% |

| 5/26/2023 | 6/23/2023 | IWM | Iron Condor | July 21, 2023 191/196 - 156/151 | $0.79 | $0.50 | 6.15% |

| 5/31/2023 | 7/12/2023 | QQQ | Bear Call Spread | July 21, 2023 375/380 | $0.60 | $1.80 | -31.60% |

| 6/30/2023 | 8/7/2023 | SPY | Bear Call Spread | August 18, 2023 462/466 | $0.52 | $0.23 | 7.82% |

| 8/4/2023 | 8/11/2023 | SPY | Bear Call Spread | September 15, 2023 470/475 | $0.65 | $0.20 | 9.90% |

| 8/17/2023 | 9/13/2023 | SPY | Iron Condor | October 20, 2023 475/470 - 390/385 | $0.72 | $0.25 | 10.38% |

| 9/6/2023 | 10/11/2023 | IWM | Iron Condor | October 20, 2023 204/199 - 169/164 | $0.62 | $0.19 | 9.41% |

| * 9/29/2023 | 10/27/2023 | SPY | Bear Call Spread | November 17, 2023 452/457 | $0.74 | $0.03 | 16.60% |

| *10/6/2023 | 11/3/2023 | SPY | Bull Put Spread | November 17, 2023 408/403 | $0.58 | $0.03 | 12.36% |

| * 10/27/2023 | 11/3/2023 | SPY | Bear Call Spread | November 17, 2023 430/435 | $0.58 | $3.50 | -33.20% |

| 10/31/2023 | 11/14/2023 | SPY | Iron Condor | December 15, 2023 450/445 - 380/375 | $0.77 | $3.00 | -44.60% |

| 11/6/2023 | 12/8/2023 | SPY | Bear Call Spread | December 15, 2023 456/461 | $0.58 | $3.08 | -50.00% |

Volatility Talk

Volatility continues to wallow around lows not seen since late 2019. Of course, we could see volatility push even lower going forward, but we are getting ever closer to what have been strong levels of support in the investor’s fear gauge over the past two decades. If complacency continues, bull spreads will prevail and if the bears return, well, bear calls will once again lead the way. We hope that the market settles down here with some “normal” returns going forward so we have the ability to profit from both sides. But volatility is low so premiums in many of the stalwart index funds are hard to come by at the moment. So, we must remain patient on that end, but we still have numerous highly liquid stocks with some surprisingly nice levels of premium to sell. Moreover, as I spoke about last week, with volatility so low, a volatility play is certainly a priority.

Weekly High-Probability Mean Reversion Indicator

Below is my watch list of ETFs and stocks with the most liquid options headed into the week of December 11, 2023.

Here are the various levels I use to determine if an ETF is in an oversold or overbought state.

| Very Overbought | a reading greater than or equal to 80.0 |

| Overbought | greater than or equal to 60.0 |

| Neutral | between 40 to 60 |

| Oversold | less than or equal to 40.0 |

| Very Oversold | less than or equal to 20.0. |

Each week I also include the current implied volatility (IV) and IV Rank. I look for an IV rank above 40, preferably higher.

ETF Watch List – Trade Ideas

| Exchange Traded Fund | Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought |

| ARK Innovation ETF | ARKK | 37.7 | 18.3 | 77.5 |

| ProShares Bitcoin ETF | BITO | 66.2 | 41.6 | 78.1 |

| SPDR Dow Jones | DIA | 11.2 | 6.6 | 81.5 |

| iShares MSCI Emerging Markets | EEM | 18.0 | 16 | 42 |

| iShares MSCI EAFE | EFA | 14.6 | 12.3 | 70.7 |

| iShares MSCI Mexico ETF | EWW | 21.2 | 20 | 67.5 |

| iShares MSCI Brazil | EWZ | 33.2 | 20.4 | 56.2 |

| iShares China Large-Cap | FXI | 29.1 | 13.6 | 19 |

| VanEck Gold Miners | GDX | 31.0 | 33.2 | 40 |

| SPDR Gold | GLD | 13.7 | 27.9 | 42.4 |

| iShares High-Yield | HYG | 6.8 | 13.7 | 66.1 |

| iShares Russell 2000 | IWM | 20.6 | 25.6 | 72.9 |

| SPDR Regional Bank | KRE | 30.3 | 18 | 82 |

| VanEck Oil Services | OIH | 29.6 | 14.5 | 30 |

| Invesco Nasdaq 100 | QQQ | 16.3 | 3.2 | 67.2 |

| iShares Silver Trust | SLV | 26.0 | 22.1 | 27.9 |

| VanEck Semiconductor | SMH | 22.9 | 10.4 | 63.4 |

| SPDR S&P 500 | SPY | 12.6 | 4.7 | 72.9 |

| iShares 20+ Treasury Bond | TLT | 18.1 | 33.7 | 64.3 |

| United States Oil Fund | USO | 35.9 | 41.7 | 36.7 |

| ProShares Ultra VIX Short | UVXY | 85.5 | 0.3 | 20.4 |

| CBOE Market Volatility Index | VIX | 80.6 | 44.7 | 31 |

| Barclays S&P 500 VIX ETN | VXX | 59.8 | 3.7 | 19.2 |

| SPDR Biotech | XLB | 14.0 | 9 | 59.7 |

| SPDR Energy Select | XLE | 22.5 | 11.6 | 35.8 |

| SPDR Financials | XLF | 14.1 | 0.1 | 73.7 |

| SPDR Utilities | XLU | 17.3 | 27.1 | 61.1 |

| SPDR S&P Oil & Gas Explorer | XOP | 27.5 | 13.5 | 32.1 |

| SPDR Retail | XRT | 25.2 | 37.2 | 68.4 |

Stock Watch List – Trade Ideas

| Stock - Quant Trader | Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought |

| Apple | AAPL | 18.1 | 0.3 | 73.8 |

| Bank of America | BAC | 24.6 | 10.3 | 74.1 |

| Bristol-Myers Squibb | BMY | 23.3 | 58.7 | 56.4 |

| Citigroup | C | 26.3 | 10.3 | 83.3 |

| Caterpillar | CAT | 22.7 | 8.5 | 76.6 |

| Comcast | CMCSA | 22.6 | 14.5 | 49.8 |

| Costco | COST | 19.8 | 32.4 | 79.5 |

| Cisco Systems | CSCO | 16.1 | 5.9 | 46.8 |

| Chevron | CVX | 22.0 | 19.1 | 52.5 |

| Disney | DIS | 23.2 | 10.4 | 56.1 |

| Duke Energy | DUK | 14.7 | 0.5 | 81.1 |

| FedEx | FDX | 31.3 | 40.8 | 87.6 |

| Gilead Sciences | GILD | 26.9 | 14.1 | 65 |

| General Motors | GM | 29.4 | 7.4 | 84.5 |

| Intel | INTC | 32.6 | 12.2 | 51.7 |

| Johnson & Johnson | JNJ | 16.6 | 23.9 | 49.2 |

| JPMorgan | JPM | 17.2 | 3.1 | 77.5 |

| Coca-Cola | KO | 12.8 | 7.8 | 63.6 |

| Altria Group | MO | 17.0 | 17.7 | 41.1 |

| Merck | MRK | 17.9 | 1.9 | 52 |

| Morgan Stanley | MS | 21.4 | 5.4 | 70.5 |

| Microsoft | MSFT | 19.9 | 0.1 | 54.1 |

| NextEra Energy | NEE | 24.7 | 29.5 | 64.1 |

| Nvidia | NVDA | 33.1 | 0.1 | 54.3 |

| Pfizer | PFE | 24.4 | 34.9 | 35.7 |

| PayPal | PYPL | 34.4 | 20.1 | 56.9 |

| Starbucks | SBUX | 19.6 | 17.3 | 30.1 |

| AT&T | T | 20.2 | 10.3 | 63.7 |

| Verizon | VZ | 18.5 | 10.2 | 61.7 |

| Walgreens Boots Alliance | WBA | 54.9 | 90.8 | 79.9 |

| Wells Fargo | WFC | 23 | 2.6 | 82.6 |

| Walmart | WMT | 17.3 | 24.9 | 24.9 |

| Exxon Mobil | XOM | 23.4 | 16.2 | 31.2 |

Weekly Trade Discussion: Open Positions

*Portfolio updated every Monday

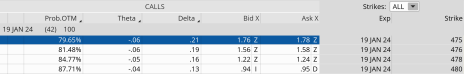

Bear Call Spread: SPY January 19, 2024, 475/480

Original trade published on 12-1-2023 (click to see original alert)

Background: At the time of the trade, SPY was trading for roughly 458.50. We sold the January 19, 2024, SPY 475/480 bear call spread for $0.75. The expected range or move was 442 to 472. The probability of success at the time of the trade was 82.51% on the call side.

Current Thoughts: SPY continues to push further and further into short-term oversold territory. And this should be no surprise given SPY’s historic November, which has bled into December. Our probability still stands at a healthy 79.65% and the price of our spread sits at $0.83, slightly above where we sold the spread. Obviously a push of any sort and we will be in profitable territory and it sure would be nice to lock in a decent profit after a challenging six weeks of market action.

Call Side:

As always, if you have any questions, please feel free to email me at andy@cabotwealth.com.

The next Cabot Options Institute – Quant Trader issue will be

published on December 18, 2023.