The market continues to suffer mightily. And while most portfolios across the investment universe have followed suit, our Quant Trader portfolio continues to display why it’s a necessity to have exposure to options selling strategies.

Our win ratio stands at 90.9% and our cumulative return stands at over 40%.

We still have one open position for the October expiration cycle, our IWM iron condor, and if the Russell 2000 (IWM) can manage to climb higher this week we should have the opportunity to tack on even more gains. Moreover, there are 47 days left in the November expiration cycle, so I intend to open a few positions for some exposure, but I want to maintain a conservative stance.

Cabot Options Institute – Quant Trader Issue: October 3, 2022

The market continues to suffer mightily. And while most portfolios across the investment universe have followed suit, our Quant Trader portfolio continues to display why it’s a necessity to have exposure to options selling strategies.

Our win ratio stands at 90.9% and our cumulative return stands at over 40%.

We still have one open position for the October expiration cycle, our IWM iron condor, and if the Russell 2000 (IWM) can manage to climb higher this week we should have the opportunity to tack on even more gains. Moreover, there are 47 days left in the November expiration cycle, so I intend to open a few positions for some exposure, but I want to maintain a conservative stance. As with each expiration cycle, my goal, at a minimum, is to have at least a bull put spread, bear call spread and iron condor using the major market ETFs. Hopefully, the market will cooperate over this week so we can get a few trades off and collect some decent premium while implied volatility is high, if not, no worries, because as I have stated repeatedly, I will never force a trade.

Current Portfolio

| Open Trades | |||||||

| Open Date | Ticker | Strategy | Trade | Open Price | Current Price | Current Probability | Delta |

| 9/13/2022 | IWM | Iron Condor | October 21, 2022 208/203 - 163/158 | $0.77 | $1.66 | 99.24% - 53.42% | 13 |

| Closed Trades | |||||||

| Open Date | Closed Date | Ticker | Strategy | Trade | Open Price | Closing Price | Return |

| 6/2/2022 | 6/13/2022 | SPY | Bear Call Spread | July 15, 2022 440/445 | $0.70 | $0.05 | 14.94% |

| 6/8/2022 | 6/17/2022 | XOP | Bear Call Spread | July 15, 2022 190/195 | $0.70 | $0.04 | 15.21% |

| 6/22/2022 | 7/13/2022 | SPY | Bear Call Spread | July 29, 2022 405/410 | $0.75 | $0.35 | 8.70% |

| 6/30/2022 | 7/25/2022 | IWM | Iron Condor | August 19, 2022 195/200 - 145/140 | $0.70 | $0.34 | 7.76% |

| 7/8/2022 | 7/28/2022 | GLD | Bull Put Spread | August 19, 2022 155/150 | $0.60 | $0.16 | 9.65% |

| 7/14/2022 | 8/11/2022 | SPY | Iron Condor | August 19, 2022 417/412 - 335/330 | $0.70 | $4.10 | -68.00% |

| 8/1/2022 | 8/29/2022 | SPY | Bear Call Spread | September 16, 2022 439/444 | $0.70 | $0.07 | 14.42% |

| 8/11/2022 | 8/29/2022 | DIA | Bear Call Spread | September 23, 2022 350/325 | $0.75 | $0.08 | 15.47% |

| 8/11/2022 | 9/8/2022 | IWM | Iron Condor | September 23, 2022 220/215 - 173/168 | $0.77 | $0.57 | 4.17% |

| 9/7/2022 | 9/9/2022 | QQQ | Bull Put Spread | October 21, 2022 260/255 | $0.62 | $0.30 | 6.84% |

| 9/9/2022 | 9/15/2022 | SPY | Bear Call Spread | October 21, 2022 430/435 | $0.75 | $0.25 | 11.11% |

Volatility Talk

The investor’s fear gauge, otherwise known as the VIX, hit strong overhead resistance last week while simultaneously hitting a short-term overbought state. Typically, this type of situation leads to a reversion to the mean, especially in the few, reliable volatility products like the VIX.

The VIX hit 35 before pulling back towards the latter part of the week, even as the S&P 500 continued to plummet, another sign that sellers have exhausted themselves over the short term. Which is why this week is pivotal for not only the VIX, but the market overall. If the VIX manages to push above 38 and hold, we could be in for a significant push lower over the next few weeks, potentially leading to a capitulation scenario as we head towards the middle of October. If not, and the VIX reverts to the mean, well, the bulls might see, at least, a short-term reprieve over the next week or two. As always, only time will tell.

Weekly High-Probability Mean Reversion Indicator

Below is my watch list of ETFs and stocks with the most liquid options headed into the week of October 2, 2022.

Here are the various levels I use to determine if an ETF is in an oversold or overbought state.

| Very Overbought | greater than or equal to 80.1 |

| Overbought | 60.1 to 80.0 |

| Neutral | 40.1 to 60 |

| Oversold | 20.1 to 40.0 |

| Very Oversold | less than or equal to 20.0 |

Each week I also include the current implied volatility (IV) and IV Rank. I look for an IV rank above 40, preferably higher.

ETF Watch List – Trade Ideas

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| ARK Innovation ETF | ARKK | 68.6 | 62.9 | 35.2 |

| ProShares Bitcoin ETF | BITO | 85.5 | 27.4 | 49.6 |

| SPDR Dow Jones | DIA | 26.4 | 67.9 | 22.7 |

| iShares MSCI Emerging Markets | EEM | 32.7 | 52.2 | 17.1 |

| iShares MSCI EAFE | EFA | 33.6 | 64.1 | 27.8 |

| iShares MSCI Mexico ETF | EWW | 35.1 | 60 | 36.5 |

| iShares MSCI Brazil | EWZ | 62.6 | 94.4 | 42.9 |

| iShares China Large-Cap | FXI | 50.4 | 40.6 | 21.2 |

| VanEck Gold Miners | GDX | 56.5 | 68.8 | 58.6 |

| SPDR Gold | GLD | 19.3 | 28.8 | 46.9 |

| iShares High-Yield | HYG | 26.8 | 65 | 31 |

| iShares Russell 2000 | IWM | 36.4 | 79.1 | 29.8 |

| SPDR Regional Bank | KRE | 34.9 | 39.6 | 28.2 |

| VanEck Oil Services | OIH | 61 | 63.8 | 38.3 |

| Invesco Nasdaq 100 | QQQ | 36 | 80.1 | 2.9 |

| iShares Silver Trust | SLV | 36.3 | 45 | 50.9 |

| VanEck Semiconductor | SMH | 44.9 | 73 | 21.7 |

| SPDR S&P 500 | SPY | 30.3 | 78.2 | 23.1 |

| iShares 20+ Treasury Bond | TLT | 30 | 85.8 | 35.1 |

| United States Oil Fund | USO | 55.2 | 50.2 | 37.3 |

| ProShares Ultra VIX Short | UVXY | 123.3 | 23.5 | 72.4 |

| CBOE Market Volatility Index | VIX | 109.4 | 30.5 | 65.4 |

| Barclays S&P 500 VIX ETN | VXX | 85.6 | 29.6 | 67.9 |

| SPDR Biotech | XLB | 36.1 | 86.5 | 29.9 |

| SPDR Energy Select | XLE | 46.4 | 79.7 | 37.7 |

| SPDR Financials | XLF | 32.3 | 55.8 | 24.9 |

| SPDR Utilities | XLU | 28.8 | 101.6 | 13.6 |

| SPDR S&P Oil & Gas Explorer | XOP | 58.9 | 53.2 | 41.6 |

| SPDR Retail | XRT | 46 | 75.8 | 28.5 |

Stock Watch List – Trade Ideas

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| Apple | AAPL | 47.7 | 92.8 | 18.4 |

| Bank of America | BAC | 45.5 | 70.5 | 22.5 |

| Bristol-Myers Squibb | BMY | 31.2 | 56.5 | 52.3 |

| Citigroup | C | 48.6 | 80.3 | 16.5 |

| Caterpillar | CAT | 47.7 | 88.6 | 30.2 |

| Comcast | CMCSA | 48.1 | 80.1 | 21.4 |

| Costco | COST | 35.6 | 48.6 | 31.8 |

| Cisco Systems | CSCO | 35.3 | 51.3 | 22.9 |

| Chevron | CVX | 42.4 | 81.5 | 31.3 |

| Disney | DIS | 43.2 | 48.7 | 22.9 |

| Duke Energy | DUK | 33.6 | 97.4 | 14.7 |

| Fedex | FDX | 45.1 | 57.2 | 27.7 |

| Gilead Sciences | GILD | 49.4 | 52.8 | 33.1 |

| General Motors | GM | 56.9 | 79.2 | 16.6 |

| Intel | INTC | 55.1 | 84.9 | 13.6 |

| Johnson & Johnson | JNJ | 30.4 | 67.8 | 40.3 |

| JP Morgan | JPM | 43.1 | 76.8 | 23.7 |

| Coca-Cola | KO | 30.9 | 72.1 | 18.3 |

| Altria Group | MO | 33.7 | 70.4 | 25.3 |

| Merck | MRK | 30.2 | 29.5 | 45.2 |

| Morgan Stanley | MS | 46.5 | 71.2 | 26.8 |

| Microsoft | MSFT | 42.2 | 62.9 | 25.7 |

| NextEra Energy | NEE | 40.4 | 82.2 | 21.8 |

| Nvidia | NVDA | 63.9 | 57.4 | 29.7 |

| Pfizer | PFE | 34.4 | 47.6 | 31.9 |

| PayPal | PYPL | 60.8 | 55.7 | 37.5 |

| Starbucks | SBUX | 42.7 | 84.5 | 37.3 |

| AT&T | T | 38.1 | 91.2 | 15.4 |

| Verizon | VZ | 34.6 | 90.8 | 21.8 |

| Walgreens Boots Alliance | WBA | 46.6 | 95.3 | 20.8 |

| Wells Fargo | WFC | 45.7 | 58.4 | 29.2 |

| Walmart | WMT | 29.8 | 67.6 | 34.8 |

| Exxon Mobil | XOM | 44.6 | 75.8 | 38.2 |

Weekly Trade Discussion: Open Positions

*Portfolio updated every Monday

Iron Condor: IWM October 21, 2022, 203/208 calls – 163/158 puts

Original trade published on 9-13-2022 (click to see original alert)

Background: At the time of the trade, IWM was trading for 183.51. We sold the October 21, 2022, IWM 203/208 – 163/158 iron condor for $0.77 with a 90.93% (upside) and 85.20% (downside) probability of success. The expected range was 171 to 196.

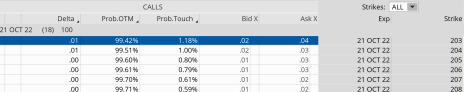

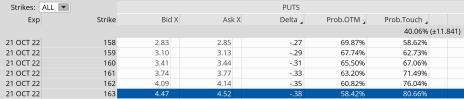

Current Thoughts: IWM is currently trading for 164.92 and our iron condor is worth $1.67. Our probability of success stands at 99.42% on the call side and 58.32% on the put side.

With 18 days left and IWM testing our short put strike of 163, there is still a good chance we will hit the stop-loss that I established with my alert that went out just over a week ago. Our iron condor currently stands at $1.67, but a continuation of the current trend lower will certainly trigger my mental stop-loss of $2.00 and convince me to take off the trade for a small loss.

As I stated in the stop-loss alert and again in the intro of today’s issue, we have managed to outperform all indices by a nice margin, and I want to keep it that way by not allowing losses to get out of hand. Remember, losses will occur; it’s how we manage them over the long term that separates success from failure. It’s that simple. We’re never going to take 100% losses, and, in most cases, we will never even get close to that percentage.

Call Side:

Put Side:

The next Cabot Options Institute – Quant Trader issue will be published on October 10, 2022.