Nothing new here. The song remains the same; the market continues to suffer. But, as I stated last week, while most portfolios across the investment universe have taken a turn for the worse, our Quant Trader portfolio continues to demonstrate why it’s a necessity to have exposure to options selling strategies.

Our win ratio stands at 90.9% and our cumulative return stands at over 40%.

We now have one open position for the October expiration cycle, our IWM iron condor, and three new positions due to expire November 18, 2022. Of course, I have no intent of holding on for that long and will gladly take profits early if possible.

Our IWM position due to expire in two weeks is currently the focus. In hindsight, after all we’ve been through with this iron condor I should have taken off the trade last week for a small profit. The position still has over a 66% probability of success, but our margin of error or cushion to the downside has dwindled down to just 3.4% and our probability of touch now stands at 80%. I discuss my thoughts on the trade in greater detail in the Weekly Trade Discussion section below.

Current Portfolio

| Open Trades | |||||||

| Open Date | Ticker | Strategy | Trade | Open Price | Current Price | Current Probability | Delta |

| 9/13/2022 | IWM | Iron Condor | October 21, 2022 208/203 - 163/158 | $0.77 | $1.16 | 99.66% - 66.77% | 13 |

| 10/3/2022 | SPY | Bull Put | November 18, 2022 325/320 | $0.54 | $0.57 | 81.58% | 3 |

| 10/4/2022 | IWM | Iron Condor | November 18, 2022 198/203 - 143/138 | $0.64 | $0.55 | 95.67% - 86.57% | 0 |

| 10/6/2022 | SPY | Bear Call | November 18, 2022 412/416 | $0.43 | $0.19 | 95.01% | -1 |

| Closed Trades | |||||||

| Open Date | Closed Date | Ticker | Strategy | Trade | Open Price | Closing Price | Return |

| 6/2/2022 | 6/13/2022 | SPY | Bear Call Spread | July 15, 2022 440/445 | $0.70 | $0.05 | 14.94% |

| 6/8/2022 | 6/17/2022 | XOP | Bear Call Spread | July 15, 2022 190/195 | $0.70 | $0.04 | 15.21% |

| 6/22/2022 | 7/13/2022 | SPY | Bear Call Spread | July 29, 2022 405/410 | $0.75 | $0.35 | 8.70% |

| 6/30/2022 | 7/25/2022 | IWM | Iron Condor | August 19, 2022 195/200 - 145/140 | $0.70 | $0.34 | 7.76% |

| 7/8/2022 | 7/28/2022 | GLD | Bull Put Spread | August 19, 2022 155/150 | $0.60 | $0.16 | 9.65% |

| 7/14/2022 | 8/11/2022 | SPY | Iron Condor | August 19, 2022 417/412 - 335/330 | $0.70 | $4.10 | -68.00% |

| 8/1/2022 | 8/29/2022 | SPY | Bear Call Spread | September 16, 2022 439/444 | $0.70 | $0.07 | 14.42% |

| 8/11/2022 | 8/29/2022 | DIA | Bear Call Spread | September 23, 2022 350/325 | $0.75 | $0.08 | 15.47% |

| 8/11/2022 | 9/8/2022 | IWM | Iron Condor | September 23, 2022 220/215 - 173/168 | $0.77 | $0.57 | 4.17% |

| 9/7/2022 | 9/9/2022 | QQQ | Bull Put Spread | October 21, 2022 260/255 | $0.62 | $0.30 | 6.84% |

| 9/9/2022 | 9/15/2022 | SPY | Bear Call Spread | October 21, 2022 430/435 | $0.75 | $0.25 | 11.11% |

Volatility Talk

The VIX continues to trade in a range between 34 and 28. Early in the week it looked there was a good chance the VIX would break below the 28 area, but the bears stepped in and brought a sense of reality back to the fray. I wouldn’t be surprised if we test the near-term highs again at around the 35 level, which means we should expect a little more pain over the short term. Of course, if the VIX manages to pull back and pierce the 28 level, a nice fourth quarter rally could be in the cards. Only time will tell, but keep an eye on that 28-35 range to see who wins this short-term tug of war between the bulls and bears.

Weekly High-Probability Mean Reversion Indicator

Below is my watch list of ETFs and stocks with the most liquid options headed into the week of October 10, 2022.

Here are the various levels I use to determine if an ETF is in an oversold or overbought state.

| Very Overbought | greater than or equal to 80.1 |

| Overbought | 60.1 to 80.0 |

| Neutral | 40.1 to 60 |

| Oversold | 20.1 to 40.0 |

| Very Oversold | less than or equal to 20.0 |

Each week I also include the current implied volatility (IV) and IV Rank. I look for an IV rank above 40, preferably higher.

ETF Watch List – Trade Ideas

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| ARK Innovation ETF | ARKK | 66.9 | 59.9 | 37.3 |

| ProShares Bitcoin ETF | BITO | 76.1 | 20.9 | 43.5 |

| SPDR Dow Jones | DIA | 27.6 | 72.2 | 38.9 |

| iShares MSCI Emerging Markets | EEM | 28.2 | 51.7 | 38.7 |

| iShares MSCI EAFE | EFA | 29.1 | 55.9 | 40.5 |

| iShares MSCI Mexico ETF | EWW | 30.5 | 47.1 | 49.9 |

| iShares MSCI Brazil | EWZ | 50.1 | 70.7 | 63.5 |

| iShares China Large-Cap | FXI | 43.2 | 40.1 | 39.1 |

| VanEck Gold Miners | GDX | 52 | 64.3 | 49.4 |

| SPDR Gold | GLD | 19.7 | 29.5 | 53.7 |

| iShares High-Yield | HYG | 19.6 | 70.6 | 41.9 |

| iShares Russell 2000 | IWM | 35.1 | 72.9 | 41.1 |

| SPDR Regional Bank | KRE | 35.3 | 48.3 | 43.1 |

| VanEck Oil Services | OIH | 57.1 | 58.8 | 71.9 |

| Invesco Nasdaq 100 | QQQ | 36.4 | 80.9 | 33.9 |

| iShares Silver Trust | SLV | 37.9 | 51.7 | 55 |

| VanEck Semiconductor | SMH | 46.2 | 75.7 | 36.8 |

| SPDR S&P 500 | SPY | 29.7 | 76.9 | 37.1 |

| iShares 20+ Treasury Bond | TLT | 25.5 | 75.3 | 30.6 |

| United States Oil Fund | USO | 53.4 | 44.2 | 75.2 |

| ProShares Ultra VIX Short | UVXY | 116.2 | 19.2 | 64.5 |

| CBOE Market Volatility Index | VIX | 106.2 | 31.7 | 61.4 |

| Barclays S&P 500 VIX ETN | VXX | 82 | 27.4 | 61.8 |

| SPDR Biotech | XLB | 35.3 | 71.8 | 41.8 |

| SPDR Energy Select | XLE | 44.8 | 67.2 | 70.6 |

| SPDR Financials | XLF | 33.4 | 56.5 | 39.4 |

| SPDR Utilities | XLU | 31.3 | 93.5 | 24.1 |

| SPDR S&P Oil & Gas Explorer | XOP | 57.9 | 47.9 | 67.7 |

| SPDR Retail | XRT | 44.8 | 75.8 | 41.8 |

Stock Watch List – Trade Ideas

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| Apple | AAPL | 46.4 | 85.2 | 31.7 |

| Bank of America | BAC | 46.3 | 70.5 | 37.5 |

| Bristol-Myers Squibb | BMY | 30.9 | 62.2 | 38.5 |

| Citigroup | C | 48.5 | 79.9 | 33.5 |

| Caterpillar | CAT | 44.7 | 75.5 | 58.6 |

| Comcast | CMCSA | 48.6 | 86.3 | 29.3 |

| Costco | COST | 36 | 47.8 | 33.5 |

| Cisco Systems | CSCO | 34.5 | 57.1 | 34.2 |

| Chevron | CVX | 41.1 | 73.8 | 66.7 |

| Disney | DIS | 45 | 51.5 | 37.8 |

| Duke Energy | DUK | 33.9 | 100.1 | 21.4 |

| Fedex | FDX | 45 | 58.2 | 41.4 |

| Gilead Sciences | GILD | 37.4 | 52.2 | 52.1 |

| General Motors | GM | 57.6 | 79.1 | 37.7 |

| Intel | INTC | 58.3 | 98.6 | 28.8 |

| Johnson & Johnson | JNJ | 26.8 | 77 | 30.6 |

| JP Morgan | JPM | 42.7 | 75.3 | 38.1 |

| Coca-Cola | KO | 29.9 | 74.9 | 17.9 |

| Altria Group | MO | 33 | 70 | 57.8 |

| Merck | MRK | 29.4 | 30.4 | 54.2 |

| Morgan Stanley | MS | 47 | 78.6 | 34.9 |

| Microsoft | MSFT | 42.4 | 64.3 | 35.5 |

| NextEra Energy | NEE | 38.6 | 88.2 | 28.3 |

| Nvidia | NVDA | 65.5 | 62.7 | 34.1 |

| Pfizer | PFE | 36.8 | 52.8 | 23 |

| PayPal | PYPL | 66.9 | 56.6 | 47.7 |

| Starbucks | SBUX | 46.1 | 89.8 | 47.6 |

| AT&T | T | 38.7 | 97.3 | 25.2 |

| Verizon | VZ | 35.1 | 101.6 | 26.4 |

| Walgreens Boots Alliance | WBA | 49.2 | 107.7 | 27.4 |

| Wells Fargo | WFC | 47.3 | 61 | 47.1 |

| Walmart | WMT | 30 | 74 | 34.1 |

| Exxon Mobil | XOM | 42.9 | 67.2 | 73.7 |

Weekly Trade Discussion: Open Positions

*Portfolio updated every Monday

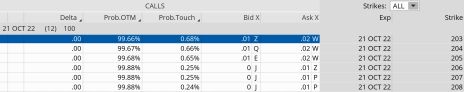

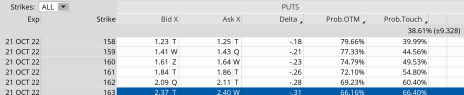

Iron Condor: IWM October 21, 2022, 203/208 calls – 163/158 puts

Original trade published on 9-13-2022 (click to see original alert)

Background: At the time of the trade, IWM was trading for 183.51. We sold the October 21, 2022, IWM 203/208 – 163/158 iron condor for $0.77 with a 90.93% (upside) and 85.20% (downside) probability of success. The expected range was 171 to 196.

Current Thoughts: IWM is currently trading for 168.61, and our iron condor is worth $1.16. Our probability of success stands at 99.66% on the call side and 66.16% on the put side.

With 12 days left and IWM testing our short put strike of 163, there is still a good chance we will hit the stop-loss that I established with my alert that went out just over a week ago. Our iron condor currently stands at $1.16, but a continuation of the current trend lower would certainly trigger my mental stop-loss of $2.00 and convince me to take off the trade for a small loss. That being said, a short-term bounce should give us an opportunity to take the trade off the table for a decent profit.

As I stated in the stop-loss alert that went out a few weeks ago, we have managed to outperform all indices by a nice margin, and I want to keep it that way by not allowing losses to get out of hand. Remember, losses will occur; it’s how we manage them over the long term that separates success from failure. It’s that simple. We’re never going to take 100% losses, and, in most cases, we will never even get close to that percentage.

Call Side:

Put Side:

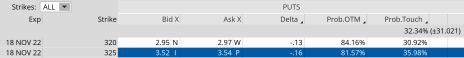

Bull Put: SPY November 18, 2022, 325/320 puts

Original trade published on 10-3-2022 (click to see original alert)

Background: At the time of the trade, SPY was trading for 364. We sold the November 18, 2022, SPY 325/320 bull put spread for $0.54 with an 82.33% (downside) probability of success. The expected range was 337 to 392.

Current Thoughts: SPY is currently trading for 362.79 and our bull put is worth $0.55. Our probability of success stands at 81.57% and the probability of touch is 35.98%.

With 40 days left, we are in good shape as we have almost 38 points of cushion to the downside or 10.5%.

Iron Condor: IWM November 18, 2022, 198/203 calls – 143/138 puts

Original trade published on 10-4-2022 (click to see original alert)

Background: At the time of the trade, IWM was trading for 174.86. We sold the November 18, 2022, IWM 198/203 – 143/138 iron condor for $0.64 with a 90.48% (upside) and 90.49% (downside) probability of success. The expected range was 160 to 190.

Current Thoughts: We just placed the trade so there isn’t much to discuss at the moment.

Bear Call: SPY November 18, 2022, 412/416 callsOriginal trade published on 10-6-2022 (click to see original alert)

Background: At the time of the trade, SPY was trading for 374.50. We sold the November 18, 2022, SPY 412/416 bear call for $0.43 with an 89.44% probability of success. The expected range was 348 to 401.

Current Thoughts: We just placed the trade so there isn’t much to discuss at the moment.

The next Cabot Options Institute – Quant Trader issue will be published on October 17, 2022.

Andy Crowder

Andy Crowder is a professional options trader, researcher and Chief Analyst of Cabot Options Institute. Formerly with Oppenheimer & Co. in New York, Andy has leveraged his investment experience to develop his statistically based options trading strategy which applies probability theory to option valuations in order to execute risk-controlled trades. This proprietary strategy has been refined through two decades of research and real-world experience and has been featured in the Wall Street Journal, Seeking Alpha, and numerous other financial publications. Andy has helped thousands of option traders learn and implement his meticulous rules-driven options trading strategies through highly attended conferences, one-on-one coaching, webinars, and his work as a financial columnist. He currently resides in Bolton Valley, Vermont and when he’s not trading, teaching and writing about options, he enjoys spending time with his wife and two daughters, backcountry skiing, biking, running and enjoying all things outdoors.