It has been a fairly quiet week for the market so I’m going to keep it short this week. Most of the potential market-moving news was backloaded coming into the week with the Fed meeting at the annual Jackson Hole summit. Jerome Powell, as always, has the potential to move the markets significantly, which is why this post-expiration week has been a slow one for trading.

We currently have three positions on and all of them are in profitable territory. If all goes well over the coming days, there is a good a chance that I will lock in profits in all three trades and immediately initiate several more positions. I continue to tread lightly, as there is no use trying to force trades at the moment.

Cabot Options Institute – Quant Trader Issue: August 26, 2022

Before I get to this week’s issue, I wanted to let everyone know that starting September 12, our weekly issues will be released on Mondays instead of Fridays. This should allow me to give all of you more thorough weekly review and prep heading into the following week. As always, if you have any questions, comments or feedback, please do not hesitate to email me at andy@cabotwealth.com.

Now let’s get to the market commentary!

It has been a fairly quiet week for the market so I’m going to keep it short this week. Most of the potential market-moving news was backloaded coming into the week with the Fed meeting at the annual Jackson Hole summit. Jerome Powell, as always, has the potential to move the markets significantly, which is why this post-expiration week has been a slow one for trading.

We currently have three positions on and all of them are in profitable territory. If all goes well over the coming days, there is a good a chance that I will lock in profits in all three trades and immediately initiate several more positions. I continue to tread lightly, as there is no use trying to force trades at the moment.

Current Portfolio

| Open Trades | |||||||

| Open Date | Ticker | Strategy | Trade | Open Price | Current Price | Current Probability | Delta |

| 8/1/2022 | SPY | Bear Call | September 16, 2022 439/444 | $0.70 | $0.45 | 89.30% | -5 |

| 8/11/2022 | DIA | Bear Call | September 23, 2022 350/355 | $0.75 | $0.35 | 90.71% | -5 |

| 8/11/2022 | IWM | Iron Condor | September 23, 2022 220/215 - 173/168 | $0.77 | $0.45 | 94.74% - 89.27% | 0 |

| Closed Trades | |||||||

| Open Date | Closed Date | Ticker | Strategy | Trade | Open Price | Closing Price | Return |

| 6/2/2022 | 6/13/2022 | SPY | Bear Call Spread | July 15, 2022 440/445 | $0.70 | $0.05 | 14.94% |

| 6/8/2022 | 6/17/2022 | XOP | Bear Call Spread | July 15, 2022 190/195 | $0.70 | $0.04 | 15.21% |

| 6/22/2022 | 7/13/2022 | SPY | Bear Call Spread | July 29, 2022 405/410 | $0.75 | $0.35 | 8.70% |

| 6/30/2022 | 7/25/2022 | IWM | Iron Condor | August 19, 2022 195/200 - 145/140 | $0.70 | $0.34 | 7.76% |

| 7/8/2022 | 7/28/2022 | GLD | Bull Put Spread | August 19, 2022 155/150 | $0.60 | $0.16 | 9.65% |

| 7/14/2022 | 8/11/2022 | SPY | Iron Condor | August 19, 2022 417/412 - 335/330 | $0.70 | $4.10 | -68.00% |

Volatility Talk

After almost two weeks of trading in a fairly tight range around 20 the VIX decided to make itself known again. On Monday the selling began in earnest in the S&P 500 and the VIX jolted higher as a result. The VIX hovered around 24 for a few days before pulling back to where it’s trading now at 22.86. I suspect the VIX closes the gap from Monday before making another directional move.

Weekly High Probability Mean Reversion Indicator

Below is my watch list of ETFs and stocks with the most liquid options headed into the week of August 29, 2022.

Here are the various levels I use to determine if an ETF is in an oversold or overbought state.

| Very Overbought | greater than or equal to 80.1 |

| Overbought | 60.1 to 80.0 |

| Neutral | 40.1 to 60 |

| Oversold | 20.1 to 40.0 |

| Very Oversold | less than or equal to 20.0 |

Each week I also include the current implied volatility (IV) and IV Rank. I look for an IV rank above 40, preferably higher.

ETF Watch List- Trade Ideas

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| ARK Innovation ETF | ARKK | 56.8 | 43.3 | 44.6 |

| ProShares Bitcoin ETF | BITO | 76.9 | 23 | 35.5 |

| SPDR Dow Jones | DIA | 19.3 | 22.2 | 51.1 |

| iShares MSCI Emerging Markets | EEM | 20.5 | 17.2 | 61.5 |

| iShares MSCI EAFE | EFA | 21.2 | 29.2 | 44.1 |

| iShares MSCI Mexico ETF | EWW | 23.4 | 12.6 | 55.7 |

| iShares MSCI Brazil | EWZ | 37.5 | 54 | 69.4 |

| iShares China Large-Cap | FXI | 29.5 | 13.9 | 72.3 |

| VanEck Gold Miners | GDX | 40.5 | 62.2 | 52.6 |

| SPDR Gold | GLD | 15.7 | 7.4 | 48.1 |

| iShares High-Yield | HYG | 14.5 | 43.4 | 47.5 |

| iShares Russell 2000 | IWM | 27.1 | 40.1 | 56.1 |

| SPDR Regional Bank | KRE | 26.9 | 19.7 | 50 |

| VanEck Oil Services | OIH | 50.2 | 35.7 | 74.1 |

| Invesco Nasdaq 100 | QQQ | 28.1 | 46.9 | 50.3 |

| iShares Silver Trust | SLV | 29.6 | 20.9 | 38.1 |

| VanEck Semiconductor | SMH | 35.5 | 41.4 | 51.8 |

| SPDR S&P 500 | SPY | 22 | 35.9 | 53.8 |

| iShares 20+ Treasury Bond | TLT | 19.9 | 42.1 | 39.5 |

| United States Oil Fund | USO | 46 | 34.1 | 58.4 |

| ProShares Ultra VIX Short | UVXY | 99.5 | 10.8 | 38.9 |

| CBOE Market Volatility Index | VIX | 86.8 | 3.5 | 50.3 |

| Barclays S&P 500 VIX ETN | VXX | 63.2 | 10.9 | 19.6 |

| SPDR Biotech | XLB | 24 | 35.9 | 63.4 |

| SPDR Energy Select | XLE | 38.1 | 37.8 | 8.1 |

| SPDR Financials | XLF | 23.6 | 18.5 | 54.3 |

| SPDR Utilities | XLU | 18.2 | 24.4 | 61.7 |

| SPDR S&P Oil & Gas Explorer | XOP | 49 | 26.9 | 79.2 |

| SPDR Retail | XRT | 8.4 | 43.5 | 46.2 |

Stock Watch List- Trade Ideas

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| Apple | AAPL | 28.1 | 15.7 | 56.8 |

| Bank of America | BAC | 31.9 | 27.6 | 51.9 |

| Bristol-Myers Squibb | BMY | 25.8 | 40.9 | 28.5 |

| Citigroup | C | 1.2 | 24.9 | 47.6 |

| Caterpillar | CAT | 31 | 24.2 | 62.5 |

| Comcast | CMCSA | 31.2 | 32.6 | 36.8 |

| Costco | COST | 29.4 | 23.9 | 57.7 |

| Cisco Systems | CSCO | 23.9 | 14.8 | 54.4 |

| Chevron | CVX | 32.7 | 38.7 | 74 |

| Disney | DIS | 30.9 | 16 | 53.4 |

| Duke Energy | DUK | 19.6 | 14.4 | 46.9 |

| Fedex | FDX | 39.3 | 31 | 46.2 |

| Gilead Sciences | GILD | 25.4 | 13.2 | 46.1 |

| General Motors | GM | 42.3 | 33.4 | 69.9 |

| Intel | INTC | 32.6 | 34.7 | 45.3 |

| Johnson & Johnson | JNJ | 19.1 | 20.6 | 45.1 |

| JP Morgan | JPM | 28.2 | 30.3 | 52.5 |

| Coca-Cola | KO | 18.8 | 20.4 | 58.4 |

| Altria Group | MO | 26.9 | 37.3 | 82.3 |

| Merck | MRK | 22.8 | 21.5 | 48.5 |

| Morgan Stanley | MS | 29 | 18.3 | 59.2 |

| Microsoft | MSFT | 27.8 | 18.9 | 41.4 |

| NextEra Energy | NEE | 25.9 | 28.8 | 58.3 |

| Nvidia | NVDA | 51.4 | 26.5 | 50.7 |

| Pfizer | PFE | 28.5 | 18.7 | 36.2 |

| PayPal | PYPL | 47.1 | 32.5 | 54.5 |

| Starbucks | SBUX | 33.6 | 47 | 56.7 |

| AT&T | T | 23.9 | 28.7 | 37.4 |

| Verizon | VZ | 21.2 | 47.2 | 33.4 |

| Walgreens Boots Alliance | WBA | 28.6 | 0.6 | 26.4 |

| Wells Fargo | WFC | 32 | 13.5 | 58.8 |

| Walmart | WMT | 20.9 | 18.5 | 58.5 |

| Exxon Mobil | XOM | 36.4 | 39.4 | 78.3 |

Weekly Trade Discussion: Open Positions

Iron Condor: IWM September 23, 2022, 220/215 calls – 173/168 puts

Original trade published on 8-11-2022 (click to see original alert)

Background: At the time of the trade, IWM was trading for 197.66. We sold the September 23, 2022, IWM 220/215 – 173/168 iron condor spread for $0.77 with an 88.09% (upside) to 88.06% (downside) probability of success. The probability of touch was 24.01% (upside) to 23.41% (downside). The expected range was 186 to 209.

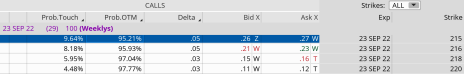

Current Thoughts: IWM is currently trading for 194.50 and our iron condor spread is worth $0.44. Our probability of success stands at 95.21% on the call side and 89.20% on the put side. As it stands, we are in good shape. If we can stay around this area over the next week or two, we should be able to take off our iron condor for a nice profit.

Call Side:

Put Side:

Bear Call: SPY September 16, 2022, 439/444 calls

Original trade published on 8-1-2022 (click to see original alert)

Background: With SPY reaching a short-term overbought reading and pushing even deeper into overbought territory, I decided to add a bear call spread in SPY. SPY was trading for 412.41 at the time and we were able to sell a September 16, 2022, 439/444 bear call spread for $0.70. The probability of success at the time of the trade was 85.63% and the probability of touch was 28.98%.

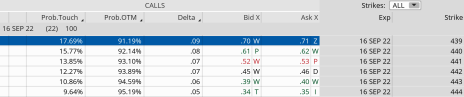

Current Thoughts: SPY is currently trading for 416.63 and our iron condor spread is worth $0.37. Our probability of success stands at 91.19% and our probability of touch is 17.69% with 22 days left until expiration. Our position looks good at the moment, but another immediate push lower would allow us to take off our position for a nice profit. Otherwise, we sit and patiently wait for time decay to work its magic.

Call Side:

Bear Call: DIA September 23, 2022, 350/355 calls

Original trade published on 8-11-2022 (click to see original alert)

Background: With DIA reaching a short-term overbought reading and pushing even deeper into overbought territory after both the CPI and PPI were announced, I decided to add a bear call spread in DIA. DIA was trading for 335.06 at the time and we were able to sell a September 23, 2022, 350/355 bear call spread for $0.75. The probability of success at the time of the trade was 82.67% and the probability of touch was 34.22%.

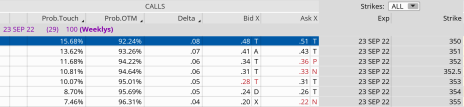

Current Thoughts: DIA is currently trading for 331.02 and our iron condor spread is worth $0.30. Our probability of success stands at 92.24% and our probability of touch is 15.68%. Like our SPY bear call spread, our DIA position looks good at the moment, but a push lower would certainly give us the opportunity to take some really nice profits. And just like our SPY bear call spread, time decay is accelerating by the day.

Call Side:

The next Cabot Options Institute – Quant Trader issue will be published on September 2, 2022.

About the Analyst

Andy Crowder

Andy Crowder is a professional options trader, researcher and Chief Analyst of Cabot Options Institute. Formerly with Oppenheimer & Co. in New York, Andy has leveraged his investment experience to develop his statistically based options trading strategy which applies probability theory to option valuations in order to execute risk-controlled trades. This proprietary strategy has been refined through two decades of research and real-world experience and has been featured in the Wall Street Journal, Seeking Alpha, and numerous other financial publications. Andy has helped thousands of option traders learn and implement his meticulous rules-driven options trading strategies through highly attended conferences, one-on-one coaching, webinars, and his work as a financial columnist. He currently resides in Bolton Valley, Vermont and when he’s not trading, teaching and writing about options, he enjoys spending time with his wife and two daughters, backcountry skiing, biking, running and enjoying all things outdoors.