We recently locked in two profitable trades in SPY and XOP. Today, we are going to go back to the well and place another bear call spread in the SPDR S&P 500 ETF (SPY). Implied volatility is still inflated.

As you can see below, IV rank is well above normal and I have no problem selling premium anytime we see an IV rank above 40. So, when the IV rank is sitting at 92.83 there is no doubt options premium is inflated and a good time to sell.

IV: 29.76%

IV Rank: 92.83

Expected Move (Range): The expected move (range) for the July 29, 2022 expiration cycle is from 349 to 401.

The Trade

With the S&P 500 (SPY) trading for 375.44 I want to place a short-term bear call spread going out 37 days. My intent is to take off the trade well before the July 29, 2022 expiration date.

Simultaneously:

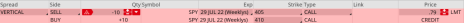

Sell to Open SPY July 29, 2022 405 call strike

Buy to Open SPY July 29, 2022 410 call strike for a total of $0.75 (As always, the price of spread will vary, so please adjust accordingly.)

Delta of spread: 0.04

Probability of Profit: 84.94%

Probability of Touch: 30.79

Total net credit: $0.75

Total risk per spread: $4.25

Max return: 17.6%

Risk Management

Since we know how much we stand to make and lose prior to order entry we can precisely define our position size on every trade we place. Position size is the most important factor when managing risk, so by keeping each trade at a reasonable level (I use 1% to 5% per trade) it allows not only the Law of Large Numbers to work in your favor … it also allows you to sleep well at night.

I tend to set a stop-loss that sits 1 to 2 times my original credit. Since I’m selling the 405/410 bear call spread for roughly $0.75, if my bear call spread reaches $1.50 to $2.25 I will exit the trade. As always, I will keep you updated on the status of the position as it progresses and send any necessary updates as needed.

If you have any questions, please do not hesitate to email me at andy@cabotwealth.com.