Bear Call Spread: XOP July 15, 2022, 190/195 calls

Original trade published on 6-2-2022 (click to see original alert)

Our timing was incredibly fortunate for this one as XOP pushed significantly lower almost immediately after our alert was sent.

Now I want to close out our XOP July 15, 2022, 190/195 bear call spread today for $0.04. By closing out the trade today we can lock in roughly 15%.

With our bear call spread trading for less than $0.05 it just doesn’t make sense (it rarely does) to hold a trade through expiration. Why would we hold on to a trade with 28 days left until expiration and the associated risk when we could simply take off the trade and move on to the next opportunity when it presents itself?

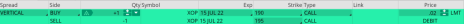

Here is the trade:

Simultaneously:

Buy to close XOP July 15, 2022, 190 call strike

Sell to close XOP July 15, 2022, 195 call strike for a total of $0.04 (As always, the price of spread will vary, please adjust accordingly.)

I will be adding new positions over the next several trading sessions. Stay tuned!

If you have any questions, please do not hesitate to email me at andy@cabotwealth.com.