Cabot Options Institute Income Trader: Alert (XLU)

SPDR Utilities ETF (XLU)

It’s time to add a new ETF to the mix, and as mentioned in our call last week, I wanted to add an ETF with a fairly conservative level of implied volatility (IV) to the portfolio. With an IV of around 23%, XLU fits the bill.

So, as a result, I’m going to place a trade in XLU today. I intend on adding another stock next week and my goal is to go with a stock that has an IV around 40% to 60%.

XLU is currently trading for 59.

Here is the trade:

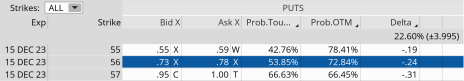

Sell to Open XLU December 15, 2023, 56 put for $0.75. (As always, prices will vary, please adjust accordingly.)

Delta of short call: 0.24

Probability of Profit: 72.84%

Probability of Touch: 53.85%

Total net credit: $0.75

Max return (cash-secured): 1.3%

Risk Management

We will use XLU as part of our Income Wheel Portfolio, so if XLU closes below our put strike at expiration, we will be assigned shares of XLU (per the guidelines of the strategy). Until that point, we will repeatedly sell puts on XLU. Of course, any necessary trade alerts/updates will follow.