Cabot Options Institute Income Trader – Alert (KO, WFC)

Coca-Cola (KO)

As part of the Income Wheel approach, we allowed our Coca-Cola (KO) calls to expire out of the money at expiration last week. As a result, our calls expired worthless and we reaped the entire premium.

Today, as our Income Wheel strategy states, we are going to sell more calls against our shares in KO. We are not selling naked calls, so you need to have at least 100 shares if you wish to enter a new position in KO. For those of you that are new to Income Trader and wish to follow along with KO, buying at least 100 shares of KO for every call contract you wish to sell is required as we are in the covered call phase of the Income Wheel strategy for KO.

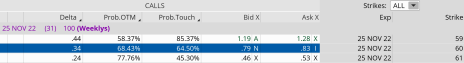

KO is currently trading for 58.30.

Here is the trade:

Sell to Open KO November 25, 2022, 60 calls for $0.80.

Wells Fargo (WFC)

As part of the Income Wheel approach, we allowed our Wells Fargo (WFC) calls to expire in the money at expiration last week. As a result, our shares were “called” away at the price of 41. As a result, we locked in 4.7% on the trade and 8% in total since first introducing the position to the portfolio.

Today, as our Income Wheel strategy states, we are going to start the Income Wheel approach again in WFC by selling more puts.

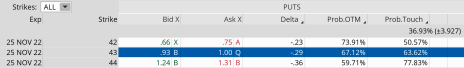

WFC is currently trading for 45.43

Here is the trade:

Sell to Open WFC November 25, 2022, 43 puts for $0.96.