Cabot Options Institute Income Trader – Alert (PFE)

In today’s trade alert I want to start out by selling puts in PFE with the intent of eventually wheeling into the position. Here is a quick review of the wheeling process.

The mechanics are simple:

- Sell Cash-Secured Puts on a stock until you are assigned shares (100 shares for every put sold),

- Sell Covered Calls on the assigned stock until the shares are called away

- Repeat the Process!

All this being said, you can simply just sell puts without the need to wheel into the position. Some of you don’t want to own stock and I get it … which is why we also have an Income Trades Portfolio that is just short-term trades consisting solely of selling puts, with no intent of holding stock.

Anyway …

I’m not going with anything too crazy here. I want to choose highly liquid market stalwarts to sell premium over the long term. These are typically lower-beta stocks with an average implied volatility.

As I stated in my latest webinar, I will be adding several new positions to the mix over the next week or so.

Pfizer (PFE)

IV: 32.5%

IV Rank: 23.3

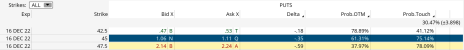

Expected Move (Range): The expected move (range) for the December 16, 2022, expiration cycle is from 43 to 48.

With PFE trading for 46.44 I want to sell puts going out 43 days.

The TradeSell to open PFE December 16, 2022, 45 put strike for a total of $1.08 or higher (As always, the price of spread will vary, please adjust accordingly.)

Delta of spread: -0.35

Probability of Profit: 61.31%

Probability of Touch: 75.14%

Total net credit: $1.08

Max return (cash-secured): 2.4%

Risk Management

If PFE closes below on expiration we will be issued shares at the 45 strike and begin the process of selling calls against it. Until that point, we will continue to sell puts on PFE. Of course, any necessary trade alerts/updates will follow.

If you have any questions, please do not hesitate to email me at andy@cabotwealth.com.