Pfizer (PFE)

Just a quick heads up, I’ll be adding several new positions early next week. We currently have four positions in the portfolio and my immediate goal is to get back up to between six and eight positions using our ladder-based approach for consistent, weekly income.

Pfizer (PFE)

Since we introduced our PFE position back in early June 2022, we’ve managed to bring in 30.4% worth of premium and capital gains by using our simple income wheel approach. Comparatively, the stock is down roughly 47.4% over the same timeframe.

Our overall return for Income Trader now stands at 161.4%.

Not bad, for one of our more conservative, lower-beta positions. Remember, in Income Trader, I not only want to diversify the portfolio with uncorrelated stocks, I also want to diversify the levels of implied volatility of the various stocks/ETFs that reside in the portfolio.

Today, I want to hopefully build upon our 30.4% return, so I want to sell more call premium against our shares.

*As a reminder, we are not selling naked calls, so you need to have at least 100 shares if you wish to enter a new position in PFE. For those of you who are new to Income Trader and wish to follow along with PFE, buying at least 100 shares of PFE for every call contract you wish to sell is required as we are in the covered call phase of the Income Wheel strategy for PFE.

PFE is currently trading for 27.42.

Here is the trade:

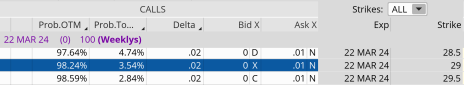

Buy to Close PFE March 22, 2024, 29 (covered) call for $0.01. (Adjust accordingly, prices may vary from time of alert.)

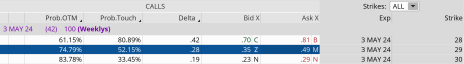

Sell to Open PFE May 3, 2024, 29 (covered) call for $0.41. (Adjust accordingly, prices may vary from time of alert.)

Delta of short call: 0.28

Probability of Profit: 74.79%

Probability of Touch: 52.51%

Total net credit: $0.41

Max return (cash-secured): 1.4%

Risk Management

We use PFE as part of our Income Wheel Portfolio, so if PFE closes above our call strike at expiration, our shares will be called away and, in most cases, we will reap the capital benefits of the stock increase, plus the premium acquired. Until that point, we will repeatedly sell calls on PFE.

Copyright © 2024. All rights reserved. Copying or electronic transmission of this information without permission is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. Disclosures: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to our publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Employees of Cabot Wealth Network may own some of the stocks recommended by our advisory services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: are made in regular issues, updates, or alerts by email and on the private subscriber website. Subscribers agree to adhere to all terms and conditions which can be found on CabotWealth.com and are subject to change. Violations will result in termination of all subscriptions without refund in addition to any civil and criminal penalties available under the law.