Cabot Options Institute Income Trader - Alert (WFC)

Wells Fargo (WFC)

WFC has provided us a nice source of income since we introduced the big bank to the portfolio. We’ve managed to bring in 18.98% of options premium/income in just under one year using the Income Wheel strategy while the stock itself has only made half of that return at 9.19%.

Today I want to buy back our July 21, 2023, 37.5 puts as they are near worthless, reap the profit and immediately sell more options premium in August.

WFC is currently trading for 42.61.

Here is the trade:

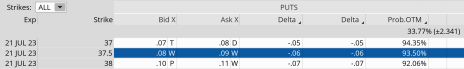

Buy to Close WFC July 21, 2023, 37.5 puts for $0.09. (As always, prices will vary, please adjust accordingly.)

Once that occurs:

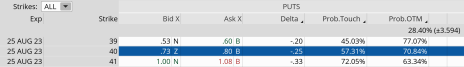

Sell to Open WFC August 25, 2023, 40 puts for $0.76. (As always, prices will vary, please adjust accordingly.)

Delta of short call: 0.25

Probability of Profit: 70.84%

Probability of Touch: 57.31%

Total net credit: $0.76

Max return (cash-secured): 1.9%

Risk Management

We use WFC as part of our Income Wheel Portfolio, so if WFC closes below our put strike at expiration, we will be assigned shares of WFC (per the guidelines of the strategy). Until that point, we will repeatedly sell puts on WFC. As always, any necessary trade alerts/updates will follow.