As stated in our latest weekly update (out today), we locked in profits in both XLU and KO at expiration last Friday. Per our income wheel guidelines, it’s time to start selling more premium. Our total return has pushed to all-time highs of just over 145%. Remember, investing/trading is a marathon and not a sprint, and Income Trader has proven this mantra in just under two years. We continue to be thrilled with the results.

SPDR Utilities ETF (XLU)

After locking in our premium last Friday, it’s time to start selling more premium in XLU.

XLU is currently trading for 60.84.

Here is the trade:

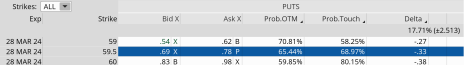

Sell to Open XLU March 28, 2024, 59.5 put for $0.72. (As always, prices will vary, please adjust accordingly.)

Delta of short call: 0.33

Probability of Closing Out of the Money: 65.44%

Probability of Touch: 68.97%

Total net credit: $0.72

Max return (cash-secured): 1.2% over the next 31 days (or less)

Risk Management

We will use XLU as part of our Income Wheel Portfolio, so if XLU closes below our put strike at expiration, we will be assigned shares of XLU (per the guidelines of the strategy). Until that point, we will repeatedly sell puts on XLU. Of course, any necessary trade alerts/updates will follow.

Coca-Cola (KO)

Like our XLU position above, we locked in premium last Friday and now it’s time to sell even more premium.

KO is currently trading for 61.05.

Here is the trade:

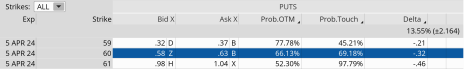

Sell to Open KO April 5, 2024, 60 puts for $0.60.

Delta of short put: 0.32

Probability Closing Out of the Money: 66.13%

Probability of Touch: 69.18%

Total net credit: $0.60

Max return (cash-secured): 1.0%

If you have any questions, please do not hesitate to email me at andy@cabotwealth.com

Copyright © 2024. All rights reserved. Copying or electronic transmission of this information without permission is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. Disclosures: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to our publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Employees of Cabot Wealth Network may own some of the stocks recommended by our advisory services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: are made in regular issues, updates, or alerts by email and on the private subscriber website. Subscribers agree to adhere to all terms and conditions which can be found on CabotWealth.com and are subject to change. Violations will result in termination of all subscriptions without refund in addition to any civil and criminal penalties available under the law.