DraftKings (DKNG)

DKNG continues to be a great addition to the portfolio. We recently locked in 17.1% in options premium and capital gains. Our total return is over 39% since adding the position to the portfolio. Now it’s time to start the income wheel cycle over again by selling puts in DKNG. Hopefully, our good fortune continues.

DKNG is currently trading for 40.33.

Here is the trade:

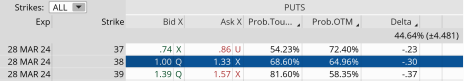

Sell to Open DKNG March 28, 2024, 38 put for $1.15. (As always, prices will vary, please adjust accordingly.)

Delta of short call: 0.30

Probability of Profit: 64.96%

Probability of Touch: 68.60%

Total net credit: $1.15

Max return (cash-secured): 3.0%

Risk Management

We use DKNG as part of our Income Wheel Portfolio, so if DKNG closes below our put strike at expiration, we will be assigned shares of DKNG (per the guidelines of the strategy). Until that point, we will repeatedly sell puts on DKNG. Of course, any necessary trade alerts/updates will follow.

Copyright © 2024. All rights reserved. Copying or electronic transmission of this information without permission is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. Disclosures: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to our publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Employees of Cabot Wealth Network may own some of the stocks recommended by our advisory services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: are made in regular issues, updates, or alerts by email and on the private subscriber website. Subscribers agree to adhere to all terms and conditions which can be found on CabotWealth.com and are subject to change. Violations will result in termination of all subscriptions without refund in addition to any civil and criminal penalties available under the law.