Weekly Commentary

The beginning of this week is going to be busy as I plan to buy back positions in DKNG, PFE and KO, lock in profits and immediately sell more options premium.

Our other positions are working through their respective expiration cycles using our “income wheel” approach. That being said, we do have one position, WFC September 15, 2023 45 puts, that will most likely close in-the-money at expiration this Friday. If that does occur, no worries, we will be assigned shares of WFC (100 per options contract) and immediately begin the covered call portion of our “income wheel” strategy.

Also, expect to see a new addition or two to the portfolio this week. Stay tuned for what should be several trade alerts this week.

Current Positions

| Open Date | Ticker | Stock Price (open) | Stock Price (current) | Strategy | Trade | Open Price | Current Price | Delta |

| Income Wheel Portfolio - Open Trades | ||||||||

| 7/24/2023 | WFC | $46.77 | $41.00 | Short Put | September 15, 2023 45 Put | $0.85 | $4.05 | 0.93 |

| 7/24/2023 | DKNG | $30.59 | $31.85 | Short Put | September 15, 2023 28 Put | $1.36 | $0.03 | 0.03 |

| 8/21/2023 | PFE | $37.09 | $34.25 | Covered Call | September 29, 2023 38 Call | $0.78 | $0.04 | 0.04 |

| 8/21/2023 | BITO | $13.41 | $13.33 | Covered Call | September 29, 2023 14 Call | $0.48 | $0.22 | 0.31 |

| 8/21/2023 | GDX | $27.61 | $28.30 | Covered Call | October 20, 2023 29 Call | $0.86 | $0.80 | 0.44 |

| 8/21/2023 | KO | $60.42 | $58.33 | Covered Call | September 29, 2023 61 Call | $0.78 | $0.06 | 0.08 |

| Open Date | Close Date | Ticker | Strategy | Trade | Open Price | Closed Price | Profit | Return |

| Income Wheel Portfolio - Closed Trades | ||||||||

| 6/3/2022 | 7/8/2022 | PFE | Short Put | July 8, 2022 50 Put | $0.65 | $0.00 | $0.65 | 1.30% |

| 6/10/2022 | 7/15/2022 | GDX | Short Put | July 15, 2022 29 Put | $0.66 | Assigned at $29 | ($2.75) | -9.48% |

| 6/10/2022 | 7/15/2022 | BITO | Short Put | July 15, 2022 16 Put | $0.82 | Assigned at $16 | ($2.09) | -13.10% |

| 6/22/2022 | 7/21/2022 | WFC | Short Put | July 29, 2022 35 Put | $0.80 | $0.02 | $0.78 | 2.23% |

| 6/30/2022 | 8/10/2022 | KO | Short Put | August 19, 2022 57.5 Put | $0.70 | $0.03 | $0.67 | 1.20% |

| 7/21/2022 | 8/10/2022 | WFC | Short Put | August 19, 2022 39 Put | $0.46 | $0.04 | $0.42 | 1.08% |

| 7/18/2022 | 8/17/2022 | BITO | Covered Call | August 19, 2022 16 Call | $0.50 | $0.03 | $0.47 | 3.59% |

| 7/18/2022 | 8/17/2022 | GDX | Covered Call | August 19, 2022 28 Call | $0.63 | $0.05 | $0.57 | 2.22% |

| 7/11/2022 | 8/23/2022 | PFE | Short Put | August 19, 2022 50 Put | $1.00 | Assigned at $50 | $0.21 | 0.43% |

| 8/17/2022 | 9/7/2022 | BITO | Covered Call | September 23, 2022 16.5 Call | $0.55 | $0.03 | $0.52 | 4.00% |

| 8/17/2022 | 9/7/2022 | GDX | Covered Call | September 23, 2022 28 Call | $0.59 | $0.07 | $0.52 | 2.03% |

| 8/23/2022 | 9/23/2022 | PFE | Covered Call | October 21, 2022 50 Call | $1.50 | $0.09 | $1.41 | 2.82% |

| 8/10/2022 | 9/23/2022 | KO | Short Put | September 23, 2022 60 Put | $0.62 | Assigned at $60 | ($0.78) | -1.30% |

| 8/10/2022 | 9/23/2022 | WFC | Short Put | September 23, 2022 41 Put | $0.61 | Assigned at $41 | $0.02 | 0.05% |

| 9/7/2022 | 10/17/2022 | BITO | Covered Call | October 21, 2022 14 Call | $0.40 | $0.03 | $0.37 | 2.60% |

| 9/7/2022 | 10/17/2022 | GDX | Covered Call | October 21, 2022 26 Call | $0.70 | $0.04 | $0.66 | 2.50% |

| 9/26/2022 | 10/21/2022 | WFC | Covered Call | October 21, 2022 41 Call | $1.30 | Called away at $41 | $1.89 | 4.67% |

| 9/26/2022 | 10/21/2022 | KO | Covered Call | October 21, 2022 60 Call | $0.70 | $0.00 | $0.70 | 1.20% |

| 9/23/2022 | 1028/2022 | PFE | Covered Call | October 28, 2022 47 Call | $0.56 | Called away at $47 | $3.49 | 7.43% |

| 10/17/2022 | 11/17/2022 | BITO | Covered Call | November 25, 2022 13.5 Call | $0.38 | $0.03 | $0.35 | 2.60% |

| 10/25/2022 | 11/17/2022 | WFC | Short Put | November 25, 2022 43 Put | $0.96 | $0.07 | $0.89 | 2.00% |

| 10/17/2022 | 11/25/2022 | GDX | Covered Call | November 25, 2022 26 Call | $0.58 | Called away at $26 | $1.09 | 3.87% |

| 10/25/2022 | 11/25/2022 | KO | Covered Call | November 25, 2022 60 Call | $0.80 | Called away at $60 | $2.20 | 3.75% |

| 11/3/2022 | 12/8/2022 | PFE | Short Put | December 16, 2022 45 Put | $1.08 | $0.02 | $1.06 | 2.36% |

| 11/17/2022 | 12/19/2022 | BITO | Covered Call | December 30, 2022 12 Call | $0.45 | $0.04 | $0.41 | 3.42% |

| 11/17/2022 | 12/30/2022 | WFC | Short Put | December 30, 2022 44 Put | $1.02 | Assigned at $44 | ($1.37) | -3.11% |

| 11/29/2023 | 1/9/2023 | GDX | Short Put | January 20, 2023 26 Put | $0.87 | $0.02 | $0.85 | 3.27% |

| 12/8/2022 | 1/13/2023 | PFE | Short Put | January 13, 2023 49 Put | $0.62 | Assigned at $49 | ($0.53) | -1.08% |

| 12/19/2022 | 1/20/2023 | BITO | Covered Call | January 20, 2023 11.5 Call | $0.30 | Called away at $11.5 | $1.49 | 14.70% |

| 11/29/2022 | 1/20/2023 | KO | Short Put | January 20, 2023 60 Put | $0.84 | $0.00 | $0.84 | 1.40% |

| 1/5/2023 | 2/17/2023 | WFC | Covered Call | February 17, 2023 45 Call | $0.84 | Called away at $45 | $4.23 | 10.17% |

| 1/9/2023 | 2/17/2023 | GDX | Short Put | February 17, 2023 29 Put | $0.54 | Assigned at $29 | ($0.05) | -0.10% |

| 1/23/2023 | 2/17/2023 | KO | Short Put | February 17, 2023 59 Put | $0.62 | $0.00 | $0.62 | 1.05% |

| 1/23/2023 | 2/17/2023 | BITO | Short Put | February 17, 2023 13.5 Put | $0.52 | $0.00 | $0.52 | 3.85% |

| 1/20/2023 | 3/1/2023 | PFE | Covered Call | March 3, 2023 46 Call | $1.00 | $0.02 | $0.98 | 2.18% |

| 2/22/2023 | 3/23/2023 | BITO | Short Put | March 31, 2023 31 Put | $0.50 | $0.05 | $0.45 | 3.46% |

| 2/22/2023 | 3/29/2023 | KO | Short Put | March 31, 2023 59 Put | $0.86 | $0.02 | $0.84 | 1.42% |

| 3/1/2023 | 3/29/2023 | PFE | Covered Call | April 6, 2023 42 Call | $0.65 | $0.05 | $0.60 | 1.43% |

| 2/21/2023 | 3/31/2023 | GDX | Covered Call | March 31, 2023 29.5 Call | $0.75 | Called away at $29.5 | $1.84 | 6.48% |

| 2/23/2023 | 3/31/2023 | WFC | Short Put | March 31, 2023 43 Put | $0.53 | Assigned at $43 | ($4.87) | -11.32% |

| 3/29/2023 | 4/28/2023 | KO | Short Put | May 19, 2023 60 Puts | $0.76 | $0.08 | $0.68 | 1.13% |

| 3/29/2023 | 4/28/2023 | PFE | Covered Call | May 19, 2023 42.5 Call | $0.53 | $0.05 | $0.48 | 1.23% |

| 4/4/2023 | 5/8/2023 | GDX | Short Put | May 19, 2023 32 Put | $0.78 | $0.70 | $0.71 | 2.22% |

| 3/23/2023 | 5/18/2023 | BITO | Short Put | May 19, 2023 15 Put | $1.10 | $0.03 | $1.07 | 7.13% |

| 4/4/2023 | 5/24/2023 | WFC | Covered Call | May 19, 2023 40 Call | $0.55 | Called away at $40 | $3.94 | 10.76% |

| 4/28/2023 | 6/16/2023 | PFE | Covered Call | June 16, 2023 40 Call | $0.63 | Called away at $40 | $1.71 | 4.40% |

| 3/29/2023 | 6/16/2023 | KO | Short Put | June 16, 2023 62.5 Put | $0.70 | Assigned at $62.5 | ($0.13) | -0.21% |

| 5/8/2023 | 6/16/2023 | GDX | Short Put | June 16, 2023 34 Put | $0.91 | Assigned at $34 | ($1.70) | -5.00% |

| 5/18/2023 | 6/30/2023 | BITO | Short Put | June 30, 2023 14 Put | $0.45 | $0.01 | $0.44 | 3.14% |

| 5/24/2023 | 7/6/2023 | WFC | Short put | July 21, 2023 37.5 Put | $1.01 | $0.09 | $0.92 | 2.54% |

| 6/30/2023 | 7/24/2023 | DKNG | Short Put | August 18, 2023 22.5 Put | $0.63 | $0.09 | $0.54 | 2.40% |

| 7/6/2023 | 7/24/2023 | WFC | Short Put | August 25, 2023 40 Put | $0.76 | $0.12 | $0.64 | 1.60% |

| 6/21/2023 | 8/18/2023 | PFE | Short Put | August 18, 2023 37.5 Put | $0.64 | Assigned at $37.5 | ($0.24) | -0.64% |

| 6/21/2023 | 8/18/2023 | GDX | Covered Call | August 18, 2023 33 Call | $0.52 | $0.00 | $0.52 | 1.60% |

| 6/21/2023 | 8/18/2023 | KO | Covered Call | August 18, 2023 62.5 Call | $0.85 | $0.00 | $0.85 | 1.40% |

| 6/30/2023 | 8/18/2023 | BITO | Short Put | August 18, 2023 15 Put | $0.78 | Assigned at $15 | ($0.78) | -5.20% |

| 95.77% | ||||||||

| Income Trader Portfolio | ||||||||

| 7/26/2022 | 8/17/2022 | JPM | Short Put | September 16, 2022 100 Put | $1.22 | $0.16 | $1.06 | 1.10% |

| 1.10% | ||||||||

ETF Watchlist – Weekly Trade Ideas

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| ARK Innovation ETF | ARKK | 35.4 | 6.5 | 57.4 |

| ProShares Bitcoin ETF | BITO | 37.1 | 2.1 | 40.1 |

| iShares MSCI Emerging Markets | EEM | 16.2 | 14.2 | 38.2 |

| iShares MSCI EAFE | EFA | 15.0 | 13.7 | 36.9 |

| iShares MSCI Mexico ETF | EWW | 25.0 | 35.3 | 41.4 |

| iShares MSCI Brazil | EWZ | 27.0 | 3.5 | 28 |

| iShares China Large-Cap | FXI | 29.3 | 8.8 | 39.3 |

| VanEck Gold Miners | GDX | 27.9 | 1.3 | 38.6 |

| SPDR Gold | GLD | 10.9 | -0.8 | 44.8 |

| iShares High-Yield | HYG | 7.8 | 6.7 | 45.8 |

| SPDR Regional Bank | KRE | 30.9 | 9.7 | 37.8 |

| iShares Silver Trust | SLV | 24.6 | 7.4 | 28.5 |

| iShares 20+ Treasury Bond | TLT | 16.1 | 13.1 | 45 |

| United States Oil Fund | USO | 27.0 | 3.6 | 79.7 |

| ProShares Ultra VIX Short | UVXY | 99.1 | 11.5 | 28.9 |

| Barclays S&P 500 VIX ETN | VXX | 67.0 | 12.4 | 29.1 |

| SPDR Biotech | XLB | 15.7 | 14.7 | 44.4 |

| SPDR Energy Select | XLE | 20.3 | 1.6 | 82.5 |

| SPDR Financials | XLF | 16.7 | 5.5 | 48.8 |

| SPDR Utilities | XLU | 15.6 | 6.6 | 53.2 |

| SPDR Retail | XRT | 22.5 | 10.4 | 31.1 |

Stock Watchlist – Weekly Trade Ideas

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| Bank of America | BAC | 23.4 | 1.8 | 37.1 |

| Bristol-Myers | BMY | 19.8 | 16.3 | 45.8 |

| Citigroup | C | 26.3 | 8.5 | 21.9 |

| Costco | COST | 21.2 | 23 | 63.3 |

| Cisco Systems | CSCO | 16.0 | 2.7 | 56 |

| CVS Health | CVS | 23.0 | 10.3 | 33.3 |

| Dow Inc. | DOW | 20.6 | 5.2 | 40.6 |

| Duke Energy | DUK | 17.6 | 7.7 | 61.9 |

| Ford | F | 32.9 | 6.4 | 63.6 |

| Gilead Sciences | GILD | 30.4 | 17.5 | 48.7 |

| General Motors | GM | 32.9 | 13.5 | 40.6 |

| Intel | INTC | 36.7 | 13.9 | 79.6 |

| Johnson & Johnson | JNJ | 17.5 | 22.3 | 35.6 |

| Coca-Cola | KO | 14.6 | 13.4 | 14.2 |

| Altria Group | MO | 15.7 | 8 | 57.2 |

| Merck | MRK | 19.1 | 7.3 | 52.9 |

| Marvell Tech. | MRVL | 37.9 | 4 | 37.2 |

| Morgan Stanley | MS | 21.3 | 2.6 | 50.4 |

| Micron | MU | 39.4 | 18.4 | 68.9 |

| Oracle | ORCL | 33.9 | 50.9 | 80.5 |

| Pfizer | PFE | 22.4 | 16.2 | 22 |

| PayPal | PYPL | 30.6 | 2.1 | 38 |

| Starbucks | SBUX | 20.2 | 4.5 | 34.7 |

| AT&T | T | 24.4 | 19.9 | 45.2 |

| Verizon | VZ | 24.3 | 24 | 36.4 |

| Walgreens Boots Alliance | WBA | 33.9 | 32.6 | 6.7 |

| Wells Fargo | WFC | 26.5 | 8 | 38.7 |

| Walmart | WMT | 14.8 | 4.9 | 70.4 |

| Exxon Mobil | XOM | 21.3 | 3.4 | 78.5 |

Weekly Trade Discussion: Open Positions

Income Wheel Portfolio: Open Positions

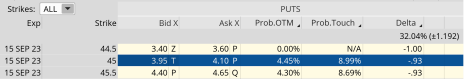

Selling Puts: WFC September 15, 2023, 45 Puts

Original trade published on 7-24-2023 (click here to see original alert)

Current Comments: We sold the September 15, 2023, 40 puts for $0.85. At the time of the alert, WFC was trading for 46.77.

Now, with WFC trading for 41.00, the probability of success stands around 5%, and the price of the 45 puts sits at $4.00. There are 4 days left in the September 15, 2023 expiration cycle. If WFC closes below the 45 puts at expiration, we will simply follow the guidelines of our income wheel strategy which means we will take our assigned shares and immediately sell calls against our newly issued shares.

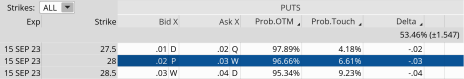

Selling Puts: DKNG September 15, 2023, 28 Puts

Original trade published on 7-24-2023 (click here to see original alert)

Current Comments: We sold the September 15, 2023, 28 puts for $1.36. At the time of the alert, DKNG was trading for 30.59.

Now, with DKNG trading for 31.85, the probability of success stands at 96.66%, and the price of the 28 puts sits at $0.03. There are still 4 days left in the September 15, 2023 expiration cycle. There is a good chance I will buy back the September 28 puts early this week and immediately sell more puts, most likely during the October expiration cycle.

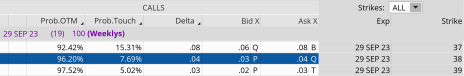

Covered Calls: PFE September 29, 2023, 38 Calls

Original trade published on 8-21-2023 (click here to see original alert)

Current Comments: We sold the September 29, 2023, 38 calls for $0.78. At the time of the alert, PFE was trading for 37.09.

Now, with PFE trading for 34.25, the probability of success stands at 96.20%, and the price of the 38 calls sits at $0.04. There are 19 days left in the September 29, 2023 expiration cycle and our calls are only worth $0.04. As a result, I want to buy back our calls, lock in profits and immediately sell more call premium.

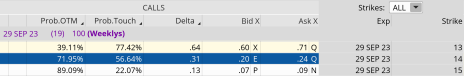

Covered Calls: BITO September 29, 2023, 14 Calls

Original trade published on 8-21-2023 (click here to see original alert)

Current Comments: We sold the September 29, 2023, 14 calls for $0.48. At the time of the alert, BITO was trading for 13.41.

Now, with BITO trading for 13.13, the probability of success stands at 71.95%, and the price of the 14 calls sits at $0.22. There are 19 days left in the September 29, 2023 expiration cycle. I’ll continue to sit on our calls as time decay accelerates over the next week. If all goes well, I will look to buy our calls back next week, lock in profits and immediately sell more calls.

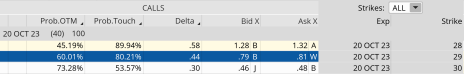

Covered Calls: GDX October 20, 2023, 29 Calls

Original trade published on 8-21-2023 (click here to see original alert)

Current Comments: We sold the October 20, 2023, 29 calls for $0.86. At the time of the alert, GDX was trading for 27.61.

Now, with GDX trading for 28.34, the probability of success stands at 60.01%, and the price of the 29 calls sits at $0.80. There are 40 days left in the October 20, 2023 expiration cycle. There’s not much to do at the moment other than allow time decay to slowly work its magic.

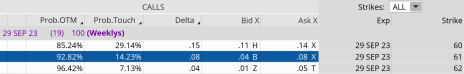

Covered Calls: KO September 29, 2023, 61 Calls

Original trade published on 8-21-2023 (click here to see original alert)

Current Comments: We sold the September 29, 2023, 61 calls for $0.78. At the time of the alert, KO was trading for 60.42.

Now, with KO trading for 58.33, the probability of success stands at 92.82%, and the price of the 61 calls sits at $0.06. There are 19 days left in the September 29, 2023 expiration cycle. With roughly three weeks until expiration and our calls only worth roughly $0.06, now is a good time to buy back our calls, lock in profits and immediately sell more call premium.

As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

The next Cabot Options Institute – Income Trader issue will be

published on September 18, 2023.