I’m going to keep it short this week as it has been a fairly quiet week for the Income Trader service. We added some calls on PFE, but other than that, we are well positioned into the September 23, 2022 expiration cycle. I plan on adding a minimum of two additional short-term positions next week and as I spoke about on our call last week I intend on taking some of the premium we’ve collected and create a black swan trade just in case we see a swift drawdown as we move into the latter part of 2022. It never hurts to have a little insurance just in case and it would only cost us a few percentage points. I’ll be discussing the details of the trade in the next issue.

Cabot Options Institute – Income Trader Issue: August 26, 2022

Before I get to this week’s issue, I wanted to let everyone know that starting September 12, our weekly issues will be released on Mondays instead of Fridays. This should allow me to give all of you more thorough weekly review and prep heading into the following week. As always, if you have any questions, comments or feedback, please do not hesitate to email me at andy@cabotwealth.com.

I’m going to keep it short this week as it has been a fairly quiet week for the Income Trader service. We added some calls on PFE, but other than that, we are well positioned into the September 23, 2022 expiration cycle. I plan on adding a minimum of two additional short-term positions next week and as I spoke about on our call last week I intend on taking some of the premium we’ve collected and create a black swan trade just in case we see a swift drawdown as we move into the latter part of 2022. It never hurts to have a little insurance just in case and it would only cost us a few percentage points. I’ll be discussing the details of the trade in the next issue.

Current Positions

| Open Date | Ticker | Stock Price (open) | Stock Price (current) | Strategy | Trade | Open Price | Current Price | Delta |

| Income Wheel Portfolio - Open Trades | ||||||||

| 7/11/2022 | PFE | $53.35 | $48.29 | Covered Call | October 21, 2022 50 Call | $1.50 | $1.00 | 0.71 |

| 8/10/2022 | KO | $63.15 | $63.22 | Short Put | September 23, 2022 60 Put | $0.62 | $0.24 | 0.12 |

| 8/10/2022 | WFC | $44.48 | $45.25 | Short Put | September 23, 2022 41 Put | $0.61 | $0.35 | 0.14 |

| 8/17/2022 | BITO | $14.41 | $14.41 | Covered Call | September 23, 2022 16.5 Call | $0.55 | $0.19 | 0.85 |

| 8/17/2022 | GDX | $26.11 | $26.11 | Covered Call | September 23, 2022 28 Call | $0.59 | $0.47 | 0.62 |

| Income Trades Portfolio - Open Trades | ||||||||

| Open Date | Close Date | Ticker | Strategy | Trade | Open Price | Closed Price | Profit | Return |

| Income Wheel Portfolio - Closed Trades | ||||||||

| 6/3/2022 | 7/8/2022 | PFE | Short Put | July 8, 2022 50 Put | $0.65 | $0.00 | $0.65 | 1.30% |

| 6/10/2022 | 7/15/2022 | GDX | Short Put | July 15, 2022 29 Put | $0.66 | Assigned at $29 | ($2.75) | -9.48% |

| 6/10/2022 | 7/15/2022 | BITO | Short Put | July 15, 2022 16 Put | $0.82 | Assigned at $16 | ($2.09) | -13.10% |

| 6/22/2022 | 7/21/2022 | WFC | Short Put | July 29, 2022 35 Put | $0.80 | $0.02 | $0.78 | 2.23% |

| 6/30/2022 | 8/10/2022 | KO | Short Put | August 19, 2022 57.5 Put | $0.70 | $0.03 | $0.67 | 1.20% |

| 7/21/2022 | 8/10/2022 | WFC | Short Put | August 19, 2022 39 Put | $0.46 | $0.04 | $0.42 | 1.08% |

| 7/18/2022 | 8/17/2022 | BITO | Covered Call | August 19, 2022 16 Call | $0.50 | $0.03 | $0.47 | 3.59% |

| 7/18/2022 | 8/17/2022 | GDX | Covered Call | August 19, 2022 28 Call | $0.63 | $0.05 | $0.57 | 2.22% |

| 7/11/2022 | 8/23/2022 | PFE | Short Put | August 19, 2022 50 Put | $1.00 | Assigned at $50 | $0.21 | 0.43% |

| Income Trades Portfolio - Closed Trades | ||||||||

| 7/26/2022 | 8/17/2022 | JPM | Short Put | September 16, 2022 100 Put | $1.22 | $0.16 | $1.06 | 1.10% |

Here are the various levels I use to determine if an ETF is in an oversold or overbought state.

| Very Overbought | greater than or equal to 80.1 |

| Overbought | 60.1 to 80.0 |

| Neutral | 40.1 to 60 |

| Oversold | 20.1 to 40.0 |

| Very Oversold | less than or equal to 20.0 |

ETF Watchlist

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| ARK Innovation ETF | ARKK | 56.8 | 43.3 | 44.6 |

| ProShares Bitcoin ETF | BITO | 76.9 | 23 | 35.5 |

| iShares MSCI Emerging Markets | EEM | 20.5 | 17.2 | 61.4 |

| iShares MSCI EAFE | EFA | 21.2 | 29.4 | 44.4 |

| iShares MSCI Mexico ETF | EWW | 37.5 | 54.1 | 69.4 |

| iShares MSCI Brazil | EWZ | 29.5 | 13.9 | 55.7 |

| iShares China Large-Cap | FXI | 40.4 | 62.2 | 72.2 |

| VanEck Gold Miners | GDX | 15.7 | 7.3 | 52.6 |

| SPDR Gold | GLD | 14.5 | 43.3 | 48.1 |

| iShares High-Yield | HYG | 26.9 | 19.1 | 47.5 |

| SPDR Regional Bank | KRE | 29.6 | 20.9 | 50 |

| iShares Silver Trust | SLV | 19.9 | 42.1 | 38.1 |

| iShares 20+ Treasury Bond | TLT | 46 | 33.9 | 39.5 |

| United States Oil Fund | USO | 99.5 | 11.1 | 58.4 |

| ProShares Ultra VIX Short | UVXY | 63.2 | 10.9 | 38.9 |

| Barclays S&P 500 VIX ETN | VXX | 24.3 | 35.9 | 19.6 |

| SPDR Biotech | XLB | 38.1 | 37.6 | 63.4 |

| SPDR Energy Select | XLE | 23.6 | 18.5 | 83.1 |

| SPDR Financials | XLF | 18.2 | 24.1 | 54.4 |

| SPDR Utilities | XLU | 38.4 | 43.4 | 61.7 |

| SPDR Retail | XRT | 23.4 | 12.6 | 46.2 |

Stock Watchlist

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| Bank of America | BAC | 31.9 | 28.2 | 51.9 |

| Bristol-Myers | BMY | 25.8 | 49 | 28.5 |

| Citigroup | C | 31.2 | 25 | 47.6 |

| Costco | COST | 29.4 | 50.9 | 57.7 |

| Cisco Systems | CSCO | 23.9 | 16.4 | 54.4 |

| CVS Health | CVS | 22.5 | 8.1 | 46.7 |

| Dow Inc. | DOW | 30.8 | 21.4 | 58.5 |

| Duke Energy | DUK | 19.6 | 10.1 | 46.9 |

| Ford | F | 43.6 | 11.2 | 58.7 |

| Gilead Sciences | GILD | 25.4 | 19.4 | 46.1 |

| General Motors | GM | 42.3 | 33 | 69.9 |

| Intel | INTC | 32.6 | 34 | 45.3 |

| Johnson & Johnson | JNJ | 19.1 | 20.6 | 45.1 |

| Coca-Cola | KO | 18.8 | 18.2 | 58.4 |

| Altria Group | MO | 26.9 | 37.5 | 82.3 |

| Merck | MRK | 22.8 | 21.5 | 48.5 |

| Marvell Tech. | MRVL | 61.5 | 60.1 | 58.5 |

| Morgan Stanley | MS | 29 | 18.3 | 59.2 |

| Micron | MU | 44.8 | 37.2 | 51.8 |

| Oracle | ORCL | 38.1 | 48.6 | 44.1 |

| Pfizer | PFE | 28.5 | 18.8 | 36.2 |

| PayPal | PYPL | 47.1 | 32.4 | 53.2 |

| Starbucks | SBUX | 33.6 | 47 | 56.7 |

| AT&T | T | 23.9 | 28.5 | 37.5 |

| Verizon | VZ | 21.2 | 47.1 | 33.4 |

| Walgreens Boots Alliance | WBA | 28.6 | 30.6 | 26.4 |

| Wells Fargo | WFC | 32 | 13.7 | 58.8 |

| Walmart | WMT | 20.9 | 18.4 | 58.5 |

| Exxon-Mobil | XOM | 36.4 | 39.2 | 78.3 |

Weekly Trade Discussion: Open Positions

Income Wheel Portfolio: Open Positions

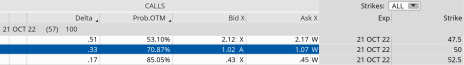

Covered Call: PFE October 21, 2022, 50 Calls

Original trade published on 8-23-2022 (click to see original alert)

Current Comments: At the time of the trade, PFE was trading for 48.30. We sold the October 21, 2022, 50 calls for a credit of $1.50.

PFE is now trading for 47.37, roughly $1 lower than when we first initiated the trade and below our 50 call strike. As a result, we could lock in almost $0.50 worth of premium and immediately sell more premium, but my preference is to hold on a bit longer to see if PFE continues to decline. If we can lock in 50%, or $0.75 of the original premium sold over the next few weeks, I will do so and begin the process of immediately selling more calls against our newly issued shares.

Our probability of success stands at 70.87% and our probability of touch is 34.78%.

Call Side:

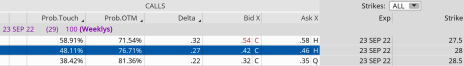

Covered Call: GDX September 23, 2022, 28 Calls

Original trade published on 8-17-2022 (click here to see original alert)

Current Comments: As part of our Income Wheel Strategy, we were assigned shares of GDX at the 29 strike during the July expiration cycle. At the time GDX was trading for 25.59, and it is currently trading for 25.81. Our total break-even on the position currently stands at 27.18, so with GDX currently trading for 25.81 we are down slightly on the position. No worries. Like BITO (see below), GDX offers wonderful opportunities to sell premium due to its high IV and we plan on continuing to take advantage of it.

We recently sold the September 23, 2022, 28 calls for $0.59. At the time the probability of success of the 28 calls was 74.05%. Now the calls stand at 76.71% and the probability of touch is 48.11%. With 29 days left until expiration, now it is all about allowing time decay to work its magic. Of course, if GDX pushes lower over the next week or so there is a good chance I will simply buy back our calls, lock in some premium and immediately sell more calls.

Call Side:

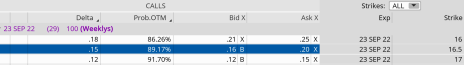

Covered Call: BITO September 23, 2022, 16.5 Calls

Original trade published on 8-17-2022 (click here to see original alert)

Current Comments: As part of our Income Wheel Strategy, we were assigned shares of BITO at the 16 strike. BITO closed at 13.11 at the end of July expiration, but now stands at 14.39. Our total break-even on the position currently stands at 14.16.

We recently sold the September 23, 2022, 16.5 calls for $0.55. At the time the probability of success of the 16.5 calls was 76.47%. Now the calls stand at 89.17% and the probability of touch is 22.85%. Not much to do here as we just placed the trade last Wednesday. If BITO can manage to climb towards the 16.5 strike at expiration, we are going to have a healthy profit on our hands. If it dips a bit lower and we can buy back our calls for $0.10 or less over the next week or two, I will buy back our calls, lock in some nice premium and immediately sell more calls.

Call Side:

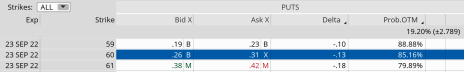

Selling Put: WFC September 23, 2022, 41 Puts

Original trade published on 8-10-2022 (click to see original alert)

Current Comments: At the time of the trade, WFC was trading for 44.48. We sold the September 23, 2022, 41 puts for a credit of $0.61. Our probability of success on the trade was 75.44% and the probability of touch was 47.48%.

WFC is now trading higher at 45.20. Our break-even is 40.39. Our probability of success stands at 82.52% and our probability of touch is 34.39%.

With 29 days until expiration, we can almost lock in roughly 50% of the original premium we sold just over two weeks ago. If WFC moves higher over the coming week there is a good chance that I will buy back our puts and sell more in the same expiration cycle or possibly one week out, at the September 30, 2022 expiration cycle.

Put Side:

Selling Put: KO September 23, 2022, 60 Puts

Original trade published on 8-10-2022 (click to see original alert)

Current Comments: At the time of the trade, KO was trading for 63.15. We sold the September 23, 2022, 60 puts for a credit of $0.62. Our probability of success on the trade was 74.78% and the probability of touch was 49.13%.

KO is now trading higher at 64.05. Our break-even is 59.38. Our probability of success stands at 85.16%, while our probability of touch is reading 31.71%. Our puts are currently trading for $0.30. With 29 days until expiration we can lock in roughly 50% of the original premium we sold just over two weeks ago. If KO continues to move higher over the coming week there is a good chance that I will buy back our puts and sell more in the same expiration cycle or possibly one week out, at the September 30, 2022 expiration cycle.

Put Side:

The next Cabot Options Institute – Income Trader issue will be published on September 2, 2022.

About the Analyst

Andy Crowder

Andy Crowder is a professional options trader, researcher and Chief Analyst of Cabot Options Institute. Formerly with Oppenheimer & Co. in New York, Andy has leveraged his investment experience to develop his statistically based options trading strategy which applies probability theory to option valuations in order to execute risk-controlled trades. This proprietary strategy has been refined through two decades of research and real-world experience and has been featured in the Wall Street Journal, Seeking Alpha, and numerous other financial publications. Andy has helped thousands of option traders learn and implement his meticulous rules-driven options trading strategies through highly attended conferences, one-on-one coaching, webinars, and his work as a financial columnist. He currently resides in Bolton Valley, Vermont and when he’s not trading, teaching and writing about options, he enjoys spending time with his wife and two daughters, backcountry skiing, biking, running and enjoying all things outdoors.