Cabot Options Institute Income Trader – Alert (KO, PFE)

Coca-Cola (KO)

There is little premium left in our May 19, 2023, 60 puts. As a result, I want to buy back our puts and immediately sell more put premium.

KO is currently trading for 63.80.

Here is the trade:

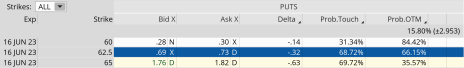

Buy to close KO May 19, 2023, 60 puts for $0.08. (As always, prices will vary, please adjust accordingly.)

Once that occurs (or if you are new to the position):

Sell to Open KO June 16, 2023, 62.5 puts for $0.70. (As always, prices will vary, please adjust accordingly.)

Delta of short call: 0.32

Probability of Profit: 66.15%

Probability of Touch: 68.72%

Total net credit: $0.70

Max return (cash-secured): 1.1%

Risk Management

We use KO as part of our Income Wheel Portfolio, so if KO closes below our put strike at expiration, we will be assigned shares of KO (per the guidelines of the strategy). Until that point, we will repeatedly sell puts on KO. Of course, any necessary trade alerts/updates will follow.

Pfizer (PFE)

There is little to no premium left in our May 19, 2023, 42.5 calls. As a result, I want to buy back our May 19, 2023, 42.5 calls, lock in profits and immediately sell more call premium.

*We are not selling naked calls, so you need to have at least 100 shares if you wish to enter a new position in PFE. For those of you that are new to Income Trader and wish to follow along with PFE, buying at least 100 shares of PFE for every call contract you wish to sell is required as we are in the covered call phase of the Income Wheel strategy for PFE.

PFE is currently trading for 38.77.

Here is the trade:

Buy to close PFE May 19, 2023, 42.5 (covered) call for $0.05 (adjust accordingly, prices may vary from time of alert).

Once that occurs:

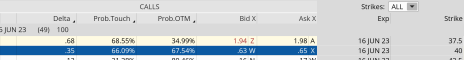

Sell to Open PFE June 16, 2023, 40 (covered) call for $0.63 (adjust accordingly, prices may vary from time of alert).

Delta of short call: 0.35

Probability of Profit: 67.54%

Probability of Touch: 66.09%

Total net credit: $0.63

Max return (cash-secured): 1.6%

Risk Management

We use PFE as part of our Income Wheel Portfolio, so if PFE closes above our call strike at expiration, our shares will be called away and, in most cases, we will reap the capital benefits of the stock increase, plus the premium acquired. Until that point, we will repeatedly sell calls on PFE.

As always, if you have any questions, please feel free to email me at andy@cabotwealth.com.