In today’s trade alert, like my last one, I want to start out by selling cash-secured puts with the intent of eventually wheeling into the position.

This will make our fourth position in the Income Wheel Portfolio. Our goal is to ramp up to five to ten. As for our open positions, you can read my thoughts in the previous issue, or watch the Live Analyst Briefing with Q&A from last week here. Both can be accessed on your subscriber page. As always, if you have any questions, please feel free to email me at andy@cabotwealth.com.

Again, the mechanics of the Income Wheel Strategy are simple.

- Sell Cash-Secured Puts on a stock until you are assigned shares (100 shares for every put sold)

- Sell Covered Calls on the assigned stock until the shares are called away

- Repeat the Process!

Of course, you can simply just sell puts without the need to wheel into the position. Some of you don’t want to own stock and I get it … which is why we also have an Income Trades Portfolio that is just trades, with no intent of holding stock.

As always, I want to choose highly liquid market stalwarts to sell premium against over the long term. These are typically lower-beta stocks with an average implied volatility. But I also want to focus my energies on defensive stocks that are somewhat uncorrelated to the overall market.

Wells Fargo (WFC)

IV: 44.4%

IV Rank: 49.7

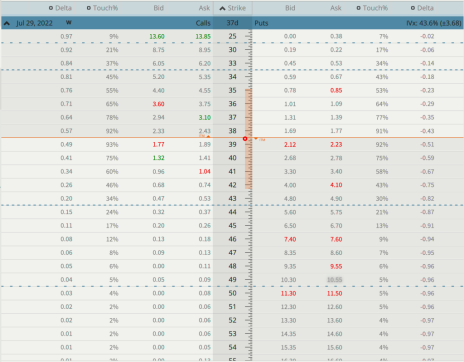

Expected Move (Range): The expected move (range) for the July 29, 2022, expiration cycle is from just under 35 to 42.

With WFC trading for 38.57 I want to sell puts at the 35 put strike going out 37 days for roughly $0.80, if not higher. Of course, due to a wide variety of factors, prices may and most likely will vary slightly.

The Trade

Sell to open WFC July 29, 2022, 35 put strike for a total of $0.80 or higher (As always, prices will vary, please adjust accordingly).

Delta of short put: 0.23

Probability of Profit: 72.13%

Probability of Touch: 53.18%

Total net credit: $0.80

Max return (cash-secured): 2.34%

Risk Management

I will be using WFC as part of our Income Wheel Portfolio, so if WFC closes below our put strike at expiration we will be issued shares at the 35 strike and begin the process of selling calls against our newly acquired shares. Until that point, we will repeatedly sell puts on WFC. Of course, any necessary trade alerts/updates will follow.